Prime Trust loses $8 million on Terra stablecoin investments.

The crypto custodian Prime Trust spent $6 million of client funds and $2 million of its own cash on investments in the collapsed algorithmic stablecoin TerraUSD (UST). This was disclosed by the platform’s head Jor Lo in the court filing.

Lo testified in the firm’s bankruptcy proceedings, which were led on November 29, 2022. He cited mismanagement by former leadership.

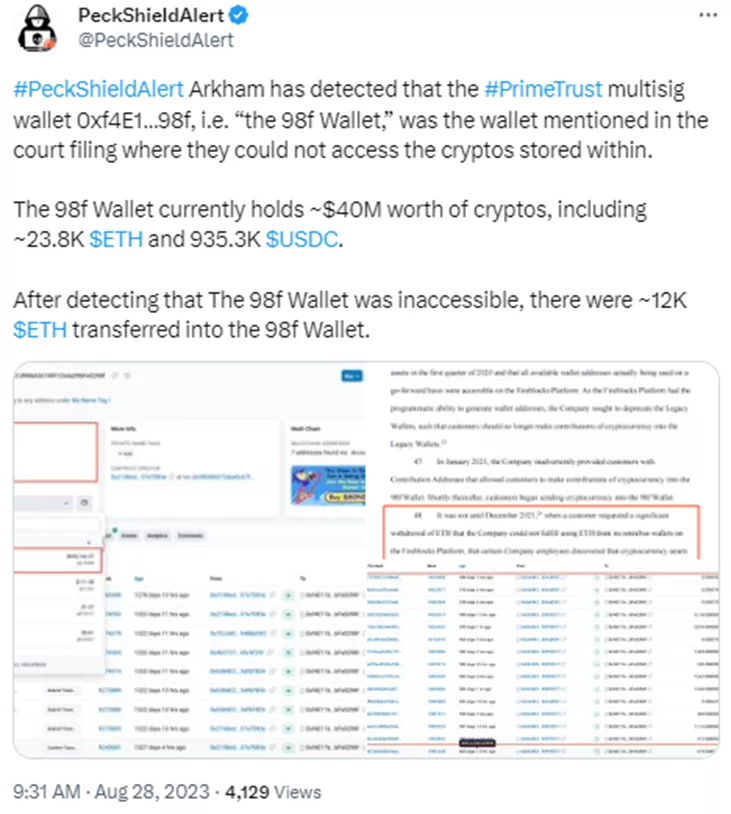

As an example, Lo cited an incident that occurred in January 2021. Customers were mistakenly asked to transfer funds to a wallet inaccessible to Prime Trust. After that, the company had to spend $76 million on buying ETH to fund withdrawal requests.

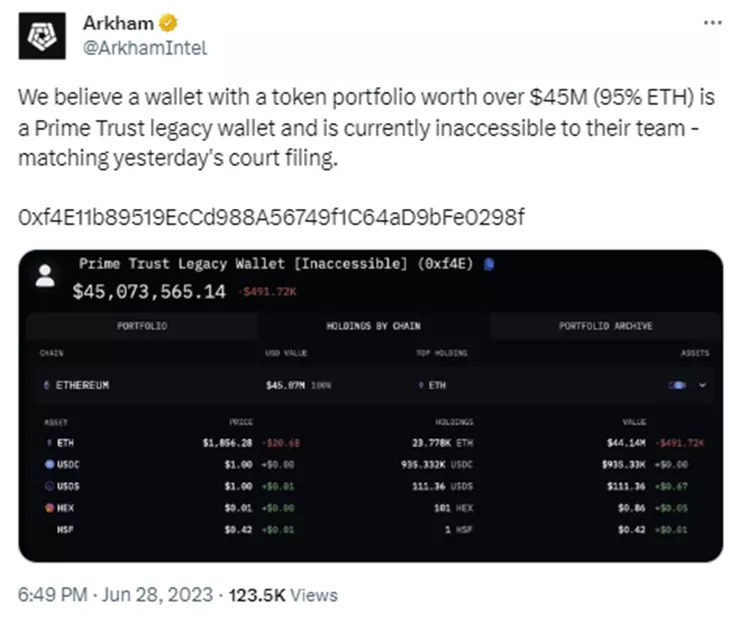

Arkham researchers located the mentioned wallet. It holds $45.1 million in ETH, USDC, USDS, HEX and HSF.

PeckShield analysts found that even after realizing the wallet had lost access, Prime Trust staff transferred about another 12,000 ETH to it.

Additionally, the head of the custodian said that even after the Terra episode, management continued to ramp up spending, sometimes bearing seemingly excessive losses. He said that in November 2022 the company spent $11.1 million with revenue of only $2.7 million.

According to the latest data, the service’s liabilities to clients are estimated at $861,000 in digital assets and $83 million in fiat.

In June, the Nevada Department of Business and Industry ordered Prime Trust to freeze deposits and withdrawals. The regulator cited a ‘capital deficiency’ that prevented the firm from fully satisfying withdrawal requests.

Also, the payments company Banq, linked to Prime Trust, filed for bankruptcy.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!