Robust Economic Data Triggers Outflow from Crypto Funds

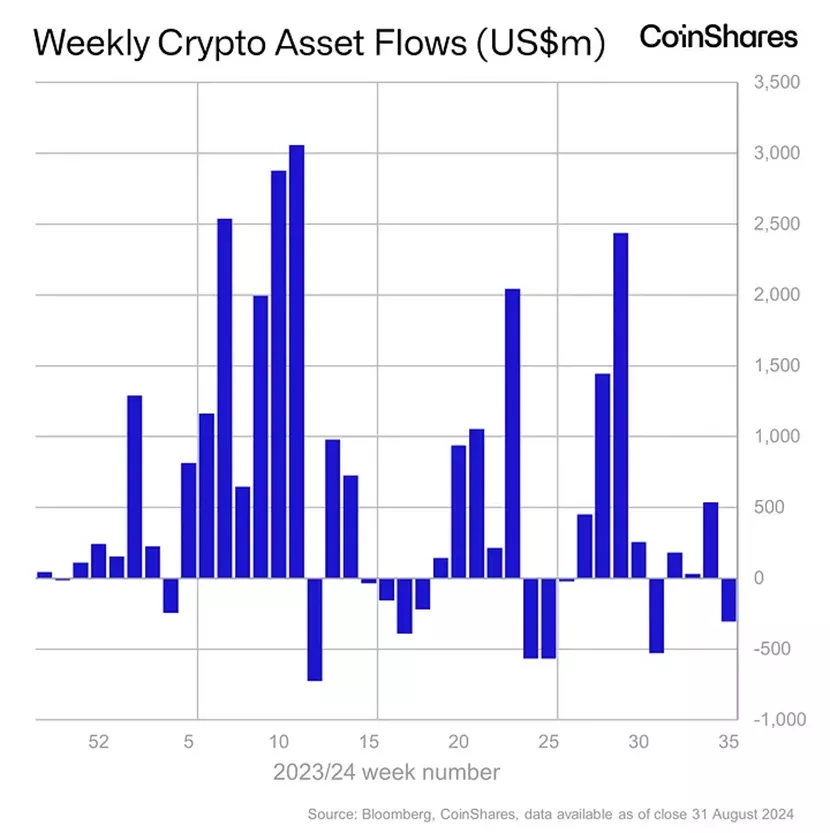

From August 25 to 31, cryptocurrency investment funds experienced an outflow of $305 million, following an inflow of $543 million the previous week, according to CoinShares.

Analysts attributed the reversal in dynamics to macroeconomic data from the US, which reduced the likelihood of a 50 basis point rate cut by the Fed.

Experts emphasized that cryptocurrencies will remain sensitive to developments surrounding upcoming changes in monetary policy.

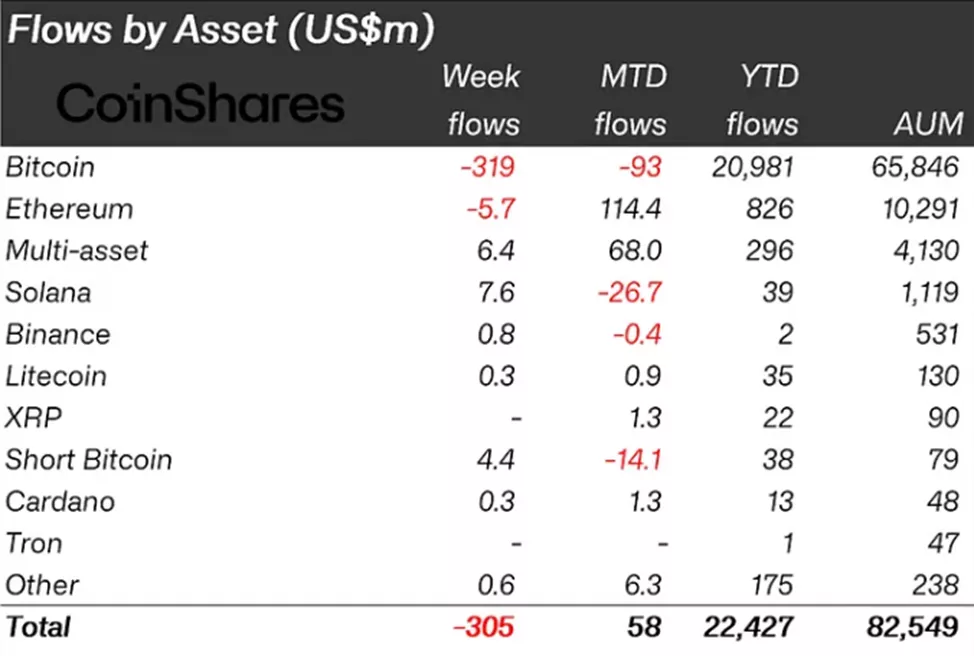

Negative sentiment was concentrated in digital gold. Clients withdrew $319 million from bitcoin-related products after inflows of $543 million the previous week.

Investors added $4.4 million to structures allowing short positions on digital gold, following $1.7 million in the previous reporting period.

Ethereum fund outflows amounted to $5.7 million (compared to $35.7 million the previous week).

Solana-based products received $7.6 million.

Earlier, the number of bitcoin wallets holding at least 100 BTC rose to a 17-month high (16,120). Vivek Sen, founder of Bitgrow Lab, noted that historically significant whale purchases often preceded new ATH.

On August 29, the aggregate balance of the first cryptocurrency on centralized platforms fell to a new annual low, according to CryptoQuant. Specialists also observed an increase in the flow of coins to US-based platforms, which “historically correlates with price increases.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!