Study: 8% of eurozone deposits could move to the digital euro

The launch by the European Central Bank of a national digital currency (CBDC) will deprive the banking system of about 8% of the deposit base (€873 billion), according to Morgan Stanley analysts. Reuters reports.

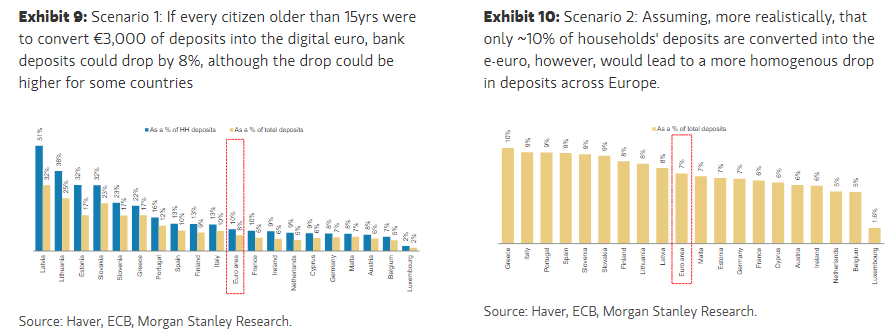

Such estimates appear in a pessimistic scenario. It assumes that all euro-area residents aged 15 and over will transfer €3,000 from deposits to the CBDC. Such a limit as a safeguard against destabilising the banking sector was previously called by Fabio Panetta, a member of the ECB’s Executive Board.

For small-country lenders such as Greece, Latvia and Estonia, with the advent of the digital euro, the damage could be even more noticeable. Analysts estimate they could face outflows of 17–30% of all bank deposits.

Real assessments may be less pessimistic, since local bank clients are unlikely to move a large portion of their savings to the digital euro, experts said. According to their calculations, in the worst case the effect could be 10%.

Morgan Stanley noted that the adoption of the CBDC would raise the loan-to-deposit ratio (LDR) on average from 97% to 105% (LDR).

This would increase the likelihood of liquidity shortages in the event of strong demand from borrowers. However, the launch of the digital euro would not lead to systemic consequences, since during the pandemic era the LDR had already risen to these levels, they stressed.

In June, the ECB warned about problems facing monetary regulators in the absence of its own CBDC.

Earlier, ECB President Christine Lagarde said that the release of the digital euro, subject to politicians’ approval, could take place in four years.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!