Trader outlines the odds of Bitcoin slipping to $20,000

A practicing trader and founder of the Crypto Mentors project, Crypto Mentors Nikita Semov explains the current market situation.

Bar-by-bar analysis

The spread of the selling bar is large, with a close of the third type (far from the minimum). This indicates that from the low, a buyer attempted to push the price higher, and succeeded (a long tail formed).

Low volume indicates a lack of initiative from the bears. There is no progress, as the current formation is merely a test of the volume bar. In the tail of the bar there is an aggressive buyer, and a volume spike formed there. From such a formation one can expect a bullish bar to form on the current week.

Japanese candlesticks

As the corrective movement continues, it may develop into a “Three Methods” pattern. The pattern has not formed yet, but there is potential for a bullish engulfing.

Price Action and VSA

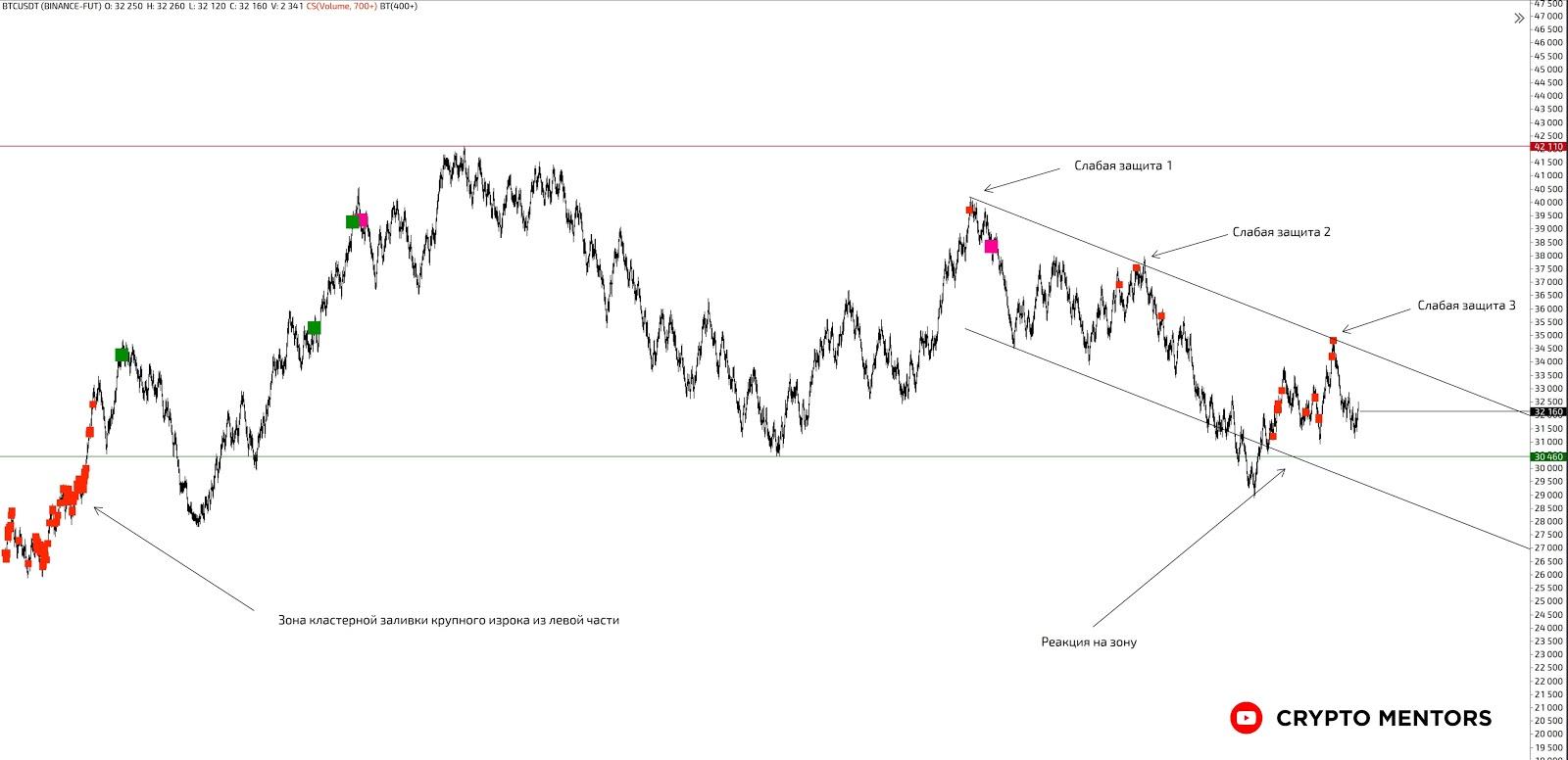

On the breakout from the triangle downward, a rather interesting formation appeared — a liquidity grab through the Spring model. A large player uses stops placed beyond obvious levels. This is done to test demand, shake out stop orders, and add to part of the position. This technique is usually used to push the price higher.

Similarly, the weak attack angle in wave AB points to not the most effective bears. A trending channel formed with a very clear trendline with three touches (points 1,2,3). But looking at the cluster filters, you can see that there is no significant seller protection. Therefore, if this channel is overcome with a close above, one can confidently speak of growth to $42,700 on CME. Until this condition is met, Bitcoin will remain in a downward phase.

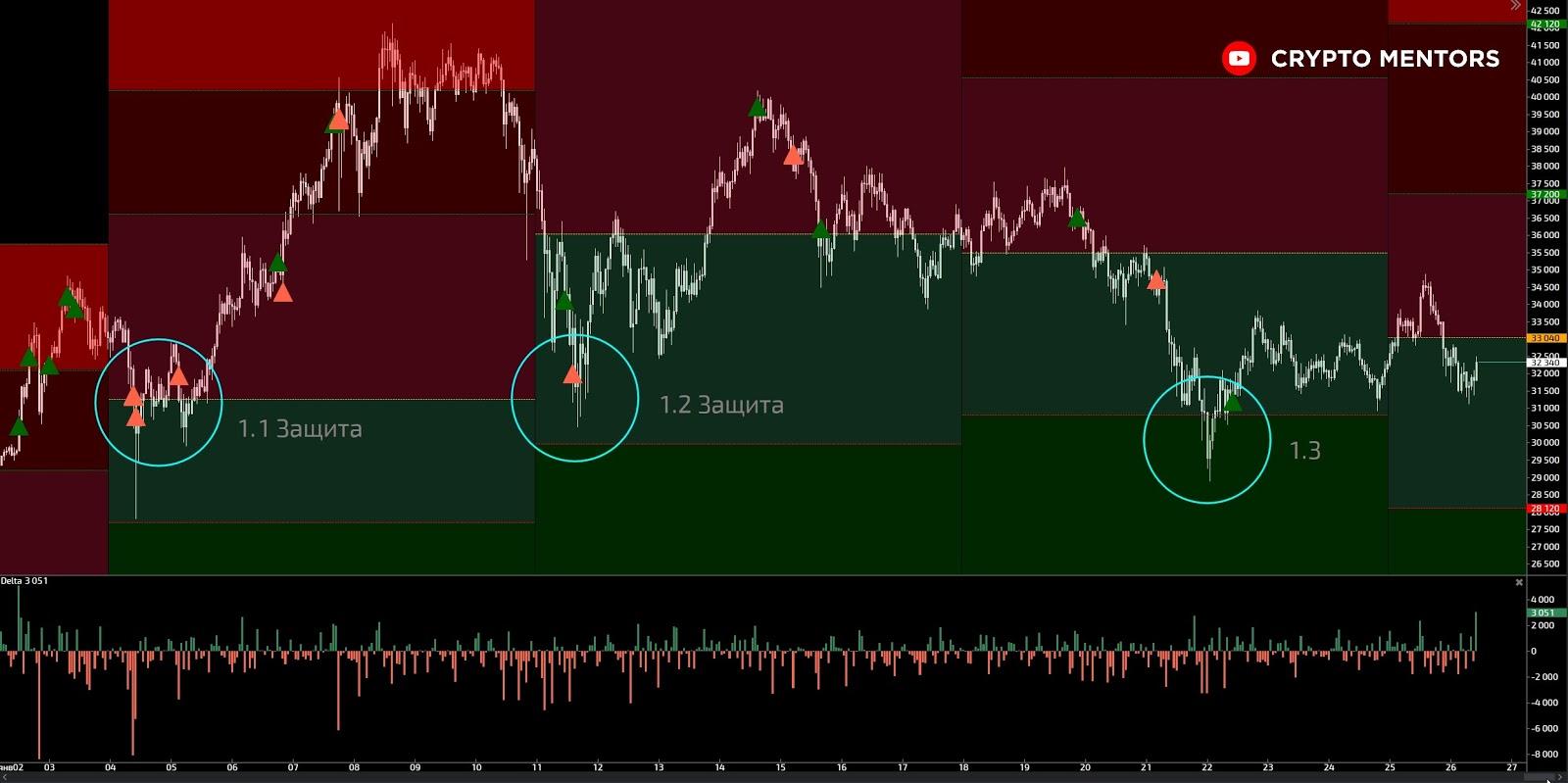

Analysis of Horizontal Volumes and Delta

Bitcoin found support in horizontal volumes, specifically from the $29,000 level. First, focus on the range $30,000-$34,800. Each time the price enters this area, a liquidity flare appears, confirmed by cluster filters. This indicates extreme interest from market participants at these values.

Given that the price has repeatedly moved higher from these levels, one can safely assert that activity is coming from a powerful buyer. However, the reaction to the range and to the $29,000 level remains very weak.

If we view more globally, one can see a “triangle” figure illustrating a squeeze toward $29,000-$30,000. Buyers need to break out of this range soon, thereby also breaking the trend line.

From the delta perspective, selling still dominates in the cumulative delta. This situation has persisted for several months and suggests the presence of a strong limit buyer, for whom the $30,000-$34,800 range could be of interest.

Examine the extremes near the range (marked with turquoise circles). In the first two cases, classic limit protection via delta inefficiency is clearly visible. However in the most recent case, which occurred very recently, such zealous protection is absent. This further indicates a gradual weakening of buying.

Bottom line

When the price is squeezed into balance, you cannot say with certainty where it will exit. If we close above $34,800, there will be a “to the moon” move and a new high. With weak reaction and an inability to overcome the level, we are likely to slide toward the $20,000-$23,000 marks.

Subscribe to ForkLog news on Telegram: ForkLog FEED — full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!