Weekly Wrap-Up: Fed Cuts Rates, Researchers Break Zcash Anonymity

Fed cuts rates; US banks okayed for crypto; Arkham tracks Zcash; Belarus briefly blocks exchanges

The Fed cut its key rate for the third time in a row; US banks were allowed to work with cryptocurrencies; Arkham built a mechanism to track Zcash; Belarus briefly blocked crypto-exchange websites; and other events from the week.

A hat-trick from the Fed

On December 10th the US Federal Reserve cut its key rate for the third consecutive time by 25bp, to 3.5-3.75%.

The move met market expectations. As for the next decision, officials said they would be guided by incoming macro data. The Fed’s committee reiterated its 2% inflation target.

In addition, the Fed announced plans to purchase US Treasury bonds to replenish its reserves. The first deal will amount to about $40bn.

That signals a gradual start to quantitative easing, which has traditionally supported risk assets.

At a press conference, Fed chair Jerome Powell noted that the macro picture had hardly changed: inflation and unemployment remain elevated. He said the US economy was significantly affected by the government shutdown. The rate is now in a “neutral range”, so markets see the situation as a “pause”.

Meanwhile, media reports increasingly suggested Mr Powell could soon be replaced. The leading candidate is Kevin Hassett, a White House economic adviser.

The crypto market initially reacted to the rate cut with heightened volatility. Bitcoin tested $91,600-93,300 within minutes.

Even so, the coin failed to break out of the $88,000-95,000 range, where it has traded for the past two weeks.

At press time the first cryptocurrency traded around $89,200. Over seven days the asset was little changed.

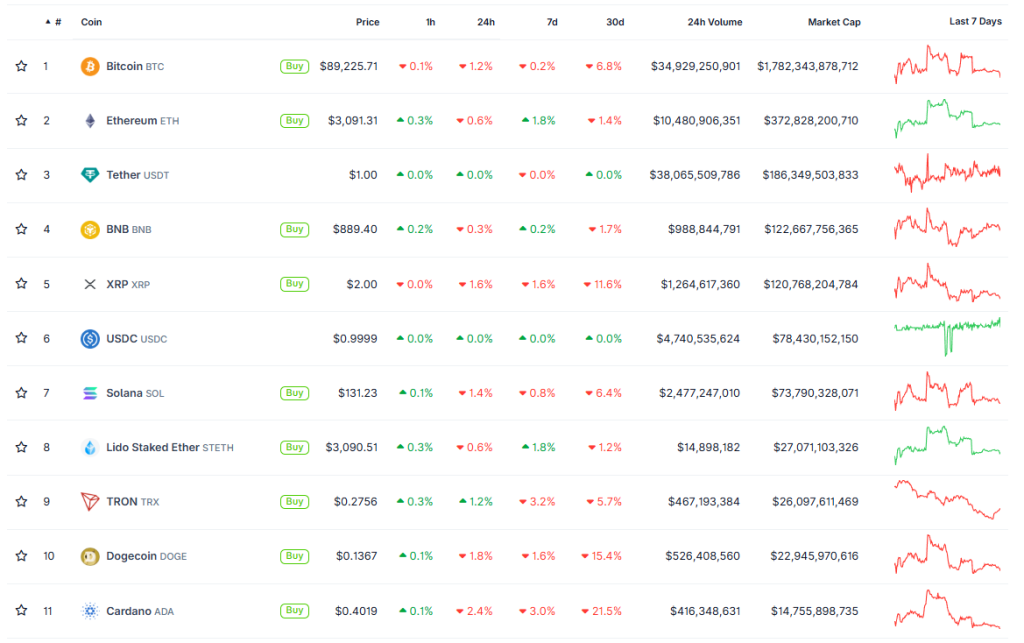

The rest of the crypto market largely followed the flagship. Almost all top-10 assets by market capitalisation were in the red, with only modest losses.

Only Ethereum posted gains (+1.8%), nearly reaching $3,100.

The Crypto Fear and Greed Index remains in the “extreme fear” zone at 21.

Total crypto-market capitalisation stands at $3.14 trillion. Bitcoin’s dominance is 56.8%, Ethereum’s 11.9%.

Bitcoin enters banking

Another notable US development came from the Office of the Comptroller of the Currency (OCC). The agency authorised national banks and federal savings associations to act as intermediaries in cryptocurrency transactions.

Under the framework, institutions will use a classic agency model: entering a transaction with one client while simultaneously opening a mirror (offsetting) position with another. This allows them not to keep crypto on balance sheet and to avoid speculative risks.

According to the OCC, the initiative will encourage users to shift from unregulated venues to transparent, fully legal instruments.

Conditions and limits include:

- mandatory verification of the legality of each transaction and its consistency with chartered powers;

- procedures to control operational and compliance risks;

- banks must have expertise in managing counterparty default risk.

Also early in the week the US Commodity Futures Trading Commission (CFTC) launched a pilot programme to use digital assets as collateral in derivatives markets.

The initiative is being implemented under the GENIUS Act. The initial set of eligible collateral includes bitcoin, Ethereum and the USDC stablecoin.

The programme lets futures commission merchants accept cryptocurrencies to secure margin positions.

In parallel, the CFTC issued guidance on tokenised real-world assets, including US Treasuries and money-market funds. The agency emphasised a technology-neutral approach — each instrument will be analysed individually.

What to discuss with friends?

- It has been 15 years since the disappearance of Bitcoin’s creator, Satoshi Nakamoto.

- XRP will appear on the Ethereum and Solana networks.

- a16z named promising areas of the crypto market for 2026.

- Analyst: the “boring” market buried the odds of an altseason.

De-anonymising Zcash

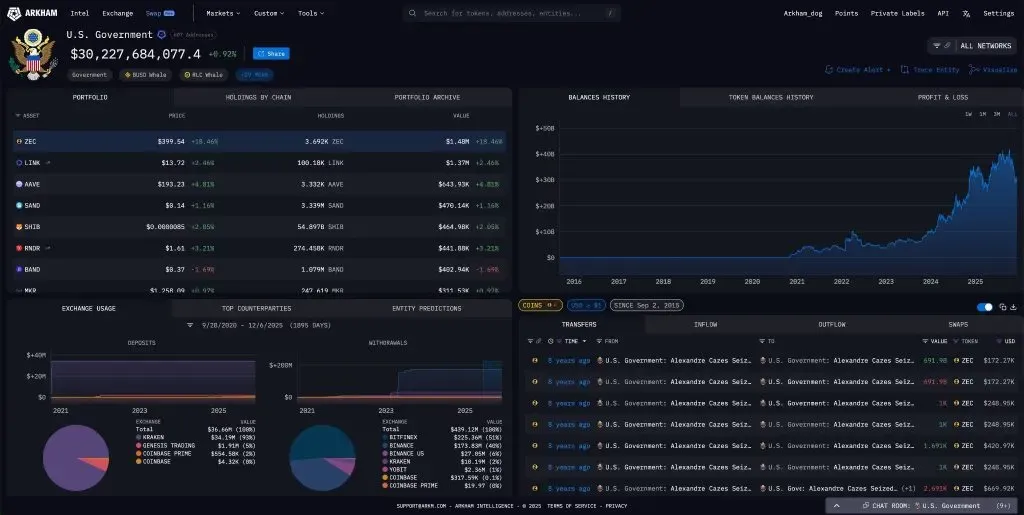

This week the analytics platform Arkham Intelligence implemented a mechanism to track on-chain activity in the privacy coin Zcash (ZEC).

Researchers have already linked more than 53% of all transparent and shielded transactions to known individuals and organisations. Over 48% of inputs and outputs have been associated with some entity.

The total value of labelled transactions exceeded $420bn.

According to Arkham, the US government turned out to be among the largest holders of Zcash. In 2018 authorities confiscated ZEC worth about $737,000 from AlphaBay founder Alexandre Cazes. Since then the value of the assets has roughly doubled.

Analysts also noted that one trader bought ZEC worth $4.49m during a broad market crash in October. Five and a half weeks later he moved the coins to the Gemini exchange. His potential net profit could have reached $6.6m.

Zcash creator Zooko Wilcox partially refuted the analysts’ claims. He noted that the platform had not de-anonymised “a single ZEC” stored in shielded pools.

“That would be impossible, because there simply is no information there. They are merely tracking wallets that chose public transparency. But the data they obtained is cool,” added Wilcox.

Blocked—briefly

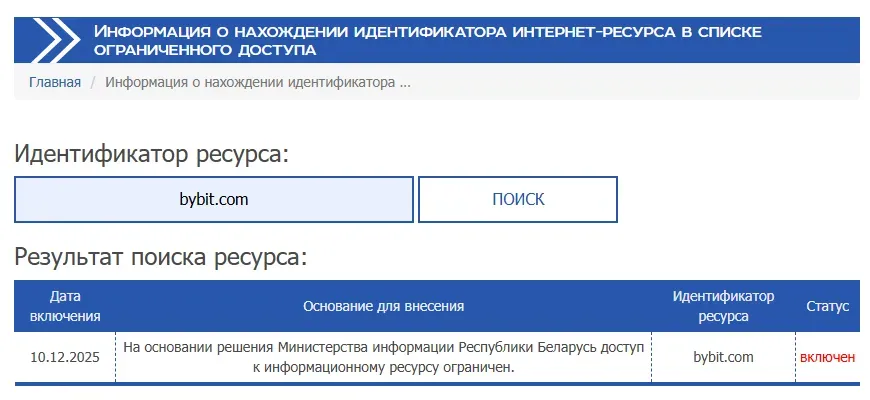

On December 10th the Republic of Belarus restricted access to a number of cryptocurrency exchanges, including OKX, Bitget, Bybit and others. The platforms were added to a blocklist by decision of the Ministry of Information.

Users could not access the trading platforms’ websites; some saw a standard placeholder page.

On December 11th it emerged that the reason for the blocks was a notice from the Minsk City Executive Committee about improper advertising on the resources.

The decision was taken under Article 51 of the “Mass Media Law”. The ministry specified that access could be restored after violations are remedied.

At the time, Andrey Tugarin, founder of the legal agency GMT Legal, said this was a block on access to the sites, not a ban on exchange activity. Such blocks are usually temporary, he said.

That thesis was confirmed the very next day, December 12th. Mininform lifted all restrictions on the exchanges’ websites. The regulator gave no details.

Also on ForkLog:

- Experts ruled out a “Santa Claus rally” for bitcoin.

- The pace of BTC accumulation by public companies hit a yearly low.

- Do Kwon was sentenced to 15 years in prison.

- YouTube launched a payout option for American creators in the PYUSD stablecoin.

Shadow moves

On December 9th, 312 wallets linked to the Silk Road darknet marketplace sent $3.14m in bitcoin to an unknown address.

The marketplace’s wallets still hold 415 BTC worth about $38.5m. The coins were last moved in 2020.

The purpose and details of the transfers remain undisclosed. Some users suggested Silk Road “is paying debts or something like that”. Others noted the transactions could be related to consolidation of UTXO.

Earlier this year Coinbase product director Conor Grogan found 430 BTC across dozens of wallets, allegedly linked to Silk Road founder Ross Ulbricht. At the same time US President Donald Trump signed an order for his full and unconditional pardon.

Notably, the US Department of Justice obtained federal court approval to liquidate 69,370 BTC confiscated from the marketplace back in 2024. Since then, no detailed information about the fate of the funds has appeared.

What else to read?

In the new instalment of the “Silicon Tanks” series we examined how the ideas of 20th-century French theorists can explain the current state of Web3.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!