Trader outlines prospects for Bitcoin price movement

The market is explained by a practising trader and founder of the project Crypto Shaman Vadim Shovkun.

Bitcoin has been in a powerful downtrend for 11 weeks—the first cryptocurrency has fallen by almost 60%. All support levels have been breached, and in recent days there has been a large amount of liquidations. Should one expect this decline to continue, or are there other factors that could influence the situation?

The first thing to note is the historically large traded vertical volume on Binance— both on spot and futures. The week is not over yet, but the bar’s height is already impressive — 1.6 million BTC (futures).

Under the classical law of market technical analysis, price moves from volume densities. The range $20 000 — $28 000 is the zone of the so-called volume vacuum. Since there is no liquidity in this area, quotes easily pierced it on impulse because of the lack of resistance. However within $17 000 — $19 000, the situation is different.

Also worth watching is the eight-hour RSI indicator—the latest downward impulse formed on a bullish divergence. Coupled with the Fear and Greed Index, which has been at an extreme level for quite some time, one can anticipate a forthcoming bounce in the market.

The Ethereum chart better reflects oversold conditions on the market across many technical indicators. The RSI alone is at a record low of 20 (weekly timeframe). This has happened only twice in the last two years — both times the second-largest cryptocurrency posted solid growth.

All this does not mean that Bitcoin’s price will not drop into the $18,000–$20,000 zone. That is quite plausible, given that after such a steep fall there is often inertia. Yet the aforementioned range, in many respects, represents a strong zone of interest for a large buyer.

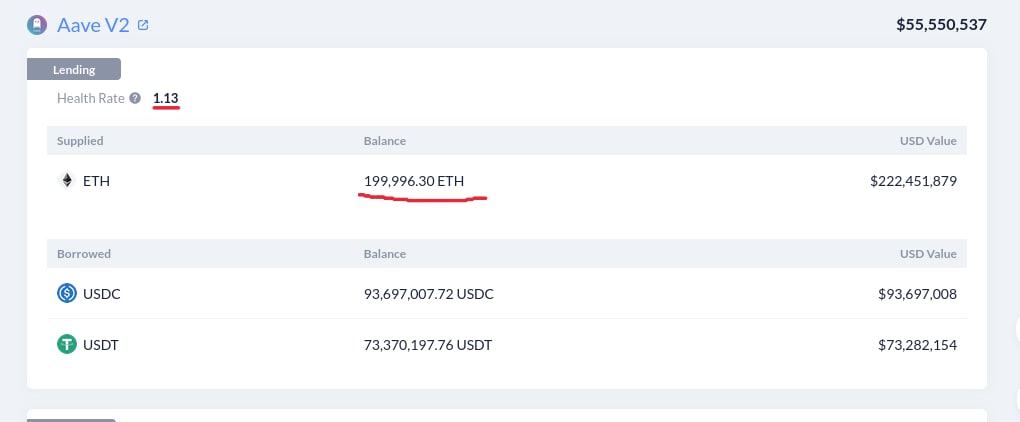

Also worth noting is the fund Three Arrows Capital, which on its balance holds 200,000 ETH with a liquidation price around $1,010. It is quite likely that if liquidity is not added soon, a small impulse and forced liquidation of positions will drive prices lower.

It is worth noting that the market will still be shook and the recent bottom will be breached again. But by many signs this prolonged decline appears to be nearing its end, and the $18,000–$20,000 range is a strong area of interest for a large buyer.

Overall, the grey area remains a zone of interest, but buyers should wait for the most favourable offer. A drop lower is quite possible, followed by a return to previous values. Then a gradual recovery, or perhaps more time spent accumulating before moving toward the $27,000–$29,000 zone.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, rates and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!