Tariff Wars Intensify Crypto Fund Outflows to $795 Million

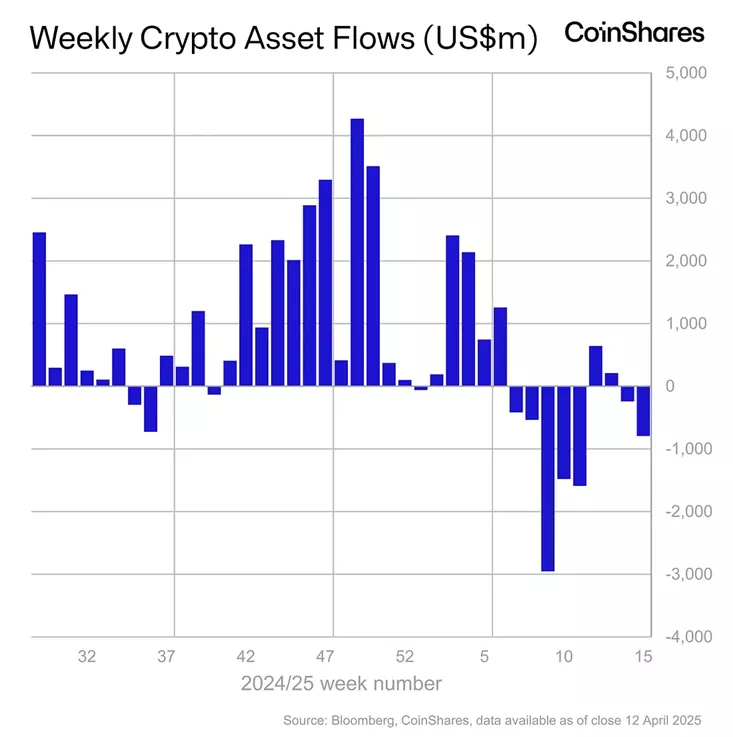

Between April 5 and 11, clients of cryptocurrency investment funds withdrew $795 million following $240 million the previous week, according to data from CoinShares.

The negative trend continued for the second consecutive week.

Since February, products have collectively lost $7.2 billion, effectively nullifying all inflows since the beginning of the year, experts calculated.

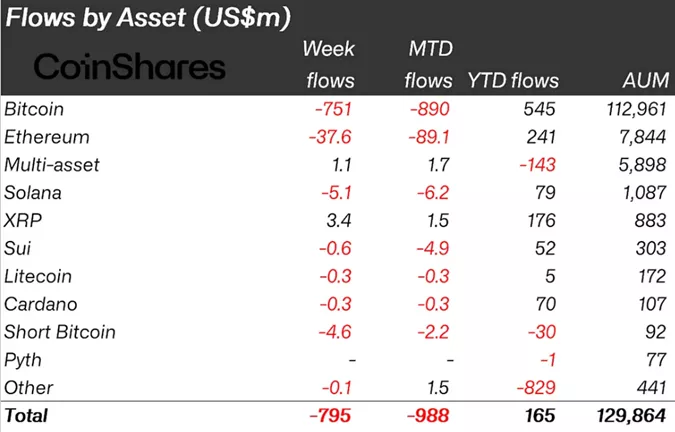

AUM fell to $129.9 billion.

The outflow was concentrated in instruments based on the first cryptocurrency ($751 million). The previous week it was $207 million.

In the segment of U.S. spot Bitcoin ETFs, fund withdrawals intensified from $172.7 million to $713.3 million.

Altcoins also experienced a negative trend: Ethereum funds saw outflows of $37.6 million, while Solana and Sui recorded $5.1 million and $0.58 million respectively.

In contrast, XRP saw an inflow of $3.4 million.

Earlier, it was suggested that the cryptocurrency market could reach a local bottom by June, with the future direction determined by the outcome of tariff negotiations between the U.S. and major trading partners, according to Nansen.

Previously, 10x Research described the bullish momentum in Bitcoin as “premature.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!