Winklevoss Brothers Predict Bitcoin at $500,000

The founders of Winklevoss Capital and the Gemini bitcoin exchange, Tyler and Cameron Winklevoss, believe that the price of bitcoin could break above the $500,000 mark. They are confident that bitcoin outperforms gold, oil, and the US dollar as a store of value and is the only long-term hedge against inflation.

The U.S. dollar is no longer a reliable store of value. @winklevoss and I make the case for $500K #Bitcoinhttps://t.co/scnBM5DcIn pic.twitter.com/0ehHOy29T6

— Tyler Winklevoss (@tylerwinklevoss) August 27, 2020

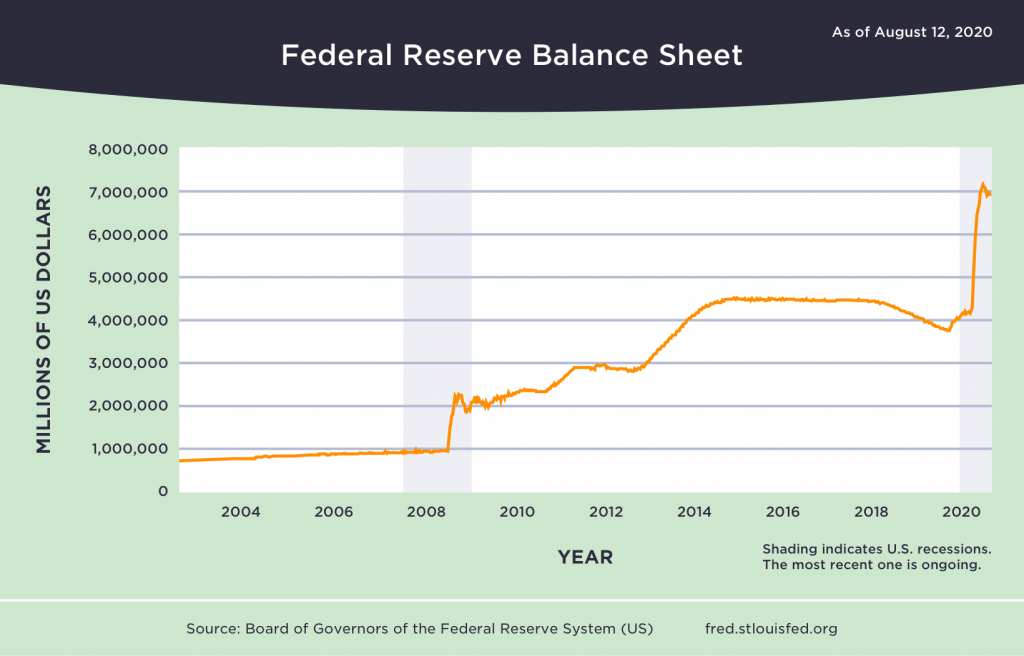

In a joint article, the entrepreneurs detailed how the Federal Reserve responded to the economic crisis provoked by the Covid-19 pandemic. They criticized quantitative easing (QE) and debt financing, and predicted a “Great monetary inflation” in the near future.

“In the last six months, the Fed printed two-thirds of the amount it printed in the previous 11 years,” the Winklevosses noted.

Fed balance sheet. Data: Winklevoss Capital.

To corroborate their words, a day earlier Fed Chair Jerome Powell said that the central bank is prepared for inflation to rise above the 2% target. He did not see any threat in such an outcome. An alternative, in his words, would be a sequence of broad-based defaults, including sovereign defaults.

“The debt-to-GDP ratio in the United States this year will rise more than in any other decade,” the Winklevosses noted.

The same trend is evident in other countries, the Gemini founders added.

When it becomes necessary to service inflated debts, governments will have three options, they continued.

- Default on part of the debt (hard default);

- Austerity policies;

- Inflation growth to reduce the value of debt (soft default).

In their view, Powell signaled a tilt toward the third option.

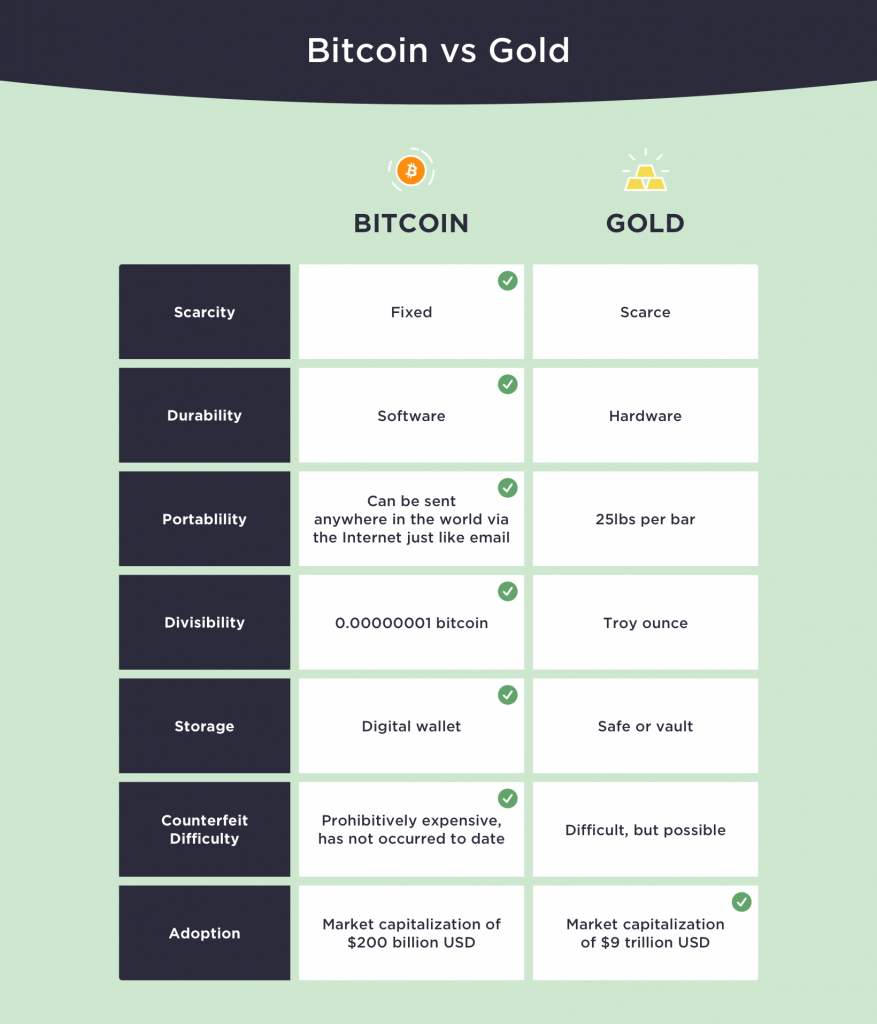

The brothers also recalled gold’s drawbacks: uncertain supply (including gold on asteroids), portability challenges, and the risk of confiscation. US authorities, they noted, are already enacting laws necessary for mining in space.

Comparison of bitcoin and gold properties. Data: Winklevoss Capital.

If bitcoin follows gold’s path and/or partly replaces fiat reserves held by central banks, its price could soar to $500,000–$600,000, the Winklevosses said.

In March, the Fed cut its key rate to 0–0.25%. At that time, the community’s views on whether bitcoin could serve as an inflation hedge were divided.

In August, the Nasdaq-listed MicroStrategy acquired 21,454 BTC (~$250 million at the time of the deal). The company regards bitcoin as a more reliable alternative to the devaluing US dollar.

In Fidelity, the investment firm managing assets of $8.3 trillion, they consider bitcoin to be a hedge against problems in the traditional financial system. Its president has already filed with the U.S. SEC an application to register a bitcoin fund aimed at institutional investors.

Earlier, the author of the bestseller “Rich Dad Poor Dad” and entrepreneur Robert Kiyosaki said that Fed and U.S. Treasury actions are bringing a serious banking crisis closer and that it is time to invest in bitcoin.

Read about the Fed’s policy during the pandemic and the current economic crisis in our articles here, here and here.

Read about helicopter money here.

Subscribe to ForkLog news on Telegram: ForkLog Feed — all the news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!