Trader outlines obstacle on Bitcoin’s path to $20,000

A practising trader and founder of the Crypto Mentors project, Nikita Semov, explains the current market situation.

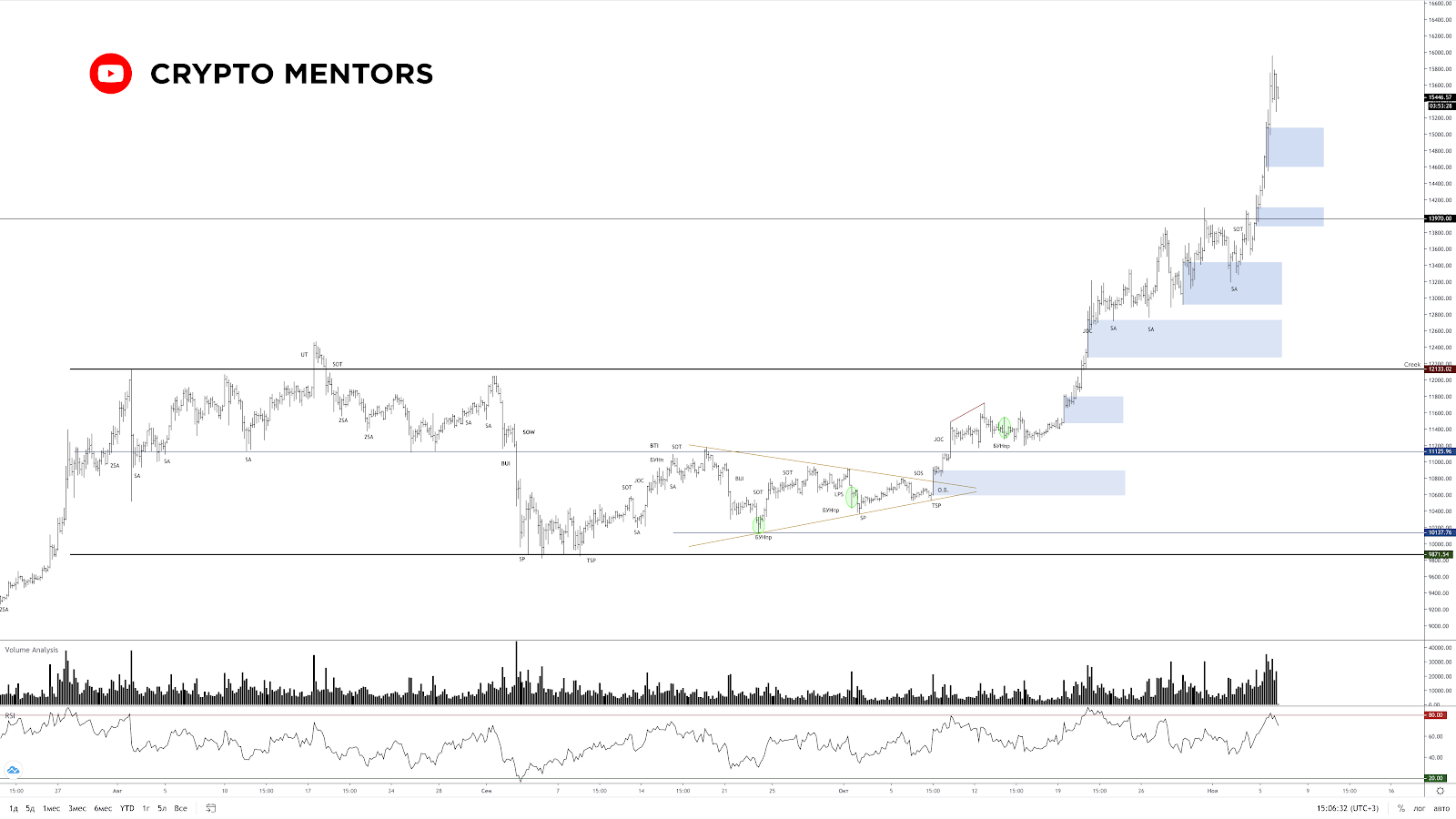

Price Action and VSA

The overall market picture points to a pronounced dominance of buying within the VSA and Price Action framework. The volumes appearing are expressed by supportive bid activity with effective price confirmation.

This implies that all volume pressure is being absorbed on the downside. The key supports will be two blue zones below, and resistance is formed at $16,745-$17,169. From these levels, a corrective wave is likely without a pronounced tilt toward selling. In any case, the targets around $20,000 are clearly in view.

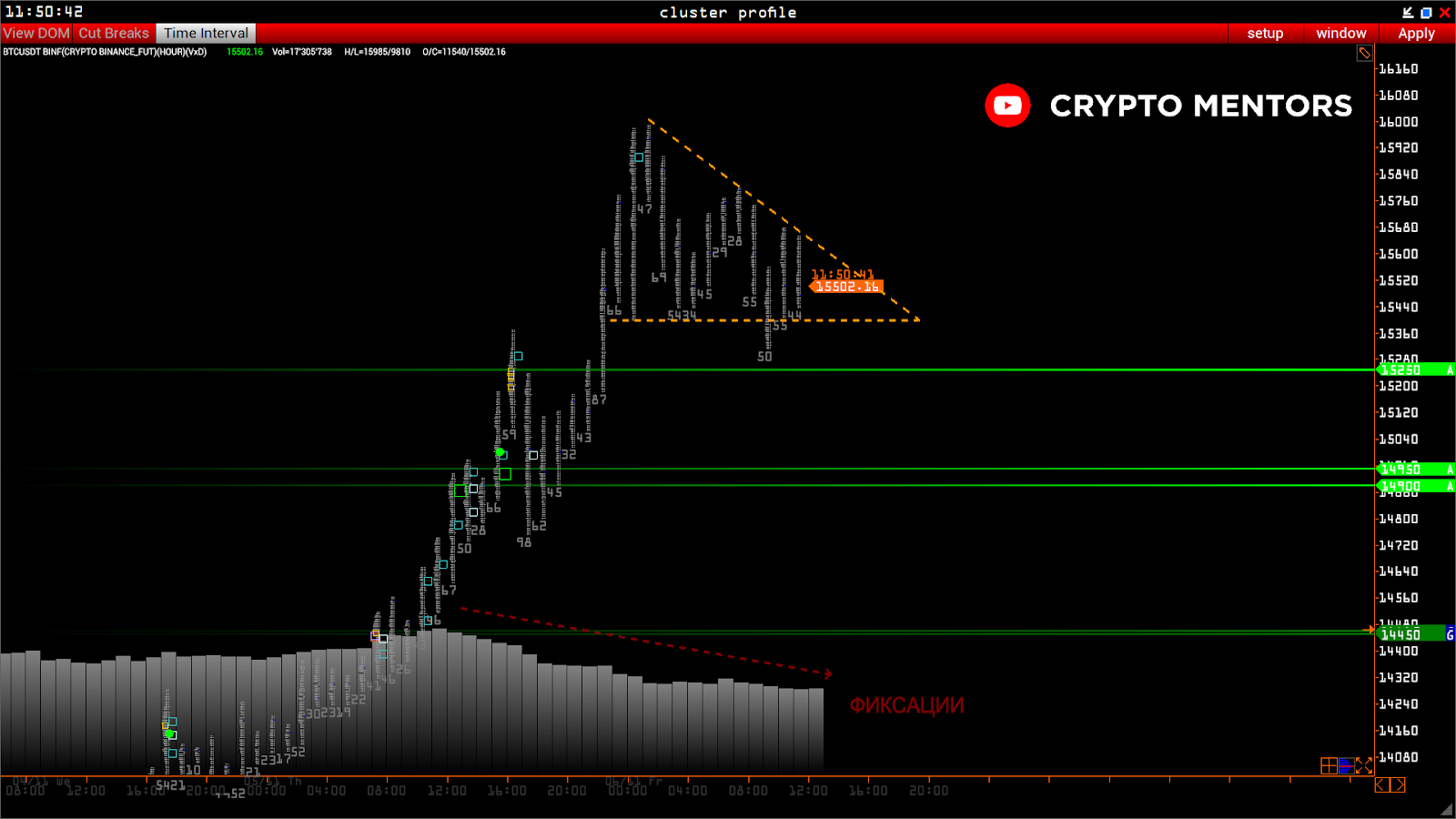

Analysis of horizontal volumes and deltas

Bitcoin has finally moved into the impulsive phase. Along the move, numerous supports formed at levels: $15 250, $14 900-$15 000. The most significant is $15 000, as the largest number of large purchases occurred there.

In broad terms the price faces no restraint up to the 2017 highs. As noted earlier, $14 000 was an important threshold. At present, only massive volumes in the counter-trend could pose a serious barrier, which should be watched in real time.

The current correction is not accompanied by fixing or inefficiency indicators, which suggests it is inconsequential. It is driven by widespread position fixing.

We do not expect major dumps; at most, a correction to $15 000, after which local highs are likely to be renewed.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!