Solana Surpasses Ethereum in Annual Fee Revenue

Solana's annual revenue reached $2.85 billion, surpassing Ethereum.

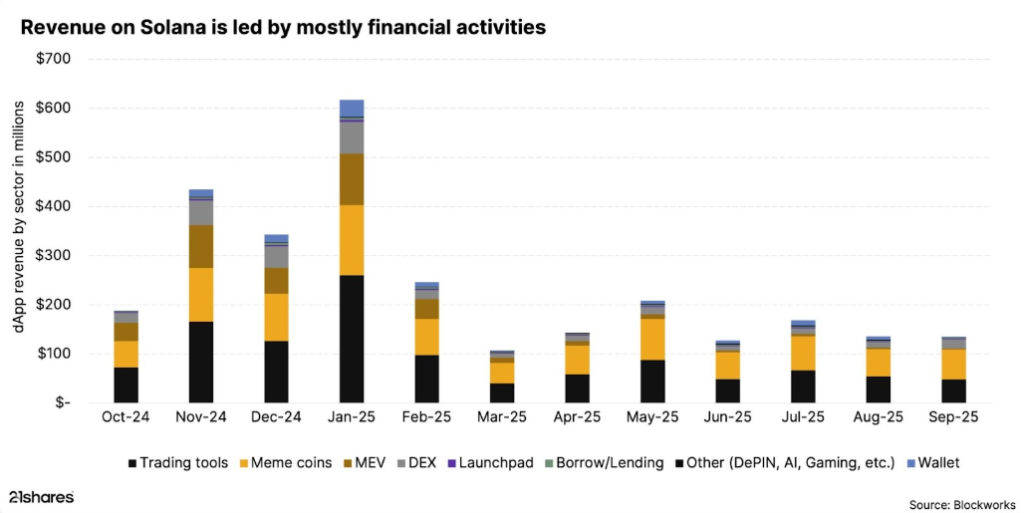

The Solana network’s revenue over the past year reached $2.85 billion, primarily driven by trading platforms, according to a report by 21Shares.

From October 2024 to September 2025, average monthly earnings were $240 million. In January, amid a meme coin boom, the figure peaked at $616 million. Following the decline in hype, monthly revenue remained in the range of $150-250 million.

The main growth driver was trading platforms, accounting for 39% of total revenue, or $1.12 billion. Funds came from various ecosystem sectors: DeFi, meme coins, AI applications, decentralized exchanges, and DePIN.

Analysts also noted that Solana significantly outpaces Ethereum at a comparable stage of development. Five years after its launch, the “DeFi flagship”‘s monthly revenue did not exceed $10 million. Current figures for the “people’s cryptocurrency” are 20-30 times higher.

Efficiency and low fees have helped Solana attract 1.2 to 1.5 million active addresses per day. This is roughly three times more than Ethereum at a comparable life cycle stage.

ETFs and Corporate Reserves

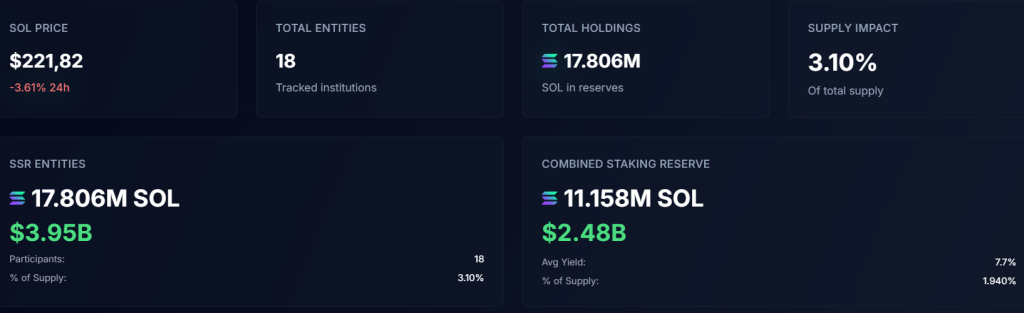

Several public companies have transformed into treasuries based on Solana. As a result, their balances hold approximately $4 billion in SOL.

A total of 18 tracked organizations hold 17.8 million SOL. The largest holders are Forward Industries (6.8 million SOL) and Sharps Technology (2.1 million SOL).

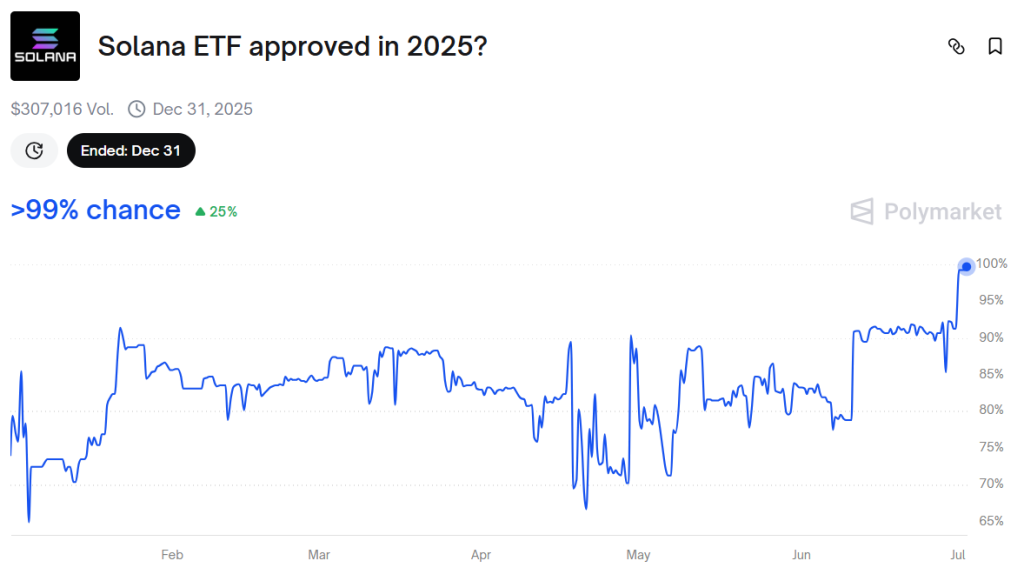

In October, the U.S. Securities and Exchange Commission (SEC) is set to review several applications for spot Solana-ETFs from companies like Fidelity, VanEck, Grayscale, and others.

Big week for Solana.

The final deadline for spot $SOL ETF approval is just 4 days away.

High chances we get the approval this week. pic.twitter.com/nAVUr2g7PC

— Lark Davis (@TheCryptoLark) October 6, 2025

The U.S. government shutdown may delay decision-making.

However, participants on Polymarket estimate a 99% chance of SOL-ETF approval by the end of the year.

Back in October, Forward Industries announced plans to sell $4 billion in shares to purchase the “people’s cryptocurrency.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!