Solana Faces ‘Liquidity Reset’, Experts Observe

Solana's liquidity reset signals a new cycle, with potential recovery by January.

Since mid-November, Solana’s 30-day realized profit-to-loss ratio has remained below one. This figure indicates a liquidity squeeze to bear market levels, as noted by Glassnode.

Liquidity can be assessed through several measures, including the Realized Profit-to-Loss Ratio (30D-SMA).

For Solana, this ratio has traded below 1 since mid-November, meaning realized losses now exceed realized profits. This signals that liquidity has contracted back to levels… https://t.co/KWA67kkGLm pic.twitter.com/cZELe5xzdD— glassnode (@glassnode) December 10, 2025

Analysts at Altcoin Vector described the situation as a “full liquidity reset.” Historically, this signal has marked the beginning of a new cycle and the formation of a local bottom.

A key lesson in alt positioning: when liquidity ignites, the move is fast.$SOL is under a full liquidity reset, setting a new liquidity cycle, as in past bottoming phases.

Forced selling exhausts, the ecosystem cleans from the inside out, and SOL begins building the base for… pic.twitter.com/tiLw6gwhdb

— Altcoin Vector (@altcoinvector) December 5, 2025

If the pattern repeats the scenario from April, experts believe the price recovery will take about four weeks, starting in early January.

Wenny Cai, COO of SynFutures, explained to Decrypt that the drop in metrics is due to loss realization, a decline in futures open interest, and the exit of market makers. The short-term situation remains susceptible to shocks, but the long-term outlook appears moderately bullish.

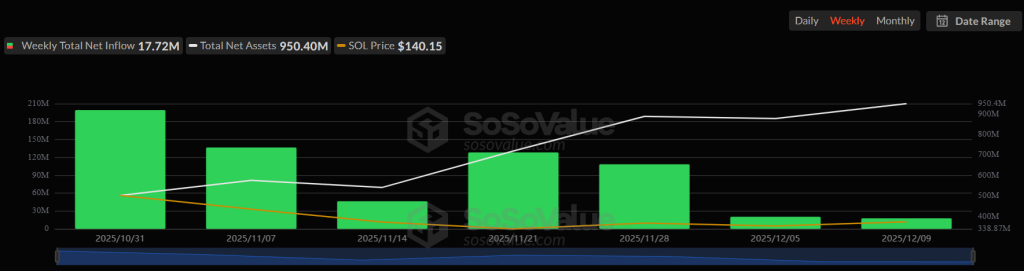

Two factors support the asset: the outflow of coins from exchanges and the inflow of capital into spot ETFs based on Solana. According to SoSoValue, exchange-traded funds attracted $17.72 million over the week.

Ryan Lee, chief analyst at Bitget, described the current correction as an opportunity for strategic accumulation. Despite purchases, conditions in the derivatives market remain tense.

The total volume of liquidations in the crypto market over the past day reached $434.94 million. Solana rose by 3.7%, leading to the forced closure of positions worth $14.5 million. This is the third-highest figure after Bitcoin and Ethereum.

The key risk is concentrated in longs. A drop in quotes to $129 (5.8% below the current price of $137, according to CoinGecko) will trigger the liquidation of long positions worth $500 million. Lee noted that such a scenario would help clear the market of excessive leverage and create conditions for institutional inflows.

Back in November, DeFi Development Corp. approved changes to Solana’s tokenomics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!