Sygnum Analysts Signal the Onset of Altcoin Season

Increasing liquidity, improved regulation, and a surge in on-chain activity create favourable conditions for the onset of an altcoin season, according to Sygnum’s third-quarter report, as reported by Cointelegraph.

Earlier this year, international political tensions and uncertainty in U.S. financial strategy led to a mass sell-off of alternative coins.

“As the regulatory status of altcoins becomes clearer, capital may flow into projects with real use cases and sustainable tokenomics. This shift may have already begun, as some data suggests,” the experts stated.

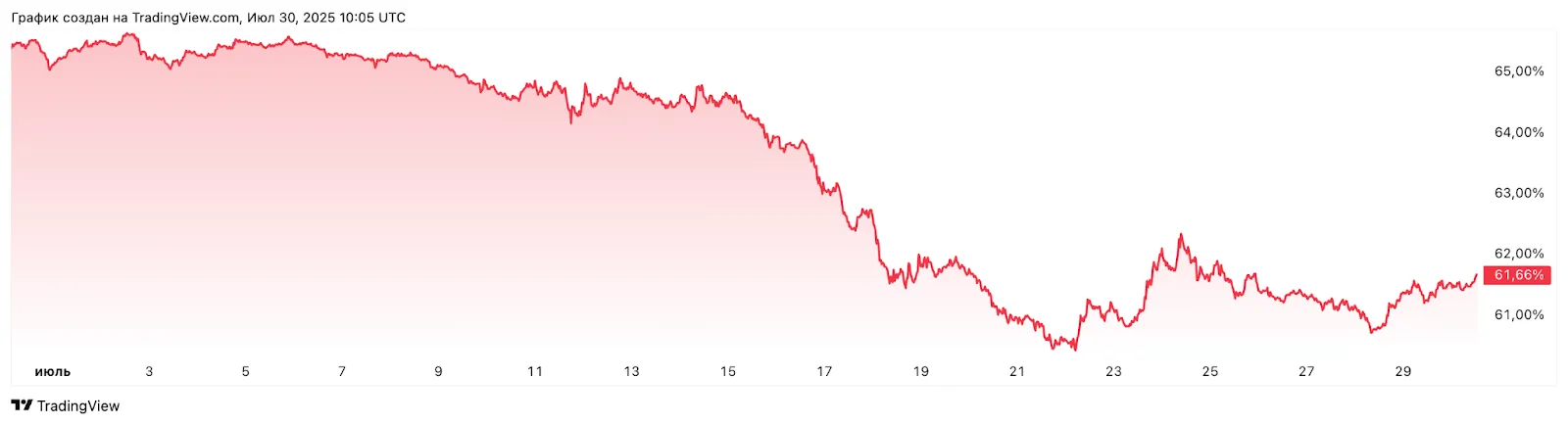

They pointed to a 6% decline in Bitcoin’s dominance over the past month. This figure has deviated from the peaks of 2021, hinting at growing investor interest in altcoins.

Bitcoin and Ethereum Set to Rise

Meanwhile, the bullish trend for Bitcoin persists, analysts noted. The imbalance of supply and demand continues to push digital gold towards new all-time highs — on July 14, the cryptocurrency surpassed a record $123,000.

The positive trend is supported by capital inflows into ETFs. The value of assets under management by crypto funds has already exceeded $160 billion. In the last quarter alone, these structures accumulated over 110,000 BTC.

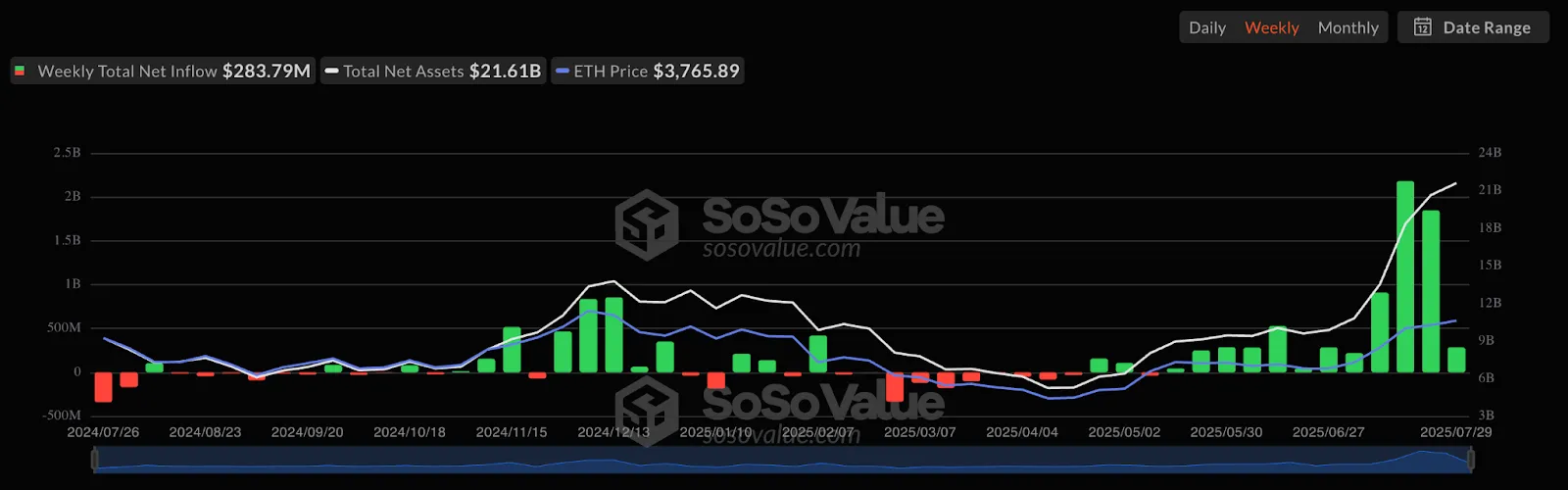

Ethereum shows a similar trend:

- ETH balances on exchanges are decreasing;

- Ether-based ETFs record unprecedented inflows.

Experts highlighted that Ethereum has “finally overcome the long-term downtrend.” This was facilitated by the Pectra update and a sharp increase in demand from institutional investors. The company Sharplink plans to invest $1 billion in ETH.

Meanwhile, Wall Street giants like BNY Mellon and Societe Generale are increasingly interested in stablecoins based on the second-largest cryptocurrency by market capitalization.

DeFi and DEX Records

Sygnum analysts also highlighted the successes of the decentralized finance sector. According to their data, in the last quarter, DEX captured 30% of the total spot trading volume of cryptocurrencies. PancakeSwap took the lead on BNB Chain, while the platform PumpSwap by Pump.fun surpassed Raydium on Solana.

The volume of DeFi lending reached a historic high of $70 billion. Currently, 30% of Ethereum’s liquid supply is also locked in staking. Experts called these factors “the main beneficiaries of the rally” in the crypto market.

However, they warned: the current hype around altcoins could trigger a repeat of the 2021 scenario, where a sharp rise was followed by a correction. Particularly dangerous are meme coins — projects without fundamental value, Sygnum stated.

Back in July, CryptoQuant author and on-chain analyst Timo Oinonen pointed to the end of the era of “mass altseasons.” According to him, the next growth cycle will not affect the entire market — only a few projects will outperform Bitcoin in terms of returns.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!