Week in review: crypto gains, Upbit hack and MegaETH tech woes

Bitcoin at $91k, Upbit hacked, MegaETH stumbles, China’s mining share hits 14%.

Bitcoin returned to $91,000; China lifted its mining share to 14%; hackers siphoned $36m from Upbit; MegaETH botched a pre-deposit raise; and other stories from the week.

Renewed optimism

Over the past seven days the crypto market strengthened markedly, though Monday began poorly for bitcoin with a dip to $85,000.

Through the first half of the week the digital gold traded between $86,000 and $89,000, but on Wednesday evening it managed to clear the key $91,000 level.

The asset held above that mark and slipped into a tight range of $90,000–$93,000.

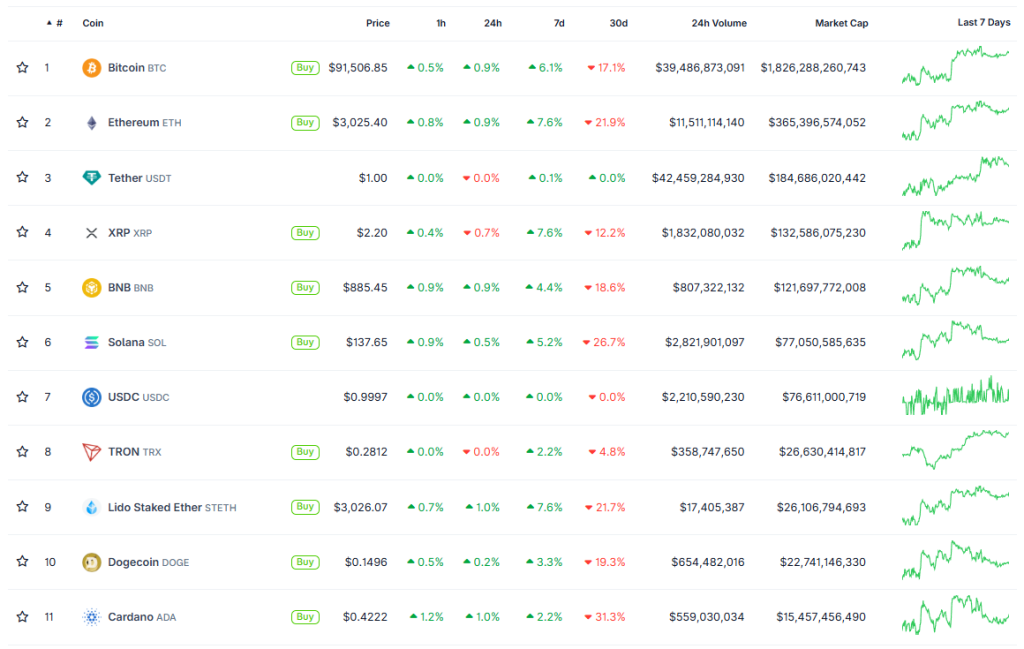

At the time of writing bitcoin trades around $91,500, up nearly 6% on the week.

Several analysts noted a moderate recovery. Kronos Research CIO Vincent Liu called the move a classic oversold bounce: the drop to $82,000 brought buyers back.

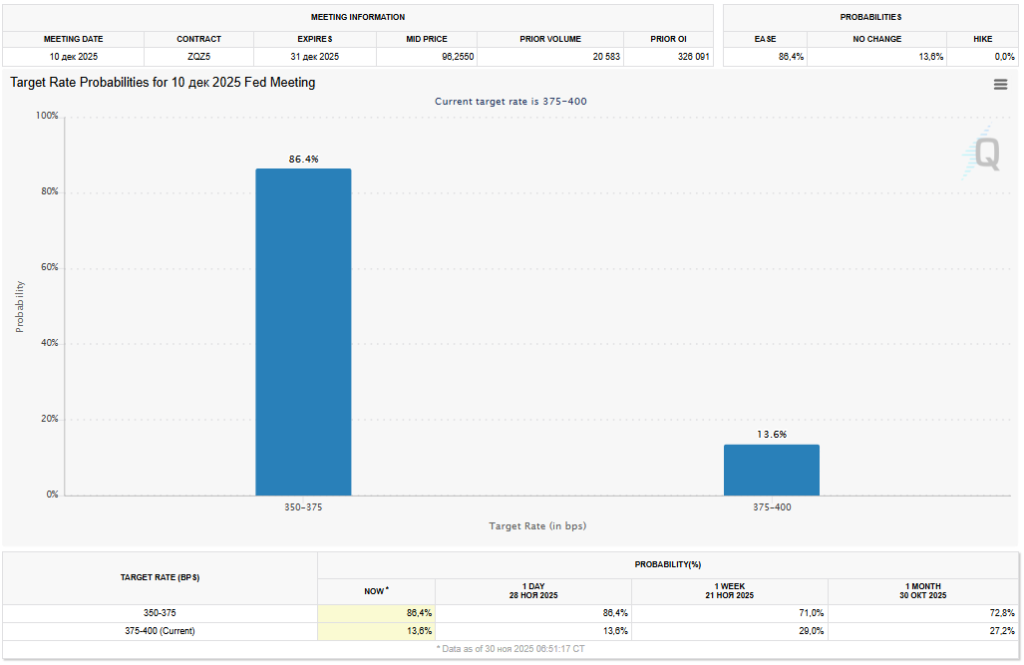

Expectations of a December rate cut by the Fed add momentum. Markets put the odds of easing next month at 86.4%.

Other cryptocurrencies also advanced. Ethereum returned to $3,000 (+7.8%).

Among other top-10 assets, XRP (+7.6%) and SOL (+5.2%) stood out.

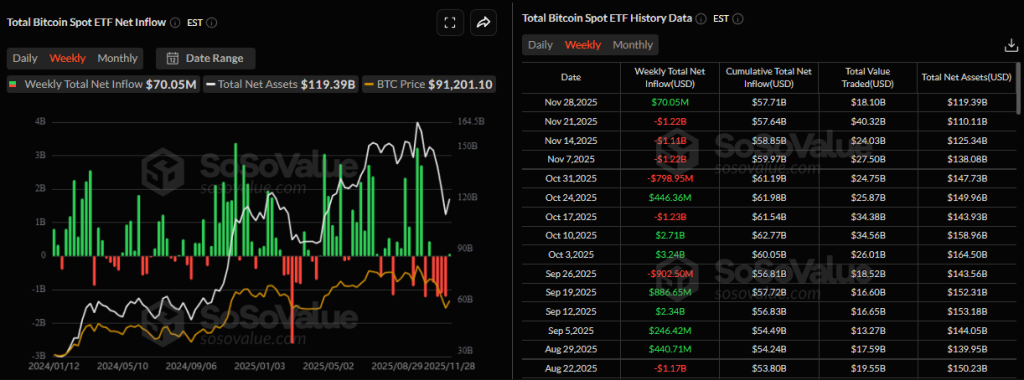

Renewed inflows into spot bitcoin ETFs also signal returning confidence. According to SoSoValue, $70m flowed into spot funds from Monday to Friday, ending a four-week streak of outflows.

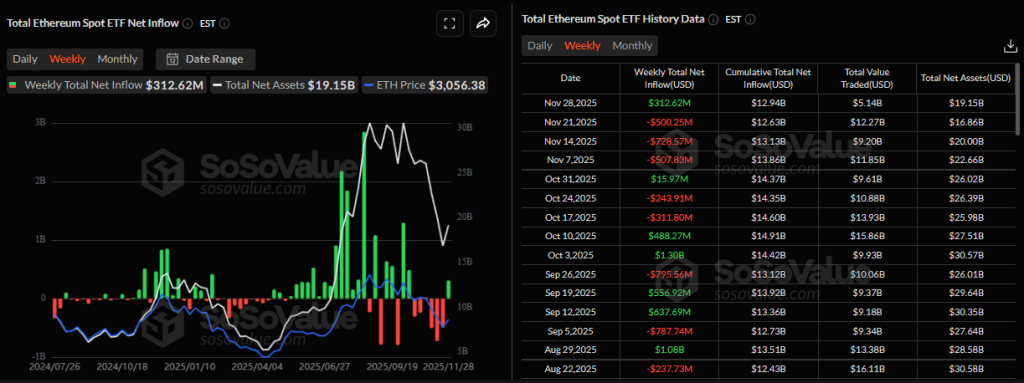

Ethereum-based products took in $312m.

Total crypto market value returned to $3.2trn. BTC dominance is 57.2%, ETH 11.4%.

The Fear and Greed Index sits at 28. The market has shifted from extreme fear to plain fear.

Upbit under attack

On 27 November hackers breached South Korea’s biggest crypto exchange, Upbit, stealing $36.8m. The platform halted withdrawals in response.

The incident occurred on Solana. Affected assets include: SOL, 2Z, ACS, BONK, DOOD, DRIFT, HUMA, IO, JTO, JUP, LAYER, ME, MEW, MOODENG, ORCA, PENGU, PYTH, RAY, RENDER, SONIC, SOON, TRUMP, USDC and W.

According to the company, the breach stemmed from a vulnerability in Upbit’s internal wallet system. The software generated weak or predictable signature data, allowing attackers to reconstruct private keys for certain addresses by analysing the exchange’s transaction history.

The trading platform moved unaffected tokens to secure cold wallets. Some stolen assets were frozen, including $8.18m in LAYER.

North Korea’s Lazarus group is suspected, though no confirmation has emerged.

Upbit pledged to compensate affected users from its own reserves.

Talking points

- A Bloomberg analyst called Zcash a threat to bitcoin.

- Monad’s market cap topped $365m in less than a day after launch.

- Uber launched driverless rides in Abu Dhabi.

- Buterin proposed shifting from scaling to optimisation for Ethereum.

MegaETH’s misfire

The L2 project MegaETH ran into technical problems during its pre-deposit campaign. The team lost control of smart-contract administration and, instead of the planned $250m, drew $500m.

On 25 November MegaETH planned to raise liquidity ahead of a mainnet launch in December. Terms were: a 9:00am (ET) start, a $250m cap, first-come-first-served and KYC via the Sonar platform.

Problems began immediately: the user-verification infrastructure buckled under load and went offline after rate limits were exceeded.

Even before the site fell over, deposits failed. The SaleUUID parameter in the contract did not match Sonar’s settings.

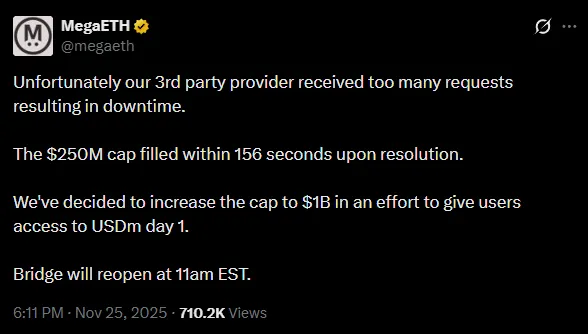

It took 23 minutes to fix, requiring signatures in a multisig wallet to update parameters. During that time thousands of users tried to send funds in vain. Once the bridge came back, the $250m cap was filled in 156 seconds.

After criticism the team raised the cap to $1bn and reopened deposits. That required changing contract parameters again via a Safe multisig, with four signatures out of six possible.

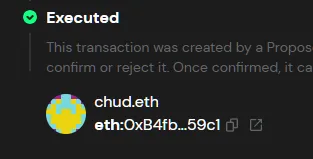

Developers collected the signatures in advance to submit the transaction at the scheduled time. But on Safe, once the required signatures are present, anyone can execute the transaction.

A user under the pseudonym chud.eth spotted the fully approved transaction in the mempool and executed it 34 minutes earlier than the team had planned.

A flood of funds ensued and was halted at $500m.

The team promised to return assets collected during the pre-deposit. Project representatives called the execution of the campaign “sloppy”.

China is back

Reuters noted that China’s share of global bitcoin hashrate has risen again, now above 14%.

As of October the figure was roughly 145 EH/s, up 13.8% in the quarter. Experts stressed that mining never left China—the activity simply “went underground”.

The former mining leader banned all operations with the digital gold in 2021, citing threats to financial stability and energy security. After its share of the global market fell to zero, Beijing gradually returned to third place.

A private miner from Xinjiang told reporters he resumed operations at the end of 2024.

“A lot of energy cannot be transmitted outside Xinjiang, so it is consumed through cryptocurrency mining. New facilities are being built—people mine where electricity is cheap,” he noted.

Another interlocutor from Sichuan, who stopped mining digital assets because of the ban, said some of his friends had returned to the business:

“It is a sensitive area… But people who have cheap electricity still mine.”

The revival of mining in China is also reflected in the financials of some equipment providers. Canaan—a Singapore-based maker of ASIC devices—increased the share of revenue from the Chinese market from 2.8% in 2022 to 30.3% in 2023.

Even so, local authorities do not plan to relax the bans. Amid rumours of a possible “crypto thaw”, the People’s Bank of China and other regulators held a meeting that reaffirmed the illegal status of digital assets and highlighted risks associated with using stablecoins.

“Virtual assets do not have the same legal status as fiat, are not legal tender and should not and cannot be used as currency in the market,” the central bank’s statement said.

Also on ForkLog:

- A major Solana holder approved a change to the project’s tokenomics.

- Investors accused JPMorgan of attacking Michael Saylor’s Strategy.

- Daily volume on Hyperliquid’s custom markets exceeded $500m.

- Turkmenistan legalised bitcoin mining.

Tether’s treasure

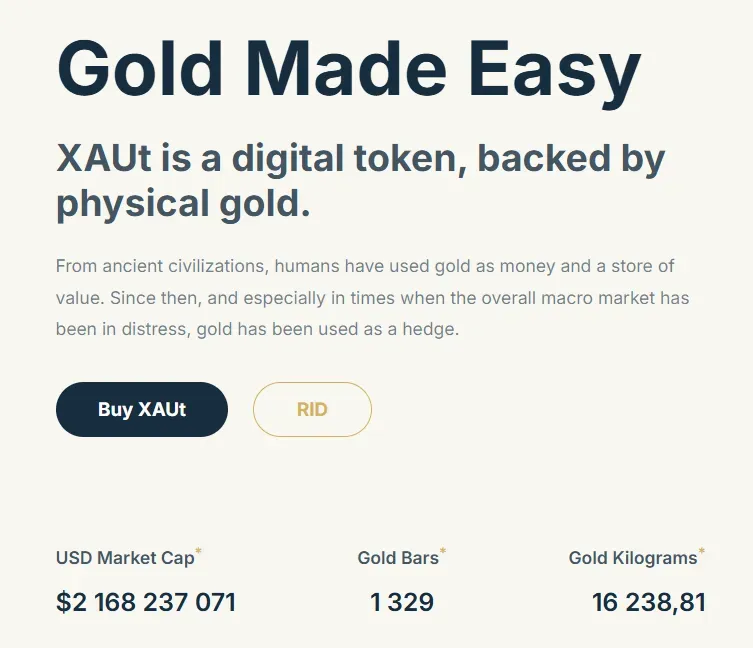

Analysts at the investment bank Jefferies revealed Tether’s stocks of physical gold. By September the company had amassed 116 tonnes—comparable to the holdings of the central banks of South Korea, Hungary or Greece.

They called the USDT issuer the largest holder of gold outside the state sector.

They added that the firm’s aggressive purchases may have directly influenced the metal’s recent price rise. In the past quarter Tether accounted for almost 2% of global demand, equivalent to 12% of all central-bank buying.

According to Jefferies, the firm plans to buy around 100 more tonnes of physical gold in 2025.

The bet, presumably, is on mass adoption of tokenisation. Since early August Tether has added more than 275,000 ounces of metal—about $1.1bn—to the backing of its gold stablecoin XAUT.

However, news of vast reserves did not stop the ratings agency S&P Global Ratings from cutting its assessment of Tether’s stability to the lowest, fifth level.

The decision was explained by the growing share of risky assets in USDT’s backing. Analysts warned the current capital buffer may be insufficient to cover losses if bitcoin falls.

Bitcoin now makes up about 5.6% of the stablecoin’s total in circulation, exceeding the 3.9% buffer recorded in the third-quarter attestation.

The share of risky assets in Tether’s reserves rose to 24% as of 30 September, up from 17% a year earlier. The agency includes the leading cryptocurrency, gold, secured loans, corporate bonds and investments with limited disclosure in this category.

Tether CEO Paolo Ardoino bristled at the conclusions and said the company “wears S&P’s disdain with pride”. He called the assessment models outdated and unfit for the new financial system.

What else to read?

BTCFi—stalled evolution or temporary troubles?

We examined the mark the once-ambitious DOGE agency left on US history—and what crypto has to do with it.

We assessed how realistic the scenario of a new fork of the first cryptocurrency is.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!