Tether’s Q4 Net Profit Reaches $2.9 Billion

Tether, the issuer of the USDT stablecoin, reported a record net profit of $2.9 billion for the October-December period, according to its attestation report.

Of this amount, $1 billion was attributed to interest from U.S. Treasury bonds, with the remaining sum resulting from positive revaluation of reserves in gold and bitcoin.

The net profit for 2023 amounted to $6.2 billion.

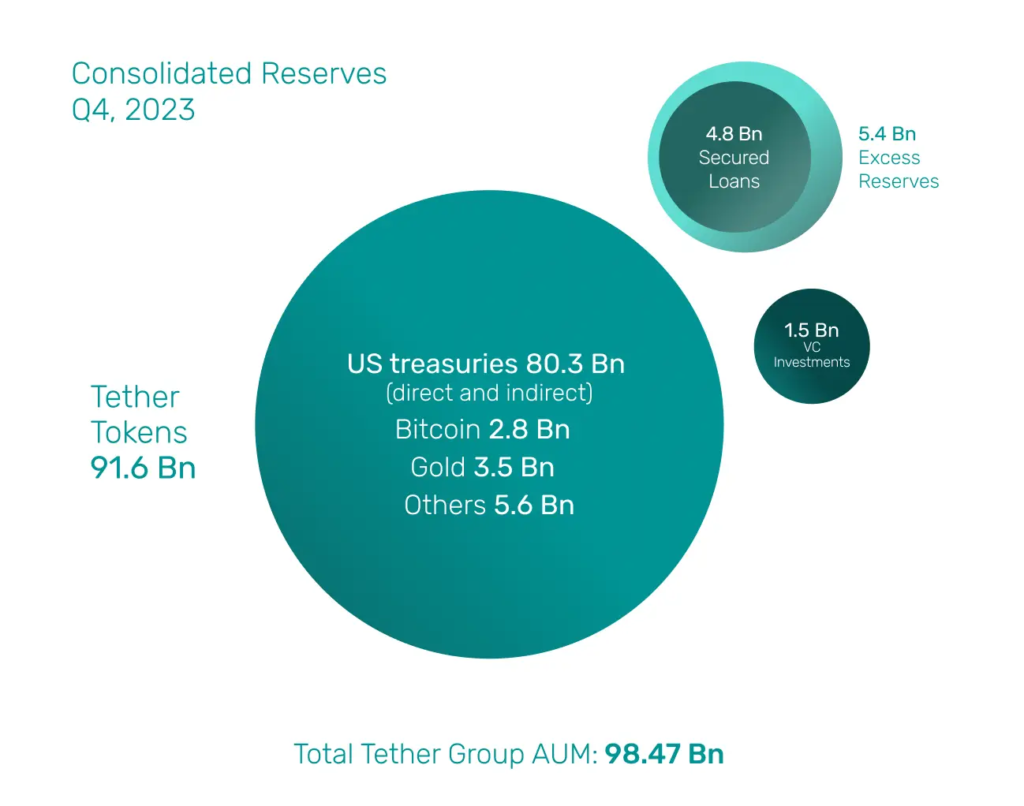

Excess reserves increased by $2.2 billion in the last reporting period, rising from $3.2 billion to a record $5.4 billion.

Tether allocated $0.7 billion of the $2.9 billion to finance investments, including cryptocurrency mining, AI infrastructure, and P2P communications.

Auditor BDO confirmed the existence of $4.8 billion in outstanding unsecured loans.

“Tether has accumulated sufficient excess reserves to cover all risk. This addresses previously expressed community concerns regarding this part of the portfolio,” the document states.

In the October-December period, the company expanded its bitcoin holdings by 8888 BTC, reaching 66,454 BTC ($2.81 billion).

As of December 31, total assets stood at $97 billion, including $80.3 billion in U.S. government bonds and $3.5 billion in gold.

Liabilities associated with USDT increased to $91.6 billion, 90% of which were covered by cash and cash equivalents.

Since December 1, 2023, Tether has begun freezing wallets linked to the SDN of the U.S. Treasury’s Office of Foreign Assets Control. The company also highlighted its assistance to agencies such as the Department of Justice, the Secret Service, and the FBI.

Previously, Tether expressed disappointment with the UN’s assessment of USDT’s use in illegal activities and the neglect of the asset’s role in developing economies.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!