SEC policy and dollar strength supported outflows from crypto funds

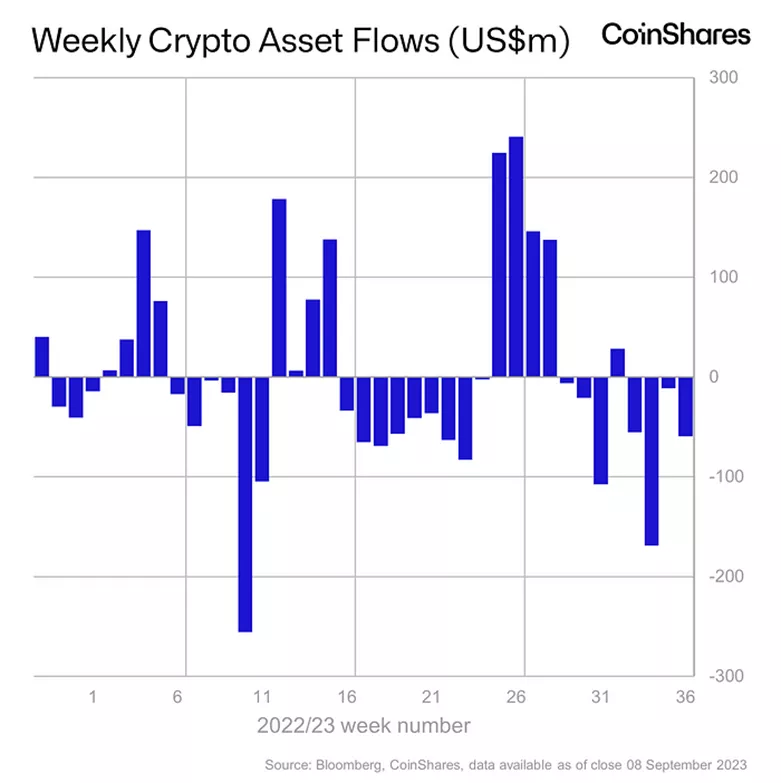

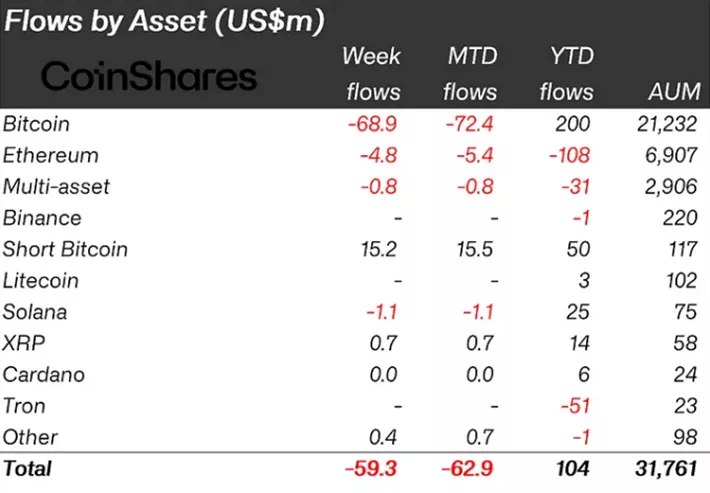

Outflows from cryptocurrency investment products in the period from September 2 to 8 totaled $59 million, compared with $11.2 million a week earlier. CoinShares analysts calculated these figures.

Over the last four weeks investors have withdrawn $294 million — 0.9% of AUM.

Since the start of the year, there has been a net inflow of $104 million.

Trading volumes collapsed by 73%, to $754 million.

Analysts attributed the deterioration in sentiment to continued concerns about digital-asset regulation and a stronger dollar.

In Bitcoin funds there was an outflow of $69 million after inflows of $3.8 million in the previous reporting period.

Structures that allow shorting the first cryptocurrency drew a record $15 million (week earlier investors withdrew $3.3 million). The negative trend ended on week 20.

In altcoin-based products there was mixed dynamics. In Ethereum funds investors withdrew $4.8 million versus $3.2 million in the previous week. Since the start of the year, outflows from them have reached $108 million (~1.6% of AUM).

XRP funds attracted $0.7 million.

Recall that the SEC appealed the blocking of Ripple Labs’ appeal of the judge’s ruling on XRP’s partial recognition as a security.

Earlier, Ripple Labs demanded the withdrawal of the motion for an interlocutory appeal by the SEC, as it did not see any legal grounds to challenge the ruling.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!