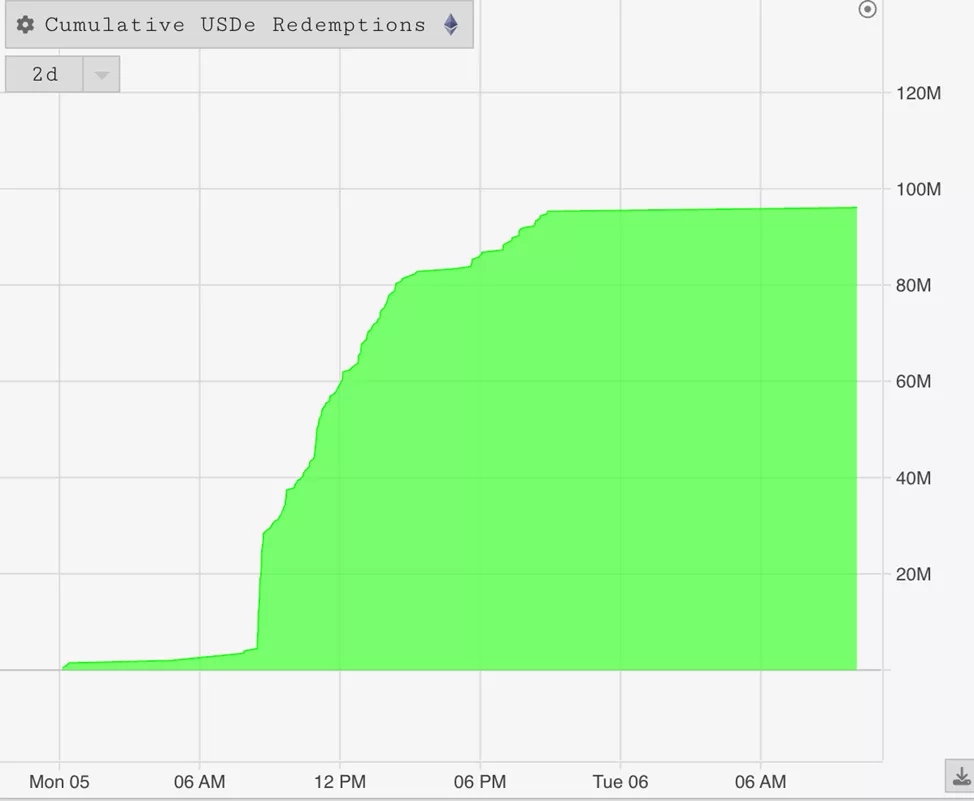

USDe Redemptions Surpass $100 Million Amid Market Downturn

Since August 5, the issuer of the collateralized stablecoin USDe, Ethena Labs, has redeemed approximately $100 million. This was spurred by a general downturn in the cryptocurrency market.

The token maintained its peg to the US dollar, slightly dipping to $0.997 before recovering to its target level of $1.

According to Parsec Finance, the cryptocurrency derivatives market saw $1 billion in liquidations, while DeFi protocols experienced $350 million in liquidations.

“I confirm there are no issues with daily redemptions exceeding $50 million, which is the largest figure to date. […] Every stress test like this, and others we have faced this year, provide additional assurances of the system’s resilience,” stated Ethena Labs founder Guy Young.

While painful, I hope every stress test like this and others we have been through this year provide additional comfort on the go-forward resilience of the system

— G | Ethena (@leptokurtic_) August 5, 2024

Earlier, the market capitalization of Ethena Labs’ stablecoin surpassed $3 billion just four months after launch, outpacing all competitors.

CryptoQuant advised USDe holders to monitor this parameter. According to calculations, under conditions of negative funding rates, the reserve fund can be maintained if the capitalization of the “synthetic dollar” does not exceed $3 billion.

Previously, experts examined the asset’s vulnerabilities amid extreme market fluctuations.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!