SEC Withdraws Claims Against Ripple

The U.S. Securities and Exchange Commission (SEC) is withdrawing its appeal in the case against Ripple, as announced by the fintech company’s CEO, Brad Garlinghouse.

This is it – the moment we’ve been waiting for. The SEC will drop its appeal – a resounding victory for Ripple, for crypto, every way you look at it.

The future is bright. Let’s build. pic.twitter.com/7WsD0C92Cm

— Brad Garlinghouse (@bgarlinghouse) March 19, 2025

The entrepreneur noted that the proceedings lasted over four years.

“Reflecting on today’s events, it seems clear to me that the case was doomed from the start. In many ways, it was the first major shot in the war against cryptocurrencies,” he stated.

In December 2020, the SEC filed a lawsuit against Ripple, accusing the company of selling unregistered securities in the form of XRP worth $1.3 billion. Garlinghouse and co-founder Chris Larsen were also named as defendants.

In July 2023, Judge Analisa Torres of the Southern District of New York ruled that programmatic sales and other distributions of Ripple’s token did not constitute an offer and sale of investment contracts. However, the decision stated that sales of coins to large players violated securities laws.

The SEC’s interim appeal was rejected by the court, which found insufficient evidence and deemed that its consideration would not “significantly advance the ultimate termination of the case.”

Subsequently, the Commission withdrew the lawsuit against Garlinghouse and Larsen. The parties reached a settlement, eliminating further charges on previous grounds.

In August 2024, Judge Torres issued the final ruling on the case, fining Ripple $125 million. The regulator initially demanded $2 billion. In October, the SEC challenged the verdict.

Following this, the agency took steps to review previously court-adopted decisions regarding the erroneous application of the law. The Commission proposed revisiting the offers and sales of XRP on digital asset platforms, the involvement of Garlinghouse and Larsen, and the distribution of the token “in exchange for consideration other than cash.”

“Ripple was the first company with the resources, determination, and fortitude to fight against regulatory overreach, and today this journey finally concludes. This is a victory and a long-overdue capitulation by the SEC,” Garlinghouse emphasized.

He thanked industry participants for their support of Ripple during the proceedings with the regulator. The entrepreneur particularly highlighted the role of the company’s chief legal officer, Stuart Alderoty.

Alderoty has already stated that the firm will consider how “best to file a counter-appeal” against the SEC.

“Today, Ripple moves forward — stronger than ever. This remarkable case has set a precedent for the American crypto industry,” he stressed.

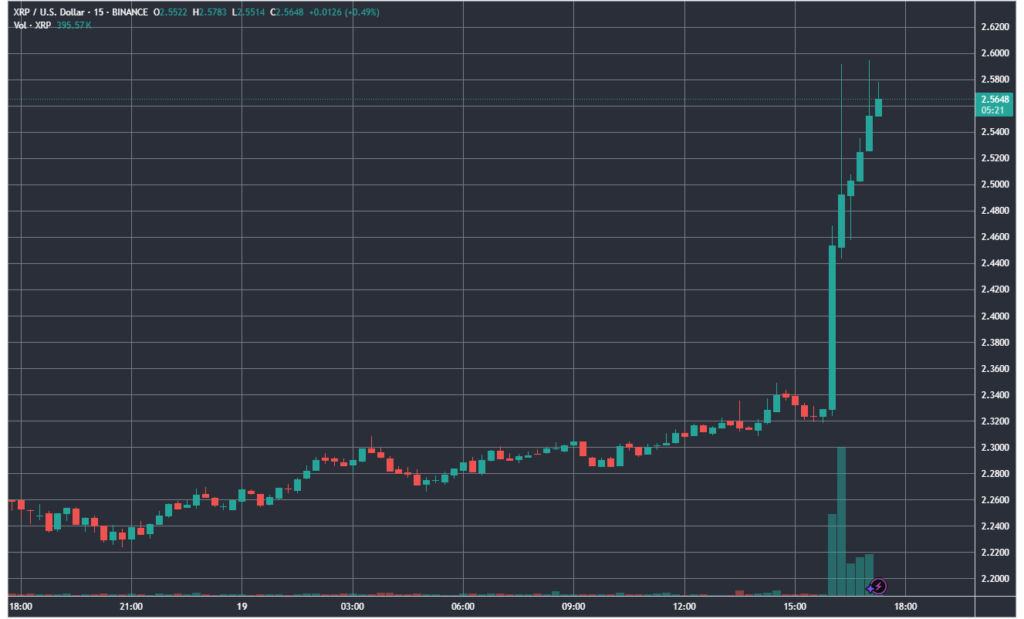

In light of the news, XRP prices surged by approximately 15%. The token’s price rose to levels near $2.6.

Earlier in March, U.S. President Donald Trump announced the creation of a strategic crypto reserve, proposing to include XRP alongside Bitcoin, ETH, SOL, and ADA.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!