Trump’s Tariffs Trigger Bitcoin Market Correction

On February 2, the leading cryptocurrency fell below $100,000 following the imposition of import tariffs by U.S. President Donald Trump on goods from China, Canada, and Mexico.

The main decline began around 3:00/4:00 (Kyiv/MSK), with Bitcoin recovering by morning, only to later breach the psychological level again.

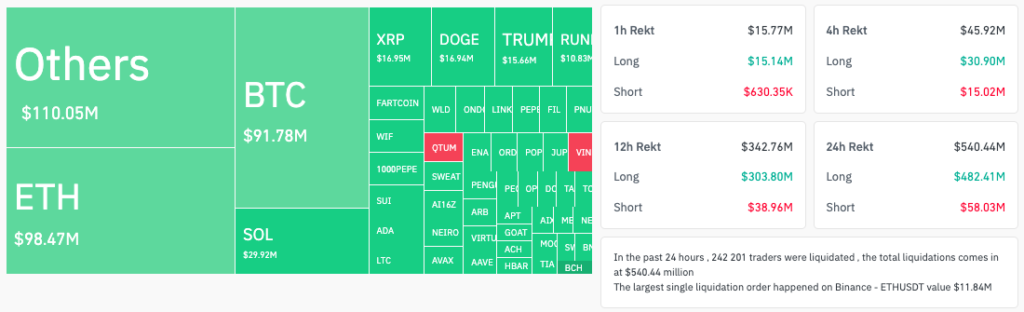

According to Coinglass, the crypto market saw $540 million in liquidations over the past 24 hours, with $482 million in long positions.

A significant portion of the forced closures involved low-cap altcoins categorized as “others.”

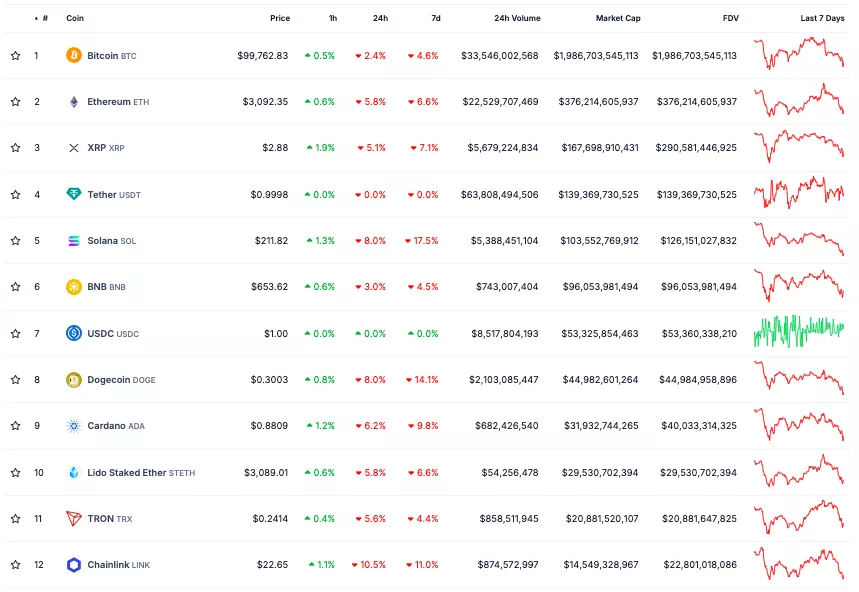

Major digital assets also experienced declines. Ethereum fell below $3100, dropping 6.6% over the day.

SOL and DOGE were hit hardest, losing 17.5% and 14.1% respectively. ADA dropped 9.8%, retreating to $0.88.

U.S. Tariffs and International Responses

According to a White House statement from February 1, “Trump imposes a 25% additional tariff on imports from Canada and Mexico and a 10% additional tariff on imports from China.”

— Donald J. Trump (@realDonaldTrump) February 1, 2025

“[The President] is taking bold action to make Mexico, Canada, and China fulfill their promises to stop illegal immigration and halt the flow of poisonous fentanyl and other drugs into our country,” the statement reads.

In response to the new tariffs, Canadian Prime Minister Justin Trudeau announced plans to impose a 25% tariff on certain American goods at a press conference.

According to CNN, China’s Ministry of Commerce is preparing to file a complaint with the World Trade Organization and “take appropriate countermeasures.”

Mexican President Claudia Sheinbaum stated in a lengthy X post that she instructed the economy minister to “implement Plan B,” which includes “tariff and non-tariff measures to protect the country’s interests.”

“As it turns out, Trump seems unafraid of economic and market fluctuations. His exact words: ‘There may be some temporary, short-term disruptions, and people will understand that.’ Based on the 2018–2019 experience, it’s reasonable to expect at least a 10% correction in the stock market index,” suggested journalist Colin Wu.

So far, the S&P 500 and Nasdaq 100 indices have not shown significant declines. However, Wu sees the U.S. tariffs as a long-term negative for the macroeconomy.

Impact on Cryptocurrency

Opinions on the impact of Trump’s tariffs on the crypto industry vary within the community. Crypto Capital Venture founder Dan Gambardello views the situation as stable.

I cannot believe there’s a popular opinion floating around that Trump tariffs and his memecoins ended the bull cycle

Blackrock is continuing to accumulate ETH and BTC while retail frantically panics because crypto is currently consolidating

— Dan Gambardello (@cryptorecruitr) February 1, 2025

“I cannot believe there’s a popular opinion that Trump tariffs and his memecoins ended the bull cycle. BlackRock continues to accumulate ETH and BTC while retail traders panic as crypto is currently consolidating,” added Gambardello.

Bitwise Invest’s head of alpha strategies Jeff Park noted that some “have not yet realized the amazing impact a tariff war will have on Bitcoin in the long run.”

You simply have not yet grasped how amazing a sustained tariff war is going to be for Bitcoin in the long run

— Jeff Park (@dgt10011) February 2, 2025

“Listen, buddy, I’m all for Bitcoin, but that’s not the case. Bitcoin is not sufficiently detached from global markets and trades like a triple-leveraged tech stock these days. Economic contraction of this magnitude means only pain for everyone, and we must be ready to condemn it,” countered Cinnaeamhain Ventures partner Adam Cochran.

Bitwise predicted “less severe” Bitcoin corrections in future cycles thanks to Trump.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!