Week in review: Circle’s IPO and bitcoin‑ETF futures debut on the Moscow Exchange

Circle’s valuation after the IPO topped $20bn, the Ethereum Foundation trimmed its developer ranks, bitcoin‑ETF futures began trading on the Moscow Exchange, and other events of the week.

Bitcoin recovered after a Trump–Musk spat

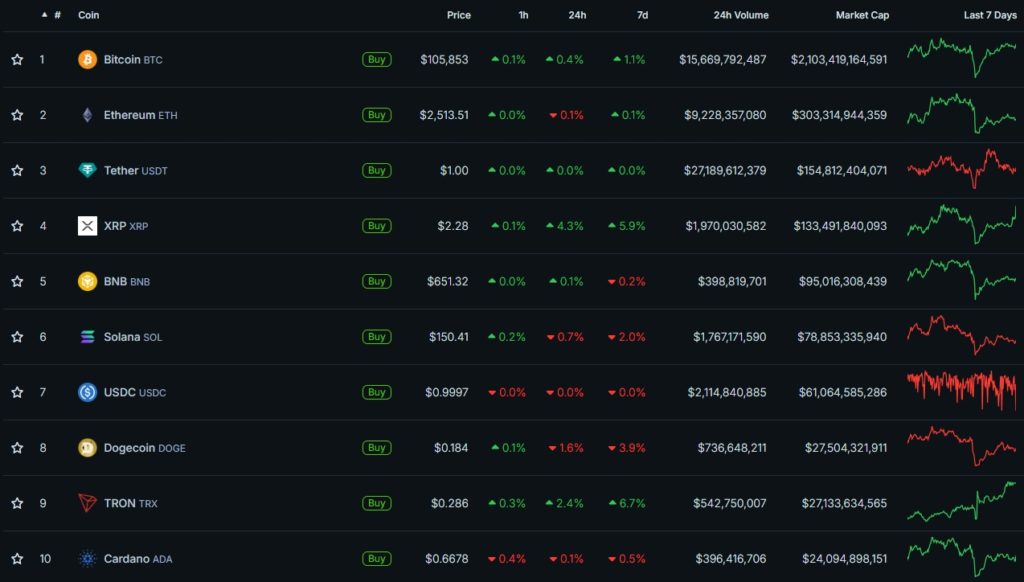

The first cryptocurrency ends the week up roughly 1%, trading near $105,900.

On Friday, June 6, a spat between US President Donald Trump and billionaire Elon Musk pressured bitcoin and the market at large. The price of digital gold fell 3%, nearing $100,000.

After an equally swift rebound, the cryptocurrency resumed climbing toward the week’s highs around $106,800.

Altcoins responded in kind to the public spat between the country’s richest man and the head of state. Only Musk’s “favorite” coin — Dogecoin — kept falling, losing 3.9% on the week.

XRP and TRON also posted gains over the period, up 5.9% and 6.7%, respectively.

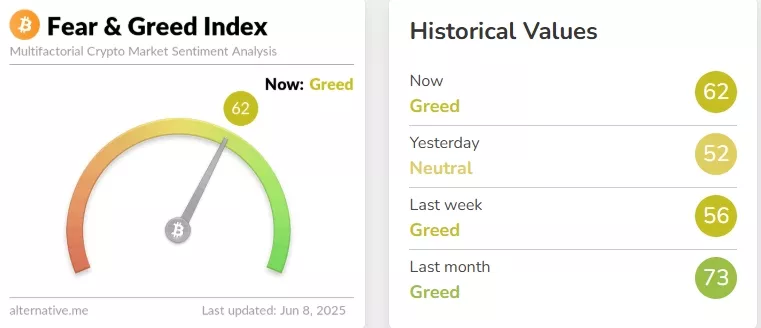

The crypto Fear & Greed Index also returned to the “green zone” after dipping to a neutral reading of 45.

Total market capitalisation stands at $3.42 trillion; bitcoin’s dominance is 61.5%.

USDC stablecoin issuer valued at $6.9bn after its IPO

Circle raised $1.1bn in an IPO that was 25 times oversubscribed.

In its debut trading session on June 5 at the New York Stock Exchange, shares under the ticker CRCL rose from $31 to $82 — up 168%.

The next day the USDC issuer’s stock added roughly another 30%.

By Sunday evening, pre‑market pricing valued Circle at $115.2 — about 7% above Friday’s close. The company’s market cap reaches $21.6bn.

Meanwhile, Artemis co‑founder and CEO John Ma presented calculations suggesting the current value of Circle’s main rival, Tether, would reach $515bn if it listed.

Tether chief Paolo Ardoino called the estimate “somewhat understated”. Even so, he said the company has no need for public status.

Some experts questioned Ma’s methodology. In their view, Tether’s real market value is $75–80bn.

Ethereum Foundation cuts researchers and developers

The non‑profit Ethereum Foundation has reduced part of its research and development team, focusing on key challenges and core protocol issues.

The revamped team will focus on three main areas:

- scaling Ethereum’s base layer;

- expanding BLOB space as a key element of the data‑availability strategy;

- improving user experience (UX).

The shake‑up comes amid prolonged criticism of the organisation’s strategic direction and management decisions.

Many in the Ethereum community are concerned that, if current technical issues persist, the platform could lose its industry‑leading position. In an earlier bid to address these challenges, the organisation had changed its leadership.

“The changes announced today are a departure from our previous way of working. But we are confident they will improve efficiency and agility,” the foundation said in a statement.

What to discuss with friends?

- Media learned that Pump.fun is preparing a $1bn token sale at a $4bn valuation.

- Rise of a neo‑grifter: who is James Wynn and what does Andrew Tate have to do with it.

- The Global South leads the race to adopt cryptocurrencies. Expert views.

- A solo miner earned $330,386 for a mined bitcoin block.

Moscow Exchange launches trading in bitcoin‑ETF futures

On June 4, the Moscow Exchange launched trading in futures on the shares of BlackRock’s iShares Bitcoin Trust ETF.

The product, ticker IBIT, is quoted in US dollars, with settlement in Russian roubles.

Trading is available exclusively to qualified investors. The first series of contracts expires on September 19.

By the end of the debut session, turnover exceeded 423m roubles, and the number of trades reached nearly 8,600.

Experts described the first day as “testing the instrument” and expressed confidence that demand will grow, given the heightened interest in cryptocurrencies overall.

For its part, Sber issued structured notes whose returns depend on bitcoin’s price dynamics. For now the product is available to a limited circle of qualified investors on the over‑the‑counter market.

Also on ForkLog:

- BitMEX revealed operational‑security vulnerabilities of Lazarus Group.

- TON resumed operations after an outage.

- Artificial intelligence created a drug for an incurable lung disease.

- Paul Atkins confirmed the SEC’s retreat from an enforcement‑led approach to crypto companies.

Binance founder warns of risks from the “fashion” for bitcoin reserves

Former head of the largest crypto exchange Binance, Changpeng Zhao (CZ), warned of risks associated with the widespread creation of corporate reserves based on the first cryptocurrency.

He pointed to the reality of extreme scenarios, such as a bitcoin crash, which investors should consider in asset management.

Economist and author of “The Bitcoin Standard” Saifedean Ammous also advised companies accumulating digital gold to prepare for a possible price collapse.

He suggested the cryptocurrency may be nearing the top of a bull cycle, after which a drop of up to 80% could follow. Companies that built bitcoin reserves amid recent highs should assess how resilient their business models are to such an outcome, Ammous stressed.

In the view of Standard Chartered analysts, the increasingly popular copying of Strategy’s approach to accumulating the first cryptocurrency is far from suitable for every enterprise.

Copycats’ average purchase price is much higher than that of Michael Saylor’s company. For now, using borrowed funds to acquire bitcoin looks effective in NAV terms, but the situation could change abruptly in the event of a deep drawdown in the digital asset.

What else to read?

In a new piece we explain how the wealthiest holders of gold and bitcoin are preparing for global changes in the financial world.

In our regular digest we round up the week’s main developments in cybersecurity.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!