Riot Expands Stake in Rival as Core Scientific Rejects $1 Billion Acquisition

Analysts anticipated a wave of consolidations in the mining industry following the halving. Recent activities by major players in the sector have confirmed these forecasts.

Core Scientific Rejects $1 Billion Offer from CoreWeave

Mining firm Core Scientific rejected a non-binding proposal from AI company CoreWeave to acquire all outstanding shares at $5.75 each, totaling approximately $1.02 billion.

According to a statement, Core’s board of directors thoroughly reviewed the “unsolicited” offer and deemed it “significantly undervalues the company and is not in the best interests of its shareholders.”

The proposal came shortly after the mining company signed a 12-year agreement with CoreWeave to provide infrastructure with a capacity of 200 MW for hosting Nvidia GPUs. This is expected to generate over $3.5 billion in revenue for Core over the contract’s duration.

The company emphasized its commitment to fulfilling the contract, despite rejecting CoreWeave’s acquisition proposal.

Core also has over 300 MW of additional capacity for high-performance computing (HPC), which it plans to utilize with its current partner or “someone else.”

“The company believes that predictable, regular income from hosting HPC will balance the volatility of its bitcoin mining business, providing stable cash flows that will enhance profitability and ensure greater financial resilience and optionality,” the press release stated.

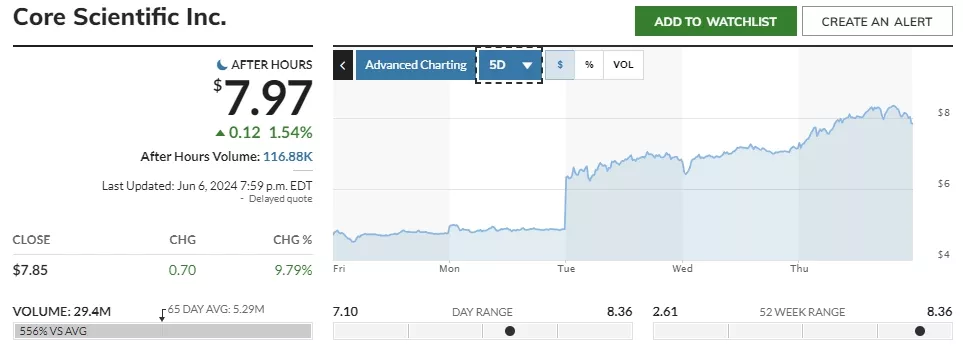

Core’s stock closed at $7.85 on June 6, gaining nearly 10% in a day. Shares continued to rise in after-hours trading.

The market capitalization of the company, which emerged from bankruptcy proceedings in January, stands at $1.4 billion.

Riot Platforms Continues Bitfarms Acquisition

Colorado-based Riot Platforms increased its beneficial stake in Canadian bitcoin miner Bitfarms to 12%.

Riot Platforms, Inc. Reports Beneficial Ownership of 12% in Bitfarms Ltd.

For more information, please visit: https://t.co/7sfqqZo5bJ

For disclaimers, please visit: https://t.co/koUzW1HLFa.

— Riot Platforms, Inc. (@RiotPlatforms) June 5, 2024

On June 5, Riot acquired 1,460,278 shares at approximately $2.45 each, totaling around $3.6 million.

In late May, it was revealed that the company had made a $950 million acquisition offer to Bitfarms’ board. This involved purchasing all shares at $2.3 each. At that time, Riot was already the largest shareholder of the Canadian firm with a 10% stake.

The valuation of Bitfarms’ shares was based on the closing prices on April 19, following Riot’s initial private approach to the competitor’s board, with a 24% premium.

Bitfarms described the offer as “significantly undervaluing the firm and its growth prospects.”

On June 6, the company’s closing share price was 3.36 CAD ($2.46), with a market capitalization of $740 million.

Riot confirmed its intention as a beneficial owner to convene a general meeting of shareholders to appoint “several highly qualified and independent directors.” This move is reportedly due to concerns about the board’s actions and a “history of poor corporate governance.”

One reason for such claims was the early dismissal of Bitfarms CEO Geoffrey Morphy in May, after he filed a lawsuit against the company. The manager demanded compensation totaling $27 million.

Bitdeer Acquires ASIC Miner Developer Desiweminer

Founded by Jihan Wu, Bitdeer Technologies Group announced the acquisition of FreeChain Inc. (Desiweminer), a company specializing in mining chip development without in-house manufacturing.

Bitdeer is excited to announce its strategic acquisition of Desiweminer. Its proprietary technologies and intellectual property complement our capabilities and will accelerate our time to market.

Read the full news release here: https://t.co/5Gad8s9oCd$BTDR $BTC #Bitcoin… pic.twitter.com/cb3S24wTNS

— Bitdeer (@BitdeerOfficial) June 6, 2024

Bitdeer will pay for the deal with 20 million of its own shares, to be transferred in equal installments over five to seven years, depending on conditions. At the time of writing, pre-market values the company’s shares at $7.31.

Bitdeer noted that the acquisition followed a 10-month due diligence period, during which the company thoroughly assessed Desiweminer’s technologies, engineering team, and supply chain.

“The firm’s chip design significantly complements Bitdeer’s developments and is ideally suited for advanced semiconductor processes at 4 nm and below,” the statement said.

Desiweminer specialists will join Bitdeer’s team in Singapore. The first products with integrated technologies are expected “soon.”

In March, Jihan Wu’s company introduced the SEAL01 4-nm chip for bitcoin mining with a claimed energy efficiency of 18.1 J/TH.

According to the roadmap, the chip is expected to provide the firm’s first device, Sealminer A1, with a performance range of 20-23 J/TH.

Introducing the @SealMiner Technology Roadmap ?️:

From SEAL01’s 18.1J/TH prowess in Q1 this year to the game-changing SEAL04’s 5J/TH efficiency by Q2 2025, we’re setting the stage for unprecedented innovation.In the fast-changing Bitcoin mining market, Bitdeer will do more to… pic.twitter.com/tgy0BJD9W9

— Bitdeer (@BitdeerOfficial) June 7, 2024

The installation is set to go into series production in Q3 2024. At the same time, Bitdeer plans to release the SEAL02 chip with 14 J/TH, which will provide the second generation of miners with an energy efficiency of 15-16.5 J/TH.

The SEAL04, scheduled for Q2 2025, is expected to achieve 5 J/TH, implying 5.5-6 J/TH for end devices.

In May, Tether invested $100 million in equity capital in Bitdeer. The deal includes an option for an additional $50 million investment.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!