Venture Investor Predicts Bitcoin Could Plunge by 70%

Bitcoin may drop 65-70% in two years, says Sigma Capital CEO.

The leading cryptocurrency will continue to experience cyclical rises and falls, with its price potentially plummeting by 65-70% in the next two years. This was stated by Sigma Capital CEO Vinit Budki in an interview with Cointelegraph.

“Even if it falls to $70,000, bitcoin will not lose its value, but the problem is that people do not realize it. When they buy assets that are unfamiliar and unclear to them, they sell them first. This is where the surge in supply comes from,” explained the head of the venture firm.

However, over a 10-year horizon, Budki expects the price of digital gold to exceed $1 million per coin. In his view, cryptocurrency adoption will grow thanks to the expansion of speculative trading and real use cases.

Some experts believe that the historical four-year cycles of bitcoin related to halvings have lost relevance under new conditions. At K33, they believe that the coin’s price movements are now largely determined by institutional investor activity and macroeconomic policy.

Former BitMEX CEO Arthur Hayes considers central bank monetary policy the dominant factor in shaping bitcoin’s dynamics. According to the expert, traders previously mistakenly linked cryptocurrency market cycles to the reduction of block rewards.

Analysts at 10x Research noted that bitcoin primarily reacts not even to macroeconomic data like liquidity. The most crucial factor is the inflows specifically into cryptocurrency, expressed, for example, by inflows into ETFs and other products.

Everyone in crypto still points to liquidity charts as if they explain everything.

Well, I have not seen this chart posted for the last two months—and there is a reason. Yes, liquidity matters.

But this cycle has made one thing very clear:

Bitcoin isn’t reacting to macro… pic.twitter.com/lPPovjxOAo

— 10x Research (@10x_Research) October 31, 2025

The company’s experts pointed out that contrary to expectations, the growth of the global M2 money supply did not always trigger a rally in digital gold prices.

“Liquidity sets the tone. Flows write the script. Once both trends converge, the movement will be sharp, and most will say no one expected it,” the analysts stated.

Bitcoin Enters Historically Favorable November

For the first time in seven years, the leading cryptocurrency closed October with a price decline. Over the month, quotes fell by approximately 3.7%. Amid the bear market in 2018, they decreased by a comparable ~3.8%.

November is historically the most favorable month for bitcoin, with an average growth of about 42.5%.

“I truly believe that seasonal charts are significant, but they need to be considered in conjunction with many other factors,” commented Cointelegraph CEO10x Research Marcus Thielen.

On October 11, threats from US President Donald Trump to impose tariffs against China triggered a market crash, which led to record liquidations exceeding $19 billion. Amid positive news about trade negotiations between the countries, cryptocurrencies partially recovered their positions.

A positive signal was the meeting between Trump and Chinese President Xi Jinping. However, experts believe it marked more of a pause in the “tariff war” rather than its end. This was stated by Dennis Wilder, a professor and senior fellow at Georgetown University’s China Initiative, to CBC News.

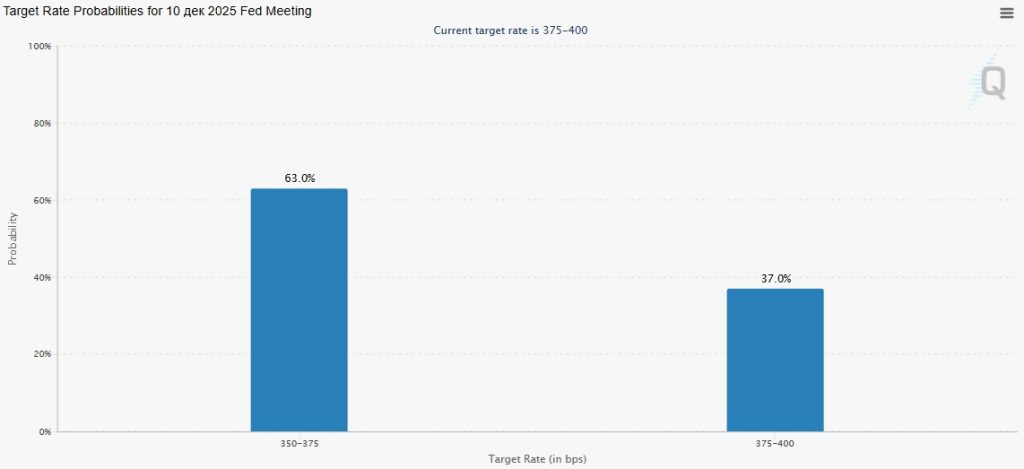

On October 29, the US Federal Reserve (Fed) cut the key rate by 25 basis points for the second consecutive time, to 3.75-4%. Bitcoin reacted cautiously to the regulator’s monetary easing.

CryptoQuant suggested that if the central bank continues this trend in December, it could trigger a new rally in cryptocurrency. However, amid cautious statements from Fed Chairman Jerome Powell, traders currently assess the probability of further rate cuts by the agency at 63%.

According to Standard Chartered, if positive macroeconomic and geopolitical events continue, bitcoin will not fall below $100,000 again.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!