SOPR: finding bitcoin’s highs and lows

Key points

- The Spent Output Profit Ratio (SOPR) is an on-chain indicator used to analyse bitcoin’s market cycles.

- SOPR is an oscillatory metric that helps identify periods when long-term investors are selling BTC at a loss or, conversely, locking in profits.

- This on-chain tool can be used to spot local price lows and highs for the leading cryptocurrency. SOPR’s creator considers the indicator to be leading.

How SOPR works

Researcher Renato Shirakashi proposed SOPR in 2019, introducing it and explaining how it works on his blog.

As with the on-chain MVRV indicator, Shirakashi assumed that each bitcoin transaction reflects a purchase or sale of the asset. Instead of realised capitalisation, SOPR looks at the ratio between the sale and purchase prices of bitcoin.

For the purchase price, SOPR uses the dollar value at the penultimate movement of the coins; for the sale price, it uses the dollar value at the most recent transaction.

To derive these, SOPR relies on data from unspent transaction outputs (UTXOs). The purchase price corresponds to an incoming transfer of, say, 10 BTC; the sale price is the subsequent movement of those same 10 BTC.

For example, if a 10 BTC UTXO was created when 1 BTC was $20,000 — the purchase price — and those 10 BTC are later moved when 1 BTC is $40,000, that implies a sale. The SOPR for these coins would therefore be 2 — the ratio of the dollar values of the two opposing transfers of the same BTC. The calculation can be made for each UTXO or for a selected cohort, depending on the SOPR variant.

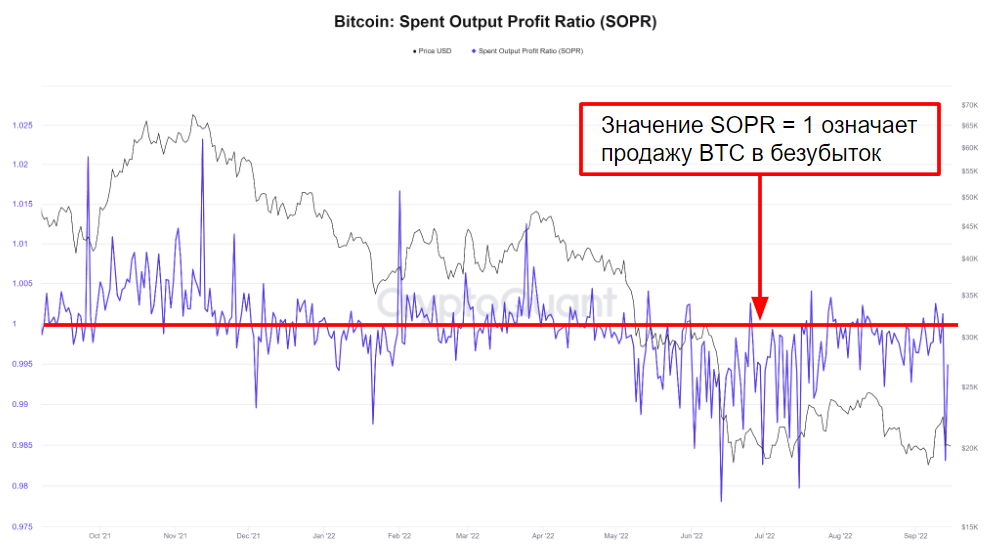

Analysts plot the SOPR curve against the bitcoin price. A BTC price at which SOPR is above 1 is considered a break-even level for selling.

Bitcoin’s SOPR can be tracked in real time on platforms such as Decentrader and Glassnode. A chart from the latter is also available on TradingView. Glassnode has also published analogous versions of the indicator for Ethereum and Litecoin.

SOPR variants

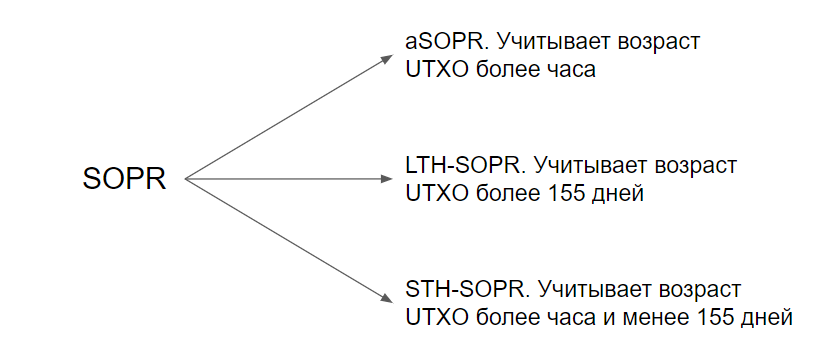

Beyond the original SOPR, analysts have devised several modifications with finer parameter tuning. The best known are:

- Adjusted SOPR (aSOPR). The most widely used variant, it excludes UTXOs younger than one hour. This dampens the impact of some speculators and arbitrageurs who use BTC as a transit asset during exchanges or trades.

- Short-Term Holder SOPR (STH-SOPR). Less sensitive than aSOPR, it considers UTXOs older than one hour and younger than 155 days.

- Long-Term Holder SOPR (LTH-SOPR). Designed to analyse long-term investor behaviour, it only includes UTXOs older than 155 days.

Using SOPR

SOPR is one of the simpler tools for analysing bitcoin’s market cycles. Interpreting the oscillator boils down to a few cases:

- If the value equals 1, investors are selling bitcoin at break-even. The purchase price equals the sale price.

- A reading above 1 signals an uptrend, with investors selling at a profit.

- A reading below 1 points to a downtrend — investors are holding losing positions or realising losses.

Risks of using SOPR

The indicator’s simplicity and popularity do not shield users from risk when trading bitcoin. Like other on-chain metrics, such tools remain an experimental way to gauge market sentiment.

- Interpretation. SOPR rests on the assumption that each bitcoin transfer is a purchase or sale. That is not a fact and may mislead traders. No one can know precisely when and at what prices all bitcoins were bought or sold.

- Trading. SOPR is intended to assess and analyse long-term trends and investor behaviour under different market conditions. Making trading decisions purely on SOPR readings is outside its remit. Price action can diverge markedly from transaction data.

- Large BTC holders. Any large investor or crypto exchange with sufficient BTC can skew SOPR’s logic and distort its readings. For example, Microstrategy, which held nearly 130,000 BTC as of September 2021, might change its custody setup and move funds to other addresses. SOPR will “see” BTC movements on-chain, indicating investors are taking profits or losses, even if it is merely an internal transfer.

Further reading

What is the RSI indicator and is it suitable for cryptocurrencies?

Why does slippage occur in crypto trading?

What is the Hash Ribbons indicator?

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!