Reef Finance and Alameda Research dispute: firms clarify their positions

The DeFi project Reef Finance and venture firm Alameda Research cast doubt on the possibility of a partnership. According to blog posts, over the past day representatives of the two companies exchanged mutual accusations and divergent views on the dispute.

On March 15, 2021, Alameda Research acquired Reef Finance tokens (REEF) in a funding round worth $20 million. At the time, the DeFi project’s CEO Danko Manchevski called the company the largest investor.

Later, Alameda trader Sam Trabucco wrote on Twitter that the venture firm “is not affiliated” and “does not endorse” REEF. According to him, the parties had agreed only on an OTC trade, which Reef Finance allegedly refused afterward.

1. Alameda is not affiliated with REEF.

2. Alameda does not endorse REEF.

3. We agreed to an OTC trade with REEF; they immediately went to the press to brag.

4. They then reneged on the OTC trade.

5. We obviously do not recommend anyone do business with REEF in any way.— Sam Trabucco (@AlamedaTrabucco) March 15, 2021

In the next tweet, Trabucco stated that the company owns the majority of the 20m tokens purchased. He called false “any claims that we [Alameda] are immediately selling all the tokens.”

For clarity, BTW: of the 20m tokens we did buy (the original deal was for much more; REEF reneged on the remaining tokens), we are still in possession of the great majority, any claims about us immediately selling all the tokens are false. https://t.co/T738aqv63f

— Sam Trabucco (@AlamedaTrabucco) March 15, 2021

Reef Finance’s account

In Reef Finance назвали statements by Trabucco contradictory. In a blog post, the DeFi project’s team explained that they first met Alameda Research in September 2020. However, regarding the investment, the firm revisited the matter in March, stating the amount of $80 million, the DeFi project noted.

«Alameda provided an investment in the Reef Finance token worth $20 million at a 20% discount […] Alameda also expressed interest in investing an additional $60 million», — is stated in the message.

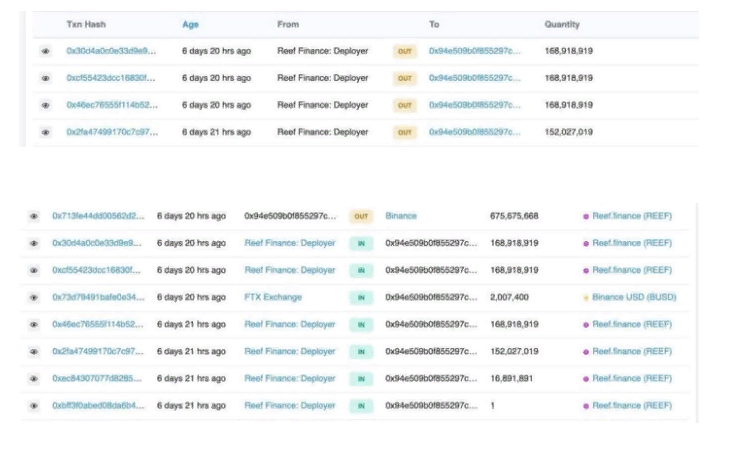

Representatives of Reef Finance said that after the first tranche of $20 million the venture firm transferred the tokens to the cryptocurrency exchange Binance. The project confirmed this with screenshots.

Screenshots from Etherscan. Data: Reef Finance.

«We did not proceed with the additional $60 million tranche due to concerns about Alameda’s long-term interest as a strategic investor», — the team said.

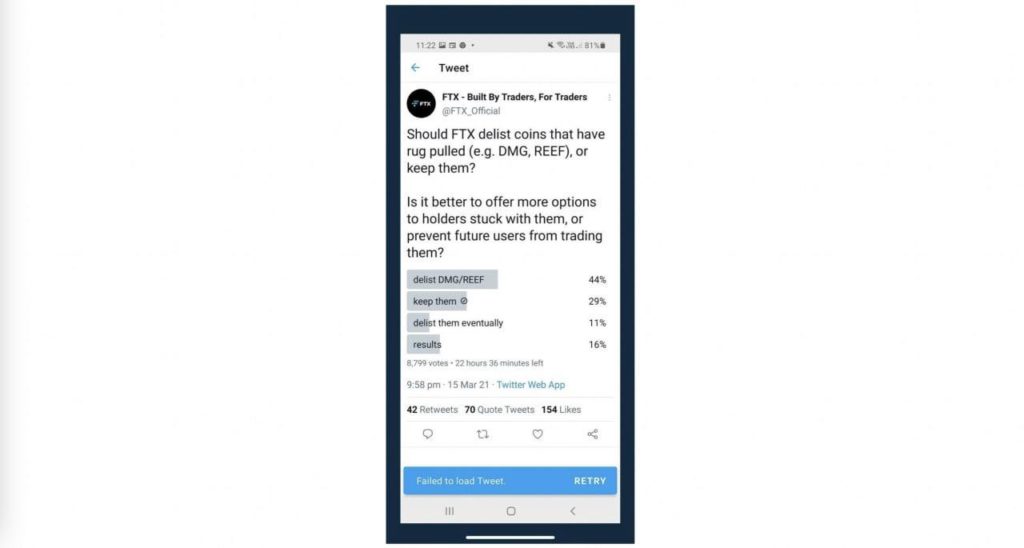

According to the Reef Finance statement, Alameda threatened to delist the REEF token on the trading platform FTX and “other leading exchanges”.

In Reef noted that on the FTX page on Twitter there appeared a poll about the fate of some coins, including REEF. As of writing, there was no such tweet; however, the project’s representatives added screenshots to their post.

Screenshot of FTX’s Twitter page. Data: Reef Finance.

Alameda’s account

In ответном заявлении Alameda presented excerpts from the dialogue between the two teams. According to the company, it agreed to a deal worth $80 million and locked in the price for the entire lot.

«After the payment of the first tranche Reef pulled back and refused to pay the following ones», — Alameda said.

The company described the DeFi project’s refusal to proceed with the deal as “bad-faith conduct,” stating that the partner breached the binding agreement. According to the exchanged messages, Reef’s decision to change course was driven by reputational risks.

According to CoinGecko, in the last 24 hours the price of the REEF token fell by 3.5%. At the time of writing the token was trading at around $0.039.

Reef Finance provides cross-chain solutions and opportunities for yield farming on the Polkadot platform, supporting non-custodial and centralized exchanges.

In February, Alameda Research led a round of funding for the DeFi project Oxygen for $40 million.

Earlier, the Opium Protocol platform attracted $3.25 million from Alameda Research and Galaxy Digital.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!