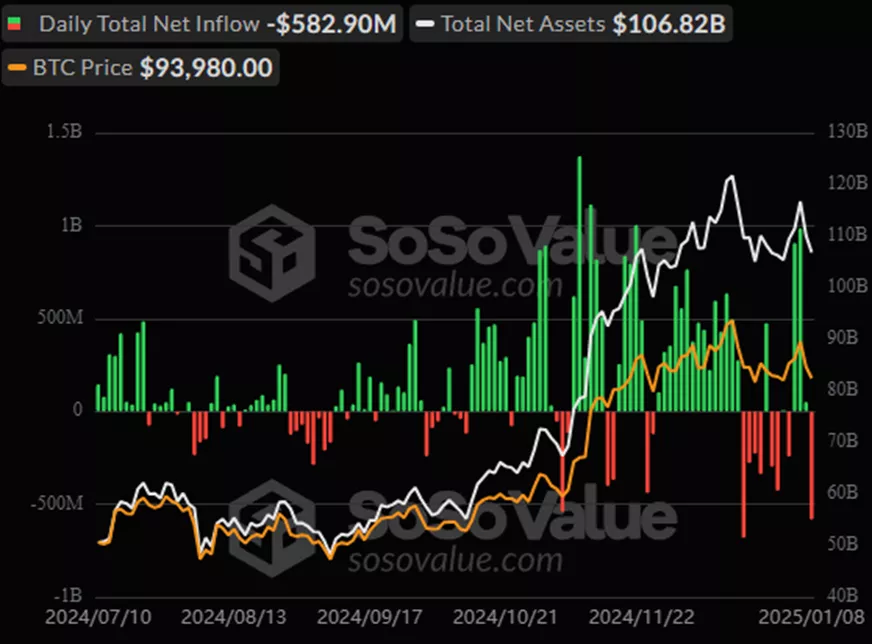

Spot bitcoin ETFs see the largest outflow in three weeks

On January 8, outflows from spot bitcoin exchange-traded funds totaled $582.9 million. Over the preceding four days, investors had put $1.95 billion into the products.

The largest outflow was from Fidelity’s FBTC ($285.7 million) — the biggest on record.

Cumulative inflows since the approval of BTC ETFs in January reached $36.37 billion.

AUM for the products fell to $106.8 billion.

IBIT accounts for 49.2% ($52.5 billion) of that total. Together with Grayscale’s GBTC ($19.2 billion) and Fidelity’s FBTC ($19.3 billion), BlackRock’s fund concentrates 85.2% of sector assets.

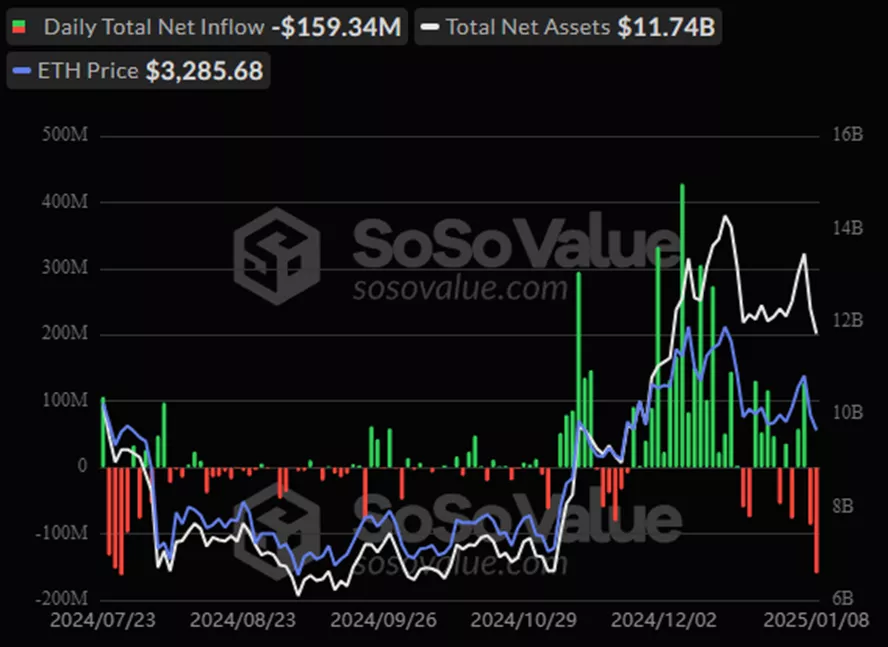

ETH-ETF

On January 8, outflows from ETH ETFs totaled $159.4 million after $86.8 million the day before.

As with the BTC ETFs, the Fidelity product (FETH) recorded the biggest losses — $147.7 million.

Since launch, the instruments have attracted $2.52 billion.

AUM fell to $11.7 billion.

The leaders are Grayscale’s ETHE ($4.61 billion) and BlackRock’s ETHA ($3.66 billion).

In 2024, issuers of BTC ETFs and public companies bought 859,454 BTC, according to K33 Research. That equals 4.3% of the available supply and is equivalent to miners’ output over the next eight years.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!