This week: Trump-era crypto regulation and bitcoin’s new high

Donald Trump was inaugurated as US president, bitcoin hit a fresh record, the Silk Road founder was pardoned, the SEC let banks custody cryptocurrencies, and other highlights of the week.

A volatile market

This week the crypto market resembled a rollercoaster more than usual. On Monday night bitcoin tumbled from $106,000 to $100,000.

By midday, however, the asset rebounded just as swiftly and set a new all-time high (ATH) of $109,588 on Binance.

After Mr Trump’s inauguration came a more restrained dip to $100,000, then a fresh rise to $107,000. Volatility gradually subsided and, by week’s end, the leading cryptocurrency went sideways around $104,000.

At the time of writing the asset trades at $104,980, with a market capitalisation of $2.07trn.

Bitwise experts noted that digital gold has become a portfolio hedge against “sovereign defaults”, and its fair value is about $219,000. Yet volatility remains a barrier to broad adoption.

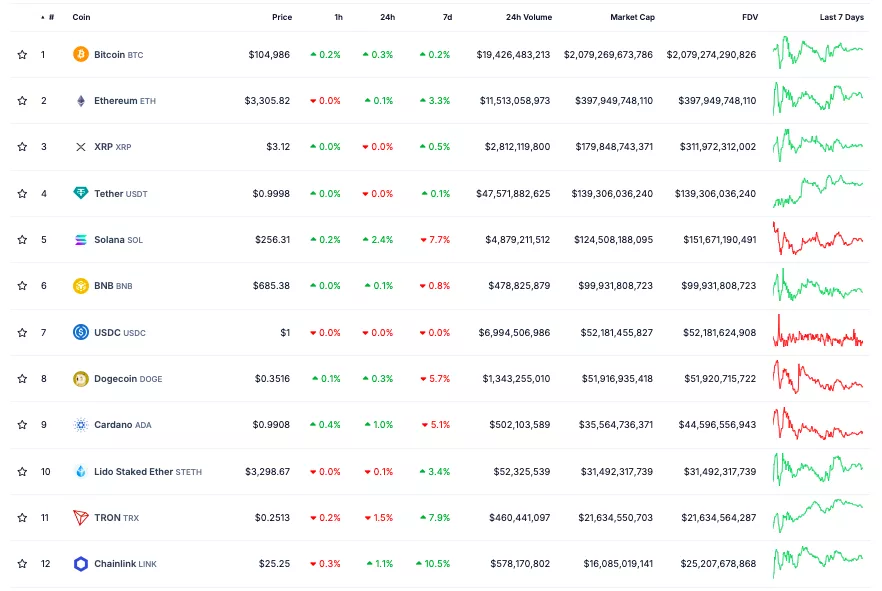

Other large-cap assets broadly followed the flagship. Ethereum sits around $3,300, up 3% on the week. Solana fell 7.7% after last week’s ATH.

LINK climbed to 12th in the rankings; its price rose 10.5% in seven days to $25.25.

Total crypto market capitalisation stands at $3.75trn. Bitcoin’s dominance is 55.5%, Ethereum’s 10.6%.

Mr Trump and his TRUMP

Mr Trump was sworn in on January 20th. He did not mention cryptocurrency in his inaugural address or in statements later that day, prompting a market pullback.

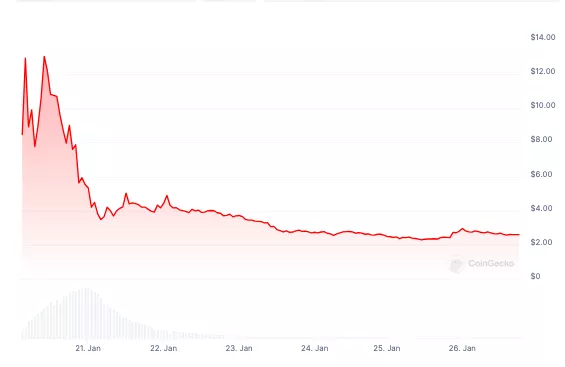

Among them fell the meme tokens linked to Mr Trump and his wife—TRUMP and MELANIA.

The president’s “official” coin plunged 58% on the week to $29. MELANIA dropped from $13 on Monday to $2.6 at the time of writing.

Meanwhile, Congress took an interest in the ethics of Mr Trump’s crypto ventures, suspecting a possible conflict of interest.

In a letter to the chair of the Oversight and Government Reform Committee, Congressman Gerald Connolly noted that the sitting president may profit from the World Liberty Financial (WLFI) platform and the TRUMP meme token. In his view, this potentially creates national-security risks.

“Ethics experts have already expressed serious concern that Trump ‘is literally cashing in on the presidency by creating financial instruments so that people can transfer money to his family in connection with the office he holds’,” Connolly stressed.

At the same time, the positions of the overwhelming majority of TRUMP holders are at breakeven or in losses of up to $1,000. Many in the market said the project’s tokenomics is “outdated” and the coin itself has no utility.

A first promise kept

Despite the crypto community’s initial disappointment, Mr Trump moved quickly. On January 22nd he signed the pardon he had promised during the campaign for Silk Road founder Ross Ulbricht.

The president phoned Ulbricht’s mother, thanking her and the Libertarian movement for election support.

“The scum who worked on his conviction are the same lunatics who are involved in the modern weaponization of government against me. [Ross] got two life sentences plus 40 years. Ridiculous!”, Mr Trump said.

Many in the crypto community welcomed the decision and congratulated Ulbricht. They included bitcoin historian Pete Rizzo, the Satoshi Nakamoto Institute, Bitcoin Magazine’s CEO David Bailey and others.

Meanwhile, Coinbase’s director of product Conor Grogan discovered 430 BTC across dozens of wallets presumably linked to the Silk Road founder. The assets had sat untouched for 13 years and are not related to the roughly 174,000 BTC seized by the US government from the marketplace.

“They were probably dust wallets then, and now their total value is around $47m. Welcome back, Ross,” Grogan wrote.

What to discuss with friends?

- The head of Goldman Sachs called bitcoin “still a speculative asset”.

- Lawyer: decentralised prediction markets are not gambling.

- Justin Sun proposed reforms for the Ethereum Foundation.

- OpenAI released an AI agent, “Operator”.

A new direction for US regulation

After Mr Trump’s inauguration, agencies and stakeholders felt freer to shape digital-asset rules. One of the week’s key events was the resignation of SEC chair Gary Gensler on the new president’s swearing-in day.

After that, the agency set up a task force on cryptocurrencies led by commissioner Hester Peirce. Its remit includes drafting clear industry rules, convening discussions and “measured enforcement”.

Peirce’s first signature move was scrapping SAB 121, a rule that had effectively barred banks from holding digital assets.

“SAB 121 was catastrophic for the banking industry and only slowed American innovation and the development of cryptocurrencies,” explained Senator Cynthia Lummis.

On January 23rd Mr Trump signed an order establishing a working group on digital-asset markets, to be led by special adviser on AI and cryptocurrencies David Sacks.

The group is tasked with assessing “the potential for creating and maintaining a national stockpile of digital assets”.

The document also bans the issuance and promotion of a CBDC in the US. Government agencies must shut down all related programmes and initiatives.

Other developments in the United States relevant to crypto:

- a court overturned sanctions against the Tornado Cash crypto mixer;

- Mr Trump ordered a plan for AI development in the US;

- at Morgan Creek they pointed to “talk” of integrating XRP, ADA and HBAR into the US banking system;

- Dogecoin rose after the appearance of a logo on the website of the Department of Government Efficiency under the US government (DOGE);

- ConsenSys founder Joe Lubin hinted at “soon” approval of staking for ETH ETFs.

Ethereum Foundation 2.0?

Amid continued criticism of the Ethereum Foundation (EF), rumours surfaced of a second foundation for the blockchain. Debate intensified after Lido’s founder, Konstantin Lomashuk, reposted an X account called Second Foundation.

Later, however, he said that a “second foundation” for EF had not in fact been created. In his words, any new organisation “should have a clear purpose that complements the colossal work of current developers”. Lomashuk will keep thinking it through.

The community criticised EF for periodic sales of crypto from its reserves, which users said pressured ether’s market price. Concerns also focused on the organisation’s financial transparency. Some suggested using staking to cover expenses from earned yield.

This week, over disagreements with the foundation, the Ethereum team was left by lead developer Eric Conner. He will focus on projects at the intersection of cryptocurrencies and artificial intelligence.

His departure post followed a statement by Ethereum co-founder Vitalik Buterin that he alone makes all decisions on changes to EF management.

Strict terms for TON and Telegram

On January 21st Telegram and TON Foundation announced an exclusive agreement obliging embedded Web3 apps to use only The Open Network.

The aim is to preserve a scalable and secure user experience.

According to TON Foundation president Manuel Stotz, existing wallet protocols for third-party networks will be banned, except for apps with cross-chain functionality.

The foundation also pledged grants of up to $50,000 for projects that migrate to TON within 30 days.

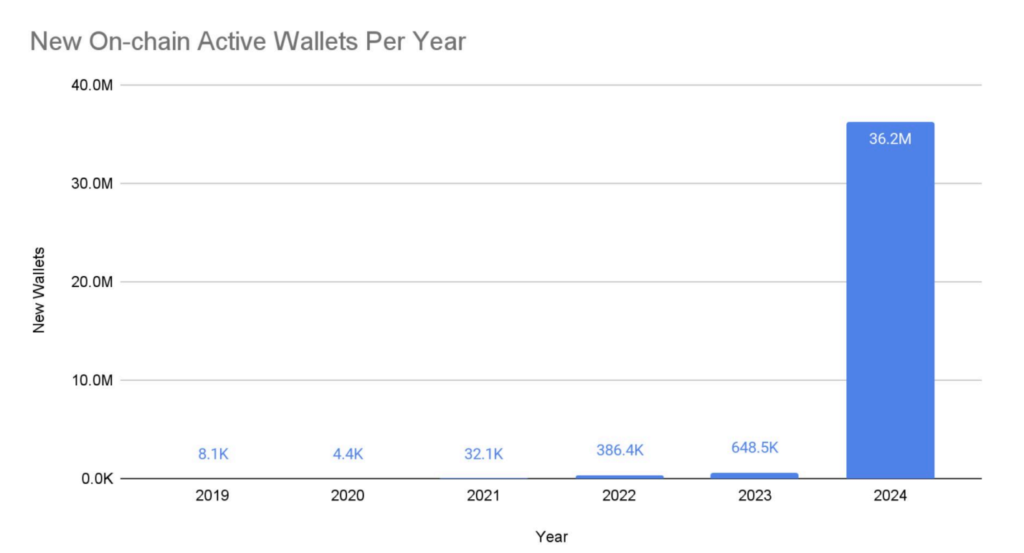

Later the network team reported wallet counts and developer earnings from mini-apps: in 2024, 36.2m cryptocurrency wallets were created on TON, and the total number of Toncoin holders surpassed 100m.

According to the statistics, in aggregate up to 40m unique addresses and smart contracts showed monthly activity.

By active wallet count the blockchain overtook Base, BNB Chain and others.

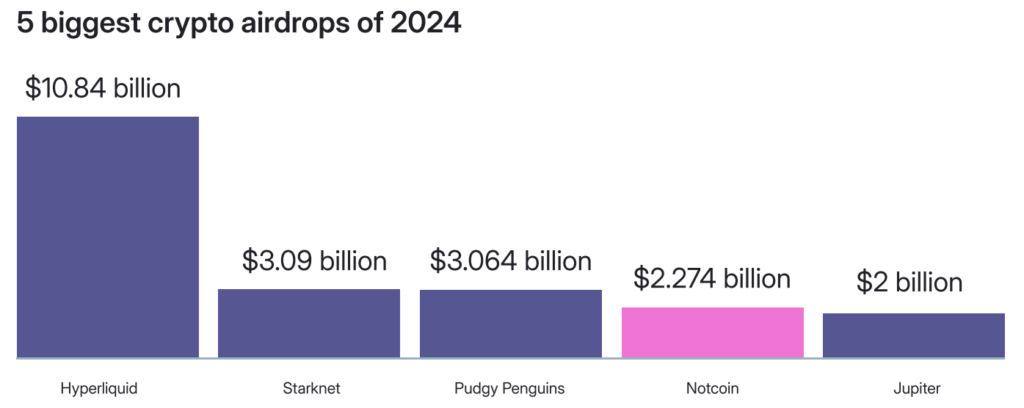

Web3 games became one of the most popular categories of mini-apps in Telegram. The Notcoin airdrop worth more than $2.2bn ranked among the five largest last year.

More than 1.19m users bought the in-game currency Telegram Stars for $63m. Over 1,700 mini-app developers and content creators withdrew $55m through the platform.

Also on ForkLog:

- Market maker CLS Global admitted to fictitious trading in an FBI AI token.

- Crypto-company shares diverged from bitcoin’s performance.

- Ledger’s co-founder was freed after a kidnapping in France.

- A Hamster Kombat partner will pay 2.5m roubles following a businessman’s lawsuit.

What else to read?

In a new piece, we explained the growing threat of trade in hacking software—Crimeware-as-a-Service.

Our traditional digest rounds up the week’s key events in cybersecurity.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!