The week: Movement’s scandal, the OP_RETURN war and a cryptoasset die-off

Movement Labs is investigating the circumstances of the “worst deal in history”, an OP_RETURN war has reignited in the bitcoin community, analysts pointed to a “die-off” in cryptoassets, and other events of the departing week.

Back to February levels

Bitcoin started the week unsteadily around $94,000, dipping slightly below $93,000 during the day.

After a brief range-bound spell at the end of April, the price began to surge. The recovery came amid a burst of activity by short‑term investors.

On May 1st the rate topped $96,000 for the first time since February, and then $97,000. Crypto’s market capitalisation reached $3trn — a level last seen in March.

Alongside livelier on-chain activity, open interest in bitcoin futures climbed markedly.

Binance Open Interest Surges by $2.2 Billion in the Last 20 Days

“This strong futures backing on Binance could signal a continuation of the recent bullish trend in Bitcoin.” – By @burak_kesmeci

Full post ⤵️https://t.co/paTq6cZu6M pic.twitter.com/jvCoA1y7BF

— CryptoQuant.com (@cryptoquant_com) April 30, 2025

“Such support in the futures market points to a continuation of the bullish trend,” wrote the CryptoQuant author under the handle burak_kesmeci.

Throughout the week, the crypto fear and greed index signalled restrained optimism among market participants.

Ethereum opened the week near $1,800. On April 30th the price fell to $1,731, only to rebound firmly the next day.

At the time of writing, the asset trades around $1,826, up 1.7% on the week.

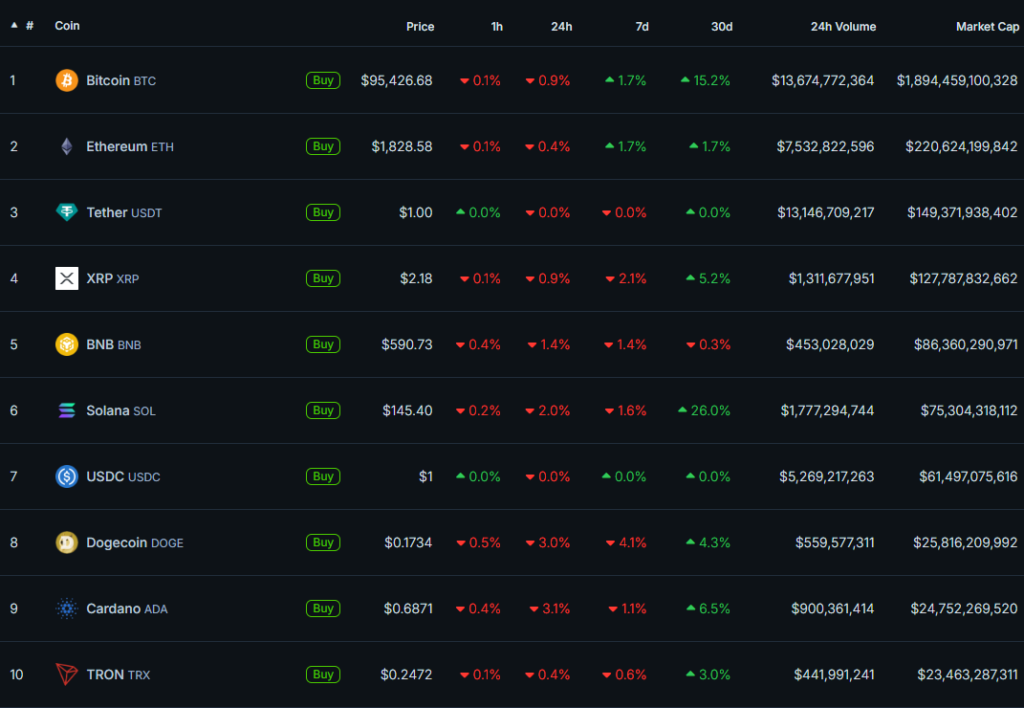

Over the past week only bitcoin and Ethereum among the top ten posted gains:

Total market capitalisation stands at $3.07trn.

Movement Labs struck the “worst deal in history”

The Movement Labs team is investigating a market-making deal that led to a dump of 66m MOVE tokens and a plunge in the asset’s price shortly after listing.

According to staff messages, Movement Foundation transferred 66m MOVE (5% of supply) to a company called Rentech — an intermediary with no public reputation.

The contract allowed the firm to sell tokens once the project’s market capitalisation hit $5bn. That created an incentive to pump the price and then sell, CoinDesk’s experts said.

On December 9th, a day after MOVE’s exchange listings, wallets linked to Rentech and market maker Web3Port withdrew $38m, triggering a 47% price drop.

Binance blocked the market maker’s account for “violations”, and Movement announced a token buyback to stabilise the market.

Movement Foundation’s counsel J. C. Peck initially called the Rentech contract “the worst deal in history” but, under pressure, signed a revised version. He had warned that the deal handed control over MOVE’s liquidity to an “opaque entity”.

The probe found Rentech had acted as an agent for both Movement Foundation and Web3Port, potentially letting it dictate terms. Rentech founder Galen Lo-Khun claims the deal’s structure was agreed with Peck; Peck denies involvement.

CoinDesk’s sources point to possible involvement by Movement Labs co-founder Rushi Manche and project adviser Sam Tappalia. Rentech’s founder Galen Lo-Khun is said to be one of Tappalia’s business partners.

Internal chats show Manche pushed the Rentech deal despite lawyers’ objections. Tappalia, present at Movement’s office on token-launch day, took part in compiling airdrop lists but denies influencing the firm’s decisions.

Industry veteran Zack Manian said Movement’s contracts created ideal conditions for a pump-and-dump. Market makers could artificially inflate the price and then “dump” tokens on retail investors, he explained.

Movement Labs hired audit firm Groom Lake to analyse the transactions.

As reported, experts called insider manipulation the cause of a recent 90% crash in the RWA project Mantra’s token. The coin, ticker OM, shed $5.5bn in market value.

On May 2nd, amid the probe, Movement Labs co-founder Rushi Manche was suspended from duties.

Bitcoiners return to the OP_RETURN row

Developer Peter Todd filed a pull request to Bitcoin Core to lift limits on storing arbitrary data on-chain. The initiative split the community.

The change would remove the 83-byte cap in the OP_RETURN script. Without the limit, node operators could include larger payloads such as media files in transactions.

Todd’s proposal formalised an idea from Chaincode Labs’ Antoine Poinsot. Both developers deem it “silly” to cling to parameters that do not work, since users easily bypass the cap by relaying transactions via private mempools like MARA Slipstream or via alternatives to Bitcoin Core such as Libre Relay.

Some commenters backed removing what is, in effect, dead code.

Others, while recognising the OP_RETURN cap’s inefficacy, opposed scrapping it. They argue lifting restrictions would foster spam on the network and threaten bitcoin’s standing as a financial asset.

Bitcoin Core developer Luke Dashjr — a staunch opponent of Ordinals and BRC-20 tokens — called Todd’s proposal “utter insanity”.

“We need to fix the bugs, not ratify the abuses,” he said.

The programmer noted that an “attack” by “arbitrary-data spammers” has been ongoing for more than two years.

“Bitcoin Core developers are about to make a change that will turn Bitcoin into a useless altcoin, and apparently no one is going to do anything about it. I have been raising objections, losing sleep over this, and despite clear public opposition, the proposal is moving forward,” wrote OCEAN pool vice president Jason Hughes.

The platform, founded by Dashjr and Jack Dorsey, encourages miners to ignore non-financial transactions by charging fees.

Casa co-founder and CTO Jameson Lopp declared a return of the “OP_RETURN wars” and reposted a statement asserting OCEAN’s censorship policy had failed.

“Attempts to filter JPEGs, art, privacy, or Bitcoin transactions deemed ‘undesirable’ by any other metric are economically irrational, trivially routable from a technical standpoint, and guaranteed to fail,” read the message published on-chain.

A bitcoiner using the handle Bryan called Todd’s proposal “technically logical and correct”.

He nevertheless sided with critics, stressing that opponents like Dashjr are right strategically. In his view, rising data volume in the long run threatens:

- blockchain “bloat”;

- higher node operating costs (hardware, bandwidth);

- centralisation pressure (only wealthier players could afford full nodes);

- weakening the narrative of bitcoin as a sound currency.

“The largest war around the first cryptocurrency today is not technical but cultural,” Bryan concluded.

What to discuss with friends?

- A dinner for TRUMP whales sparked $2.4bn in on-chain activity.

- A TV series about the Briton who lost 7,500 BTC will be made.

- Crypto pioneer Adi Shamir criticised cryptocurrencies.

- The Kraken team identified a North Korean spy among job applicants.

CoinGecko points to a “die-off” in cryptoassets

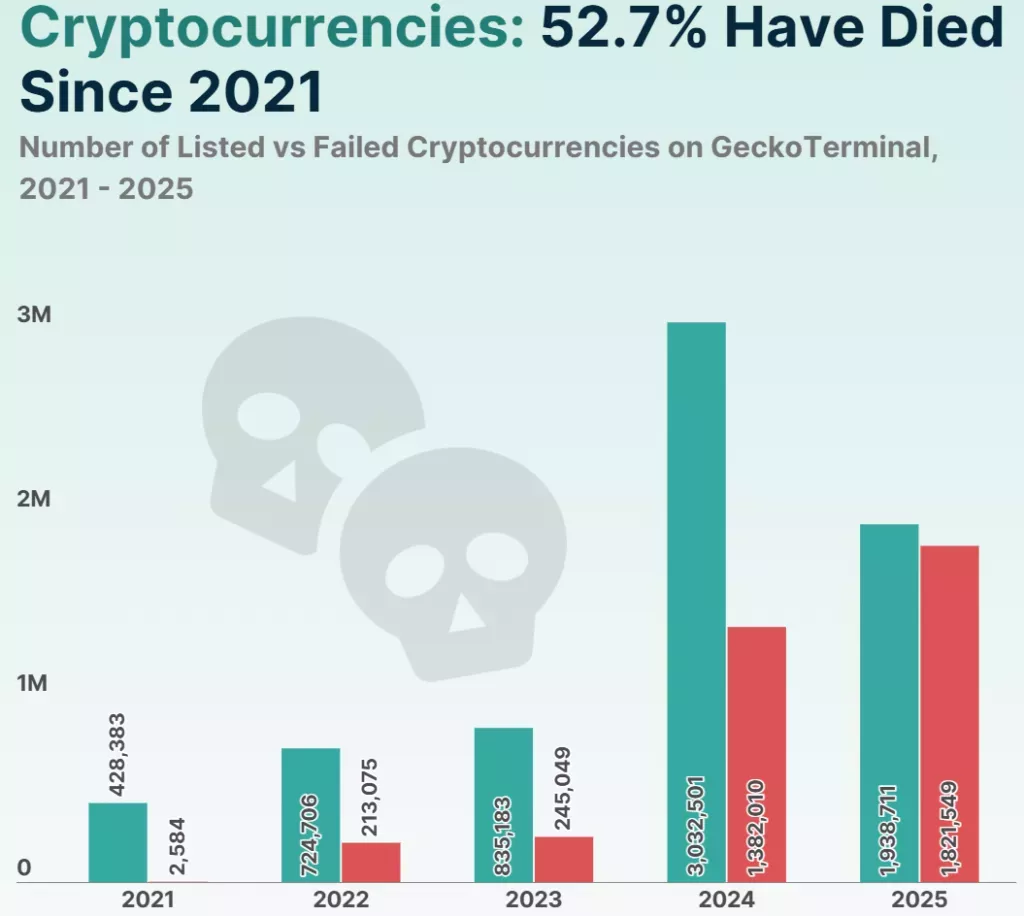

Of nearly 7m cryptoassets tracked by the DEX monitor GeckoTerminal since 2021, 3.7m — more than half — have ceased trading. These projects are deemed failures, CoinGecko’s analysts say.

“52.7% of all coins on GeckoTerminal have failed, with most of them in 2024 and early 2025,” the researchers stated.

In the first quarter of 2025, 1.8m tokens collapsed — 49.7% of all crypto-project failures recorded by CoinGecko.

“Such a sharp drop in ‘survivability’ may be linked to overall market turbulence, which intensified after Donald Trump’s inauguration in January 2025 and coincided with a market correction,” the experts explained.

The total number of crypto projects has also surged: in 2021, 428,383 coins were added to GeckoTerminal; by 2025 the figure had approached 7m.

Analysts tie the explosive growth to the launch of Pump.fun — a “meme-coin factory” that radically simplified coin creation. Thanks to it, new cryptoassets began appearing in minutes and with minimal effort.

The number of projects that “collapsed” in Q1 2025 reached 1.8m (49.7% of the total) — more than in any other year.

In 2024, 1.4m projects shut down — 37.7% of the five-year total.

“But this was also the year that saw a record number of launches — more than 3m new projects entered the market. Until Pump.fun appeared in 2024, the number of failed crypto initiatives remained at modest six‑figure levels. The period from 2021 to 2023 accounted for just 12.6% of all industry failures over the past five years,” the experts observed.

Also on ForkLog:

- An alleged $330m bitcoin theft boosted Monero’s price.

- Adam Back outlined bitcoin’s path to a $200trn market cap.

- Mastercard launched stablecoin payments.

- Vitalik Buterin shared his personal priorities for 2025.

A “neutral rollup” is coming to Ethereum

An independent team of developers announced the launch of Ethereum R1, a “neutral rollup” with no token and no centralised control.

The core idea of R1 is a return to Ethereum’s fundamentals — decentralisation and neutrality.

According to the creators, the project relies solely on donations instead of venture funding or token sales. In their view, this is the way to achieve true neutrality and align with the ecosystem’s interests.

“General‑purpose L2s should be consumer goods — simple, replaceable, and free from centralised dependencies or risky governance,” the developers noted.

The new rollup is built on Nethermind’s Surge stack and uses open-source code from Taiko. Taiko DAO will receive 1% of the network’s base fees until 2030 or until all fees are burned.

By design, Ethereum R1 will launch straight as a stage‑two rollup — a fully decentralised system governed by smart contracts.

“If you believe rollups should be commodities rather than cartels, this initiative is for you,” the creators added.

What else to read?

In a new piece we spoke with Bitget’s head Gracy Chen about today’s crypto market, this year’s big trends, and the industry’s outlook.

We found out how blockchain and Web3 are transforming the labour market, which professions are emerging in the decentralised world, and what challenges specialists face along the way.

We examined the features of the current halving cycle and explained why things have not followed the usual script.

In our regular digest we compiled the week’s main cybersecurity events.

We explained what the Nakamoto coefficient is and how to calculate it.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!