Tether Faces Renewed Criticism Over Transparency and Business Structure

Concerns about Tether’s transparency and business structure evoke memories of the FTX collapse, according to a thread by Cyber Capital founder Justin Bons.

2/17) The potential for collapse here is greater than Terra Luna!

Making it one of the biggest existential threats to crypto as a whole

As we have to trust they hold $118B in collateral without proof!

Even after the CFTC fined Tether for lying about their reserves in 2021… pic.twitter.com/KoJFbyjRj1

— Justin Bons (@Justin_Bons) September 14, 2024

“[Tether] — one of the biggest existential threats to cryptocurrencies as a whole. We have to trust them, and they hold $118 billion in collateral without proof! Even after the CFTC fined Tether for lying about their reserves in 2021,” wrote the entrepreneur.

Bons also noted that the stablecoin issuer has yet to conduct an audit of its reserves.

“However, the ‘auditor’s report’ or ‘accountant’s report’ is not an official document! Despite claims, Tether has never provided its alleged reserves for a real unrestricted third-party assessment,” the expert expressed indignantly.

The purchase by the organization of a 9.8% stake in the Latin American agricultural giant Adecoagro for $100 million in September revealed its management structure.

“The board of directors of Tether Holdings consists of only two people: Giancarlo [Devasini] and Ludovicos [Jan Van der Vende]. This means that in 2024, USDT reserves are still not segregated. These two have absolute control!” commented Bons.

In a comment to Cointelegraph, IDA Finance co-founder Sean Lee also expressed concerns about the company’s lack of transparency:

“Tether is structured as a business, and its persistence in refusing detailed transparency, which would ensure real trust from the community and institutional players, is indeed concerning.”

According to CoinGecko, USDT’s share of the stablecoin market has exceeded 75%, amplifying such concerns. Over two years, this figure has grown by 20%.

Lee noted that a hypothetical collapse of the issuer could arise due to its banking partners.

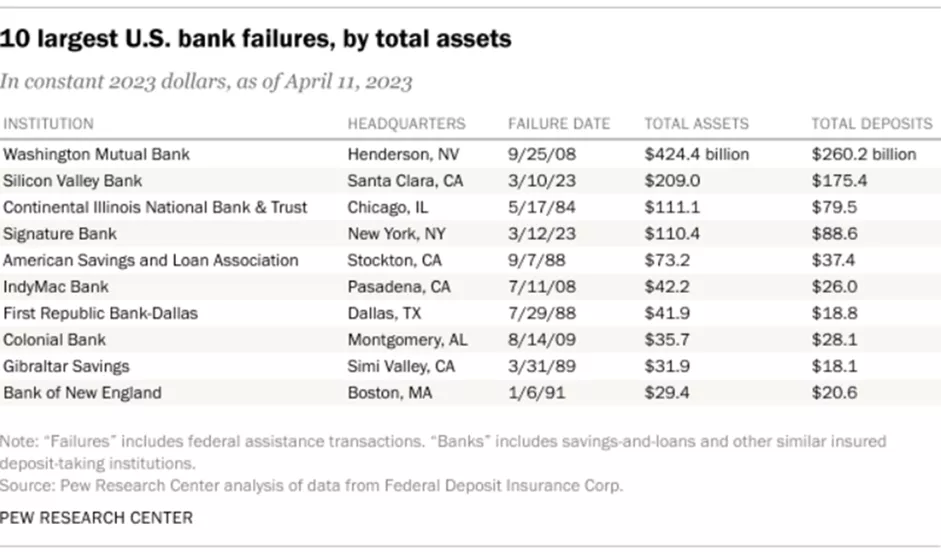

“The possibility of Tether’s collapse is linked not so much to market movements as to its structural connection with underlying assets and TradFi. Otherwise, USDT would have suffered during the latest downturn. But instead, USDC experienced a depeg due to its reliance on Silicon Valley Bank and Signature Bank,” the specialist explained.

The publication recalled the token’s resilience amid market turbulence. This was confirmed during the UST’s decoupling from the USD in May 2022, when Tether converted 10 billion USDT into fiat within a week (over 12% of the supply at that time).

This contrasts with the situation surrounding Washington Mutual in 2008. The institution ceased operations after depositors withdrew $16.7 billion in deposits over 10 days.

Intergovernmental blockchain expert Anndy Lian did not share his colleagues’ views. He does not expect Tether to face issues. In his opinion, large centralized structures may pose a risk to the industry.

In September, the company responded to previous comparisons with FTX and Alameda Research by the consumer advocacy group Consumers’ Research. The USDT issuer emphasized its commitment to customer protection and regulatory compliance.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!