Trump’s ‘Helicopter Money’ Could Propel Bitcoin’s Growth

Experts drew parallels with 2020, when similar measures led to a 1050% rise in cryptocurrency.

President Donald Trump has proposed distributing payments ranging from $1,000 to $2,000 to U.S. residents, funded by revenue from import tariffs. Analysts at Bitfinex believe this could serve as an additional catalyst for the cryptocurrency market.

In an interview with One America News Network, the American leader stated:

“We are going to do something, we are studying a question. First, we will pay off the debt. Because people have allowed it to grow uncontrollably. We can also make payments to people, something like dividends for American residents.”

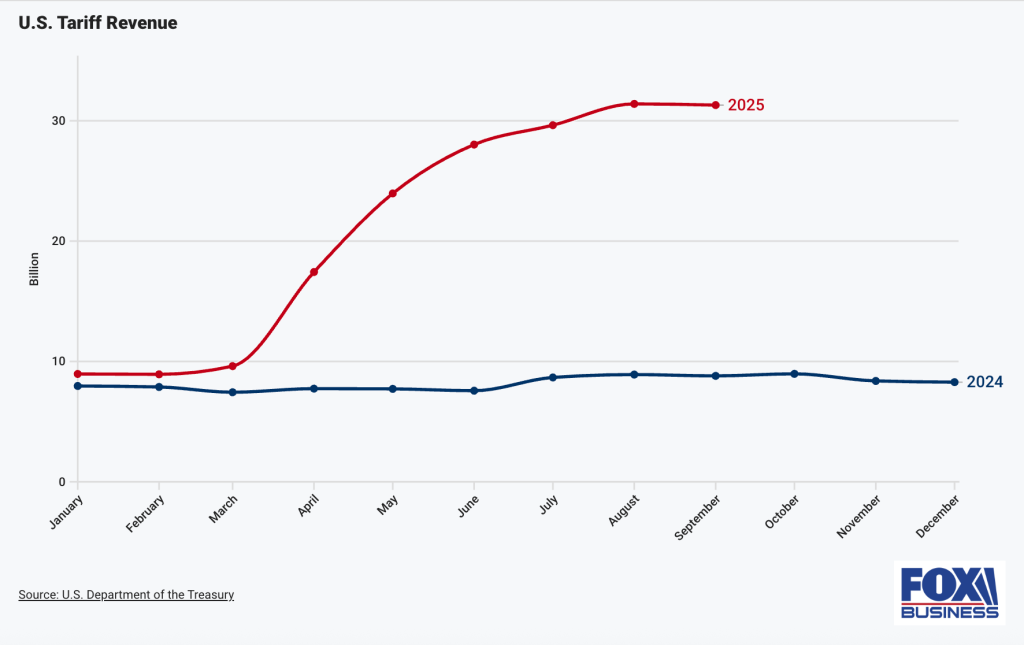

According to him, the funds from tariffs are “just starting to come in.” As calculated by Fox Business, the government has already received $214 billion since the beginning of the year.

Trump anticipates that eventually, tariffs will bring the U.S. “over a trillion dollars a year.” Part of these funds is planned to be used to pay off the national debt, which currently exceeds $37 trillion.

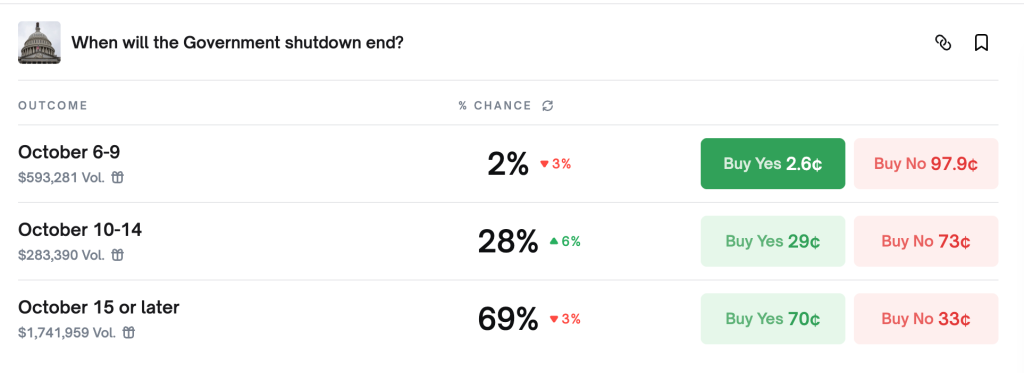

The politician made this statement amid political and economic uncertainty in the country. On October 1, the American government halted operations as Democrats and Republicans failed to reach an agreement on healthcare funding.

On October 7, the U.S. Senate will revisit this issue. According to forecasts by users of the Polymarket platform, the shutdown will not end before October 15.

New Liquidity

Analysts at Bitfinex have described Trump’s stimulus package as a “new catalyst for the cryptocurrency market.”

They drew a parallel with 2020, when similar payments due to the COVID-19 pandemic spurred a rally in the first cryptocurrency as retail investors poured in funds.

“Users injected significant liquidity into both traditional and digital markets, contributing to the explosive growth of bitcoin,” experts stated.

A 2023 study by the John F. Kennedy School of Government confirmed that “money from thin air” increased investments in bitcoin and cryptocurrencies overall.

In March 2020, the U.S. President signed a $2 trillion initiative that provided payments of up to $1,200 to citizens with an adjusted gross income of up to $75,000.

During this period, the price of digital gold surged by 1050% — from $6,000 in March 2020 to $69,000 by November 2021. However, the rally also coincided with a period of quantitative easing — the Fed announced a $4 trillion bond-buying program, increasing the money supply.

On October 7, the first cryptocurrency reached a new all-time high above $126,000, attracting a wave of retail investors to the market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!