Rumours of possible Credit Suisse bankruptcy unsettled the market

Credit default swaps (CDS) on the debt of one of Europe’s largest investment banks, Credit Suisse, jumped to levels not seen since the 2008 financial crisis. Such elevated readings imply a 23% probability of its collapse within the next five years.

The credit default swaps (CDS) for Credit Suisse are going absolutely vertical and are now approaching the highs of the great financial crisis of 2008. Higher CDS = Stronger market-wide belief that CS is going to fail.

Chart courtesy: @FossGregfoss

(/6)#CDS pic.twitter.com/HmmcoTZt6F

— Rajat Kumar Singh (@imfamousrajat) October 2, 2022

From the 2009 highs, Credit Suisse’s shares have fallen about 90%. A similar dynamic was seen in the securities of Germany’s largest financial institution, Deutsche Bank.

On October 3, Credit Suisse fell by 12%. The market ignored CEO Ulrich Körner’s assurances that the bank had sufficient liquidity and capital. In an internal note to staff, the chief executive acknowledged that the organisation is in a “critical moment.”

In September, Credit Suisse said it was examining options to shrink its investment-banking business in the United States. Among the options are the separation of the organisation into three standalone units and the sale of its Global Trust business. Additionally, the institution is prepared to cut around 5,000 staff.

The bank’s position may have been affected by a deteriorating market environment amid tighter monetary policy and signs of a global economic recession.

Credit Suisse may incur losses from unsuccessful investments in the debt market, including Citrix bonds worth about $600 million. The bank is also the defendant in a $1.27 billion lawsuit brought by Georgian Prime Minister Bidzina Ivanishvili, who fell victim to mismanagement of capital.

Credit Suisse is not the only major bank whose price-to-book ratio has fallen below the troubling 40% threshold. On this list are Deutsche Bank, Societe Generale, Standard Chartered, Credit Agricole, UniCredit, Barclays and Bank of China. The market fears a Lehman Brothers-style collapse and a domino effect.

The collapse of any one of them could call the survival of the others into question, according to Alasdair Macleod, Goldmoney’s head of research.

Credit Suisse is not the only major bank whose price-to-book is flashing warning signals. The list below is of all G-SIBs with PtBs of under 40%. A failure of one of them is likely to call the survival of the others into question. pic.twitter.com/LJA0YVrqco

— Alasdair Macleod (@MacleodFinance) October 2, 2022

Speculation about Credit Suisse’s insolvency as of 13:00 (MSK/Kiev) had not spread to market sentiment. The S&P 500 futures are trading modestly higher. Bitcoin is up 0.5% at $19,140, and Ethereum up 1.1% at $1,290.

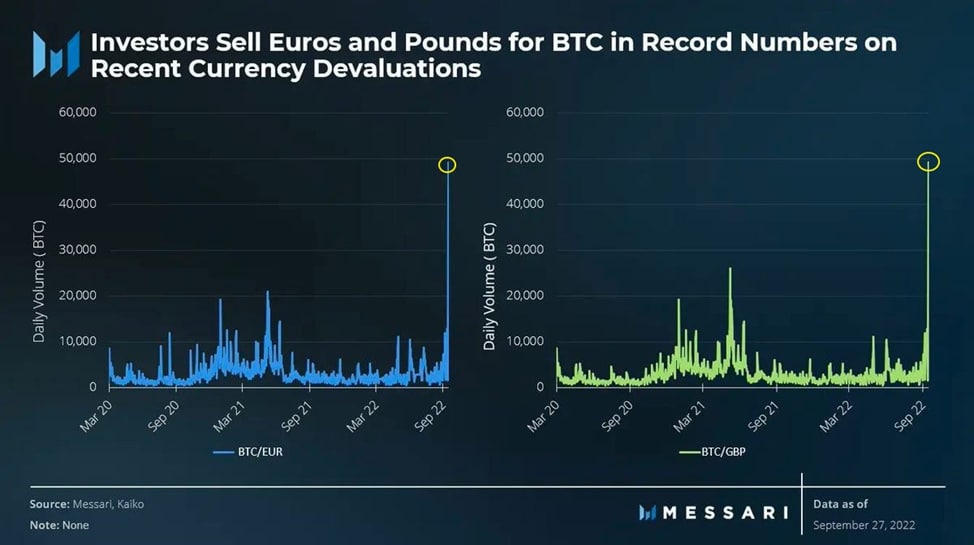

Earlier, against a backdrop of debt-market turbulence and the sharp devaluation of the British pound and the euro against the dollar, there was a spike in purchases of digital assets for these fiat currencies.

On September 21, Bitcoin reacted with a sharp correction to the Federal Reserve’s rate hike.

Follow ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!