Open Interest in Bitcoin Options Hits a Record as Bitcoin Rallies to $13,000

Against the backdrop of Bitcoin’s first breach of the $13,000 mark, total open interest (OI) in Bitcoin options hit an all-time high.

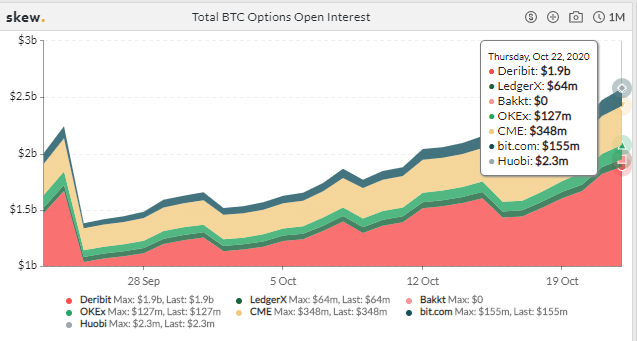

The chart below shows that on October 22 the figure crossed the $2.5 billion threshold.

Data: skew.

As before, the highest activity is concentrated on Deribit. The total open interest on this platform stands at $1.9 billion, on the regulated CME exchange — $348 million.

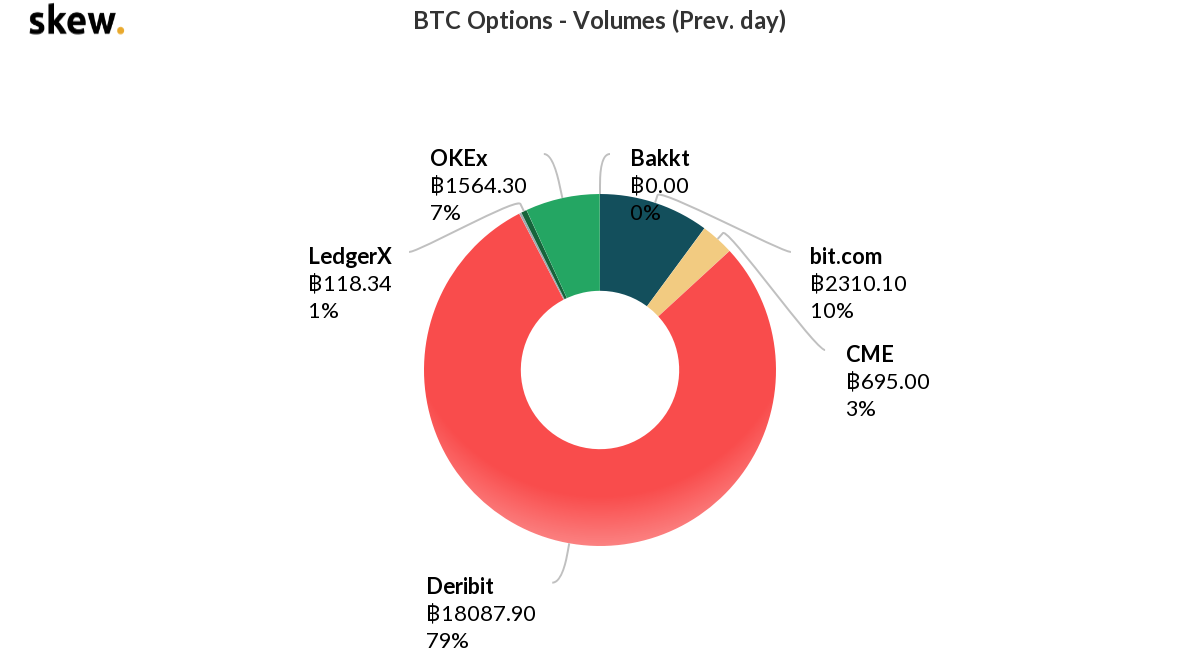

The Deribit share in aggregate trading volume is close to 80%.

Data: skew.

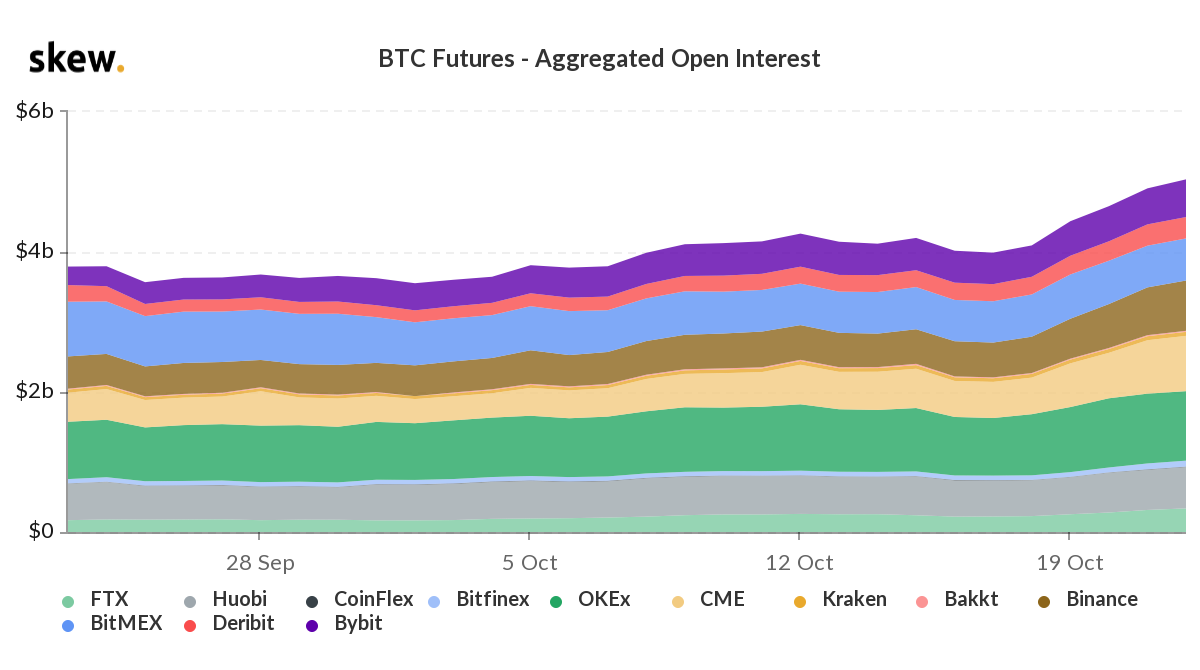

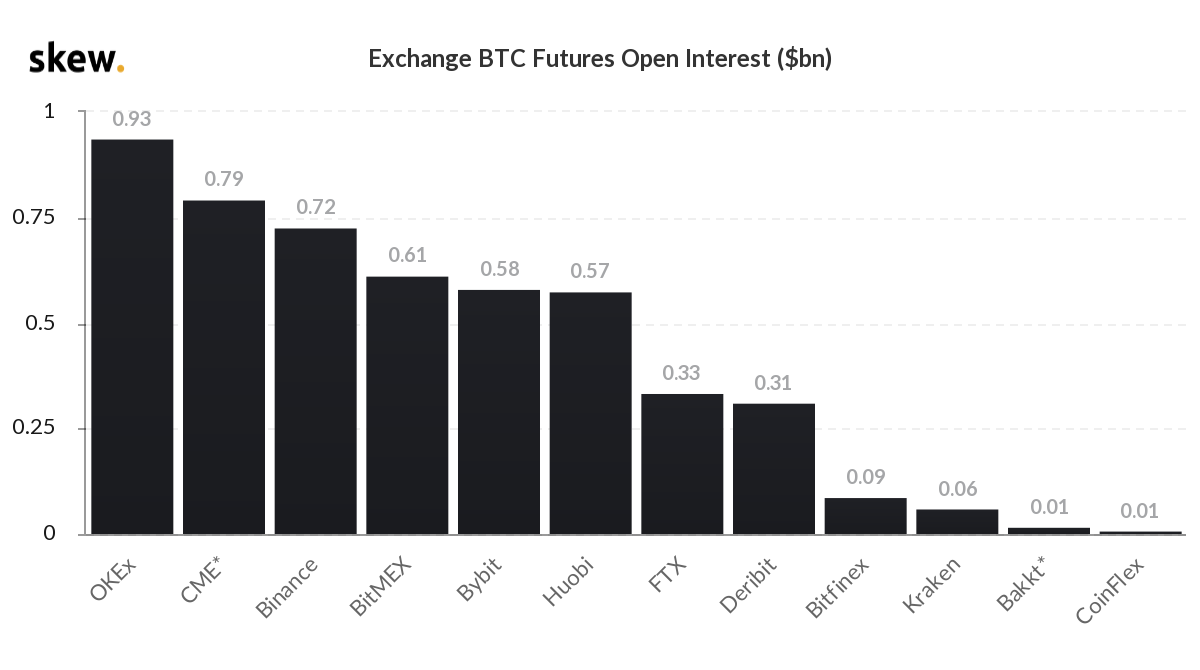

There is also a notable uptick in the Bitcoin futures market. Aggregated open interest in this segment has reached $5 billion.

Data: skew.

Notably, CME’s open interest surpassed Binance’s for the first time. This may indicate rising interest in Bitcoin among large players.

Data: skew.

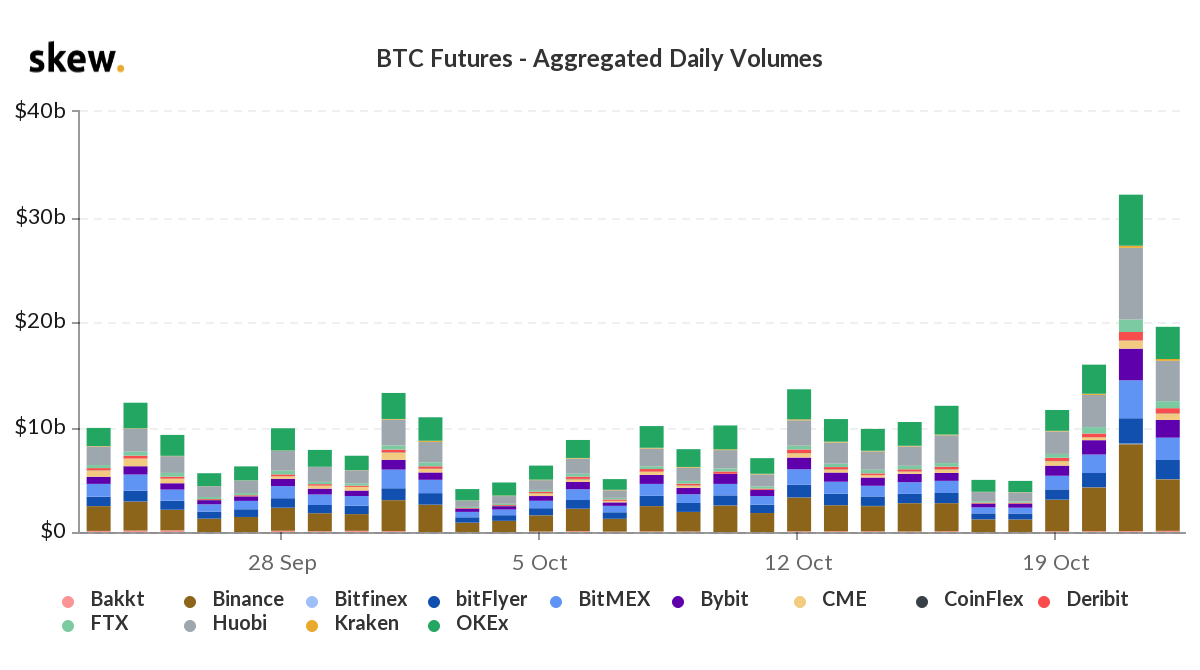

On October 21 there was a notable spike in futures trading volume for the leading cryptocurrency.

Data: skew.

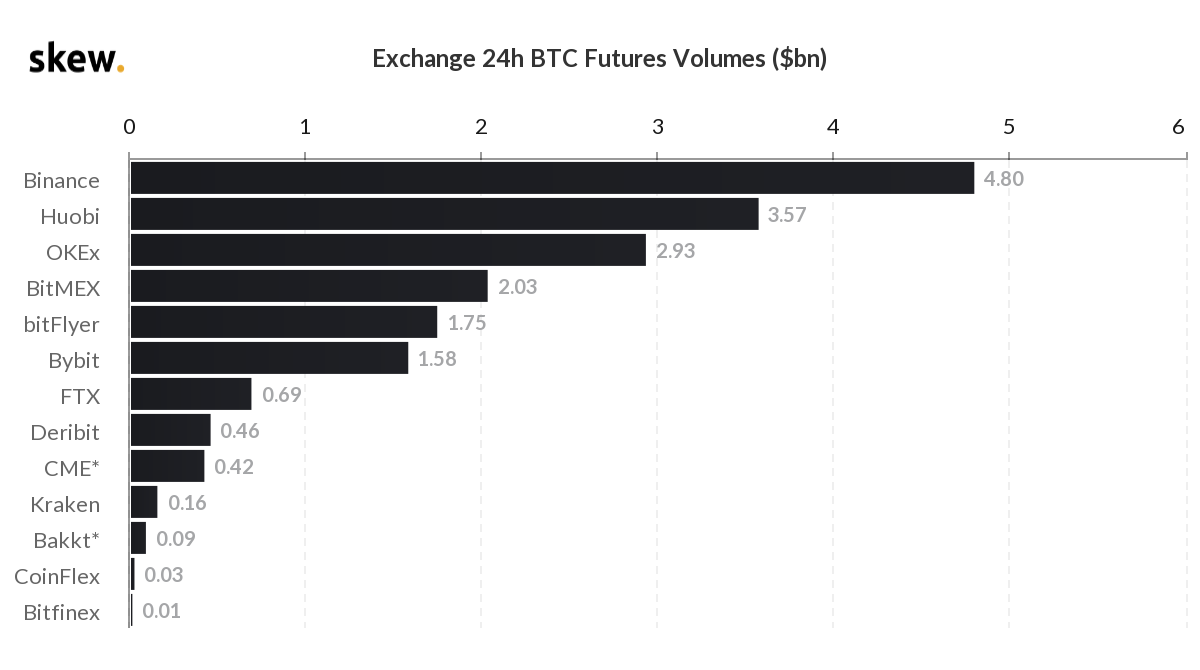

The most active turnover is shown by Binance’s futures platform. BitMEX ranks fourth by trading volume.

Data: skew.

Earlier Arcane Research expressed the view that the decline in BitMEX’s share would benefit the crypto-derivatives market.

Subscribe to ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!