Opinion: Perpetual DEX to Define Stock Prices, Not Nasdaq

By 2026, stock pricing will shift from Nasdaq to on-chain, says ex-BiMEX CEO Hayes.

By the end of 2026, the pricing of major American stocks will shift from traditional exchanges to the on-chain space: the market will begin to focus not on Nasdaq, but on perpetual contract charts. This view was expressed by former BiMEX CEO Arthur Hayes.

The expert highlighted three key reasons for this tectonic shift:

- 24/7 trading, eliminating dependence on traditional exchange sessions;

- global accessibility for traders worldwide without geographical restrictions;

- absence of intermediaries inherent in TradFi.

This forecast explains how stock perpetual contracts (perps) are already capturing the market, offering a more efficient model for traders.

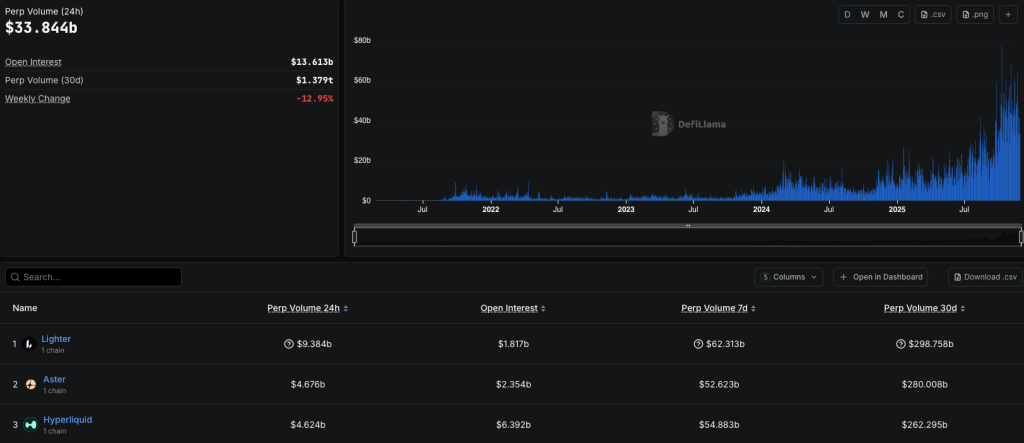

This relatively new instrument demonstrates significant trading volumes, confirming its demand.

As an example, Hayes cites the launch of a perpetual contract on the Nasdaq 100 index on the decentralized exchange Hyperliquid. The instrument was created using the permissionless protocol HIP-3; its average daily trading volume already exceeds $100 million.

According to the expert, by the end of next year, all major CEX and DEX will offer similar products. He says this will completely change the landscape of the derivatives market. The success of such derivatives is due to their fundamental advantages for retail traders.

Why Perps Are More Attractive for Retail

The value of the new product lies in its focus on the retail investor. Arthur Hayes asserts that the success of perpetual contracts lies in solving two key problems for traders: liquidity and leverage.

Since perps have no expiration date, all liquidity is “concentrated in one instrument.” This sets them apart from traditional futures, where liquidity is spread across a range of contracts with different expiration dates, making the market fragmented.

Cryptocurrency exchanges can offer significantly higher leverage (for example, 100x) compared to TradFi platforms. This is possible due to a different margin management system used in the digital asset industry.

There Is a Difference

The main difference lies in the format of the instruments themselves. Cryptocurrencies are “bearer assets.” This means direct control by the owner and the absence of intermediaries capable of enforcing debt collection.

Unlike traditional markets, where financial intermediaries like banks are required to comply with court decisions regarding overdue debts, cryptocurrency exchanges do not have this capability.

In TradFi, a system of guaranteed settlements operates: clearinghouses must have significant capital and are entitled to go to court against bankrupt traders. This model reduces risks for participants but simultaneously limits the size of available leverage.

Cryptocurrency exchanges use a system of socialized losses, where a trader’s maximum losses are limited to the initial margin amount. According to Hayes, this is a conscious compromise: participants are willing to accept the risk of partial profit payouts during periods of high volatility to have the opportunity to work with greater leverage.

This approach makes derivatives in the crypto market accessible to a wide audience worldwide.

A Political Catalyst

According to Hayes, political changes in the United States are easing regulatory barriers that previously hindered the integration of new technologies into the traditional financial system.

He believes that Donald Trump’s administration will create conditions for direct competition between crypto projects and TradFi giants. According to the expert, this shift is linked to the personal experience of the American president: after instances of “debanking” his family, he seeks to use cryptocurrencies as a tool to pressure the system that tried to limit him.

Hayes predicted a favorable climate will persist at least until the end of the presidential term — until 2029.

The US political course effectively signals regulators in other countries to adopt similar solutions, he noted. As an example, the specialist cited the Singapore Exchange (SGX). The latter, “according to his scenario,” launched similar products immediately after the new Washington administration made cryptocurrencies an acceptable element of the financial market.

The Future Belongs to Next-Generation Derivatives

In conclusion, Arthur Hayes returned to his key thesis: the future of financial markets is tied to more flexible, accessible, and efficient instruments like perpetual contracts.

In his view, the time will come in the foreseeable future when financial media will begin to use the perpetual contract ticker on the S&P 500 as the main price indicator instead of quotes from CME Globex. This will mark a paradigm shift — the final shift of the financial center from Wall Street to the on-chain environment.

Back in April, Hayes asserted that the traditional four-year crypto market cycle is no longer relevant.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!