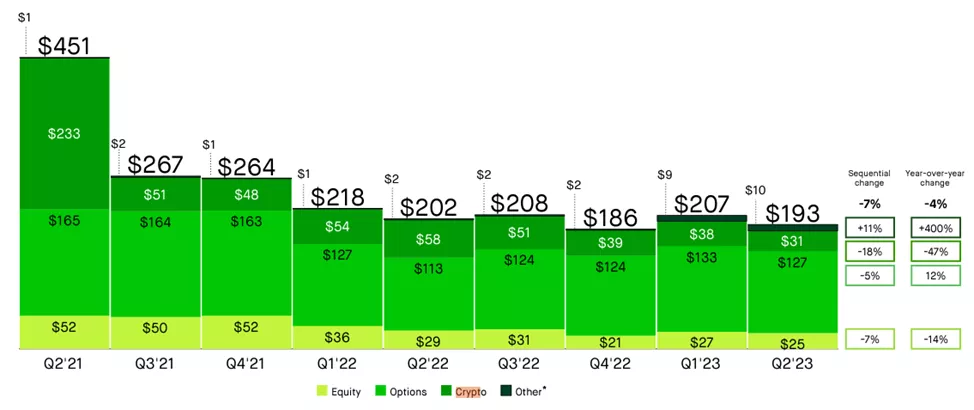

Robinhood’s crypto revenue slides 18%

In the second quarter of 2023, Robinhood’s revenue from digital-asset-related operations declined 18.5% year over year to $31 million. The company said in a report.

The figure was the lowest in the past two years. During this period, it ranged from $31 million to $233 million.

Total operating revenue in the second quarter declined by 7% to $193 million — during the period, the figure was only lower in October–December 2022 ($186 million).

Total revenue rose 10% to $486 million, helped by a 13% rise in net interest income to $234 million.

For the first time in the online broker’s history, net income of $25 million was recorded, versus a $511 million loss in the previous quarter. This was driven in part by a sharp reduction in operating expenses (down 24% year over year).

The decline in revenue from its crypto-focused activity was attributed to a 6% quarterly drop in order executions and a 15% drop in funds in settled trades.

The amount of digital assets held in custody remained at $12 billion.

“Despite the challenging environment for the entire crypto ecosystem, Robinhood continues to develop in this space. In the second quarter, the company added a number of new coins to its listing,” — according to the press release.

The company noted the release of a non-custodial wallet and the associated fiat gateway. A separate app is expected later this year.

In June, media reported on the third wave of layoffs at Robinhood.

Since June 27, the online broker stopped supporting cryptocurrencies Cardano, Polygon and Solana.

On June 5, the SEC filed suit against the Bitcoin exchange Binance, and the following day the regulator made allegations against Coinbase. In both cases the agency classified ADA, MATIC and SOL as assets with the characteristics of securities.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!