Uniswap leads DeFi as SushiSwap hype fuels rally.

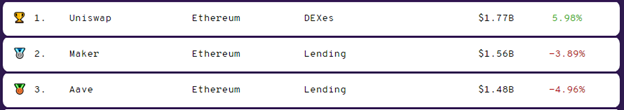

The largest non-custodial exchange, Uniswap, has overtaken Aave and Maker in terms of the value of assets locked on smart contracts. The drivers behind the ascent to the top were yield farming, which led to a significant rise in trading volumes, and the hype around the SushiSwap project.

Data: DeFi Pulse.

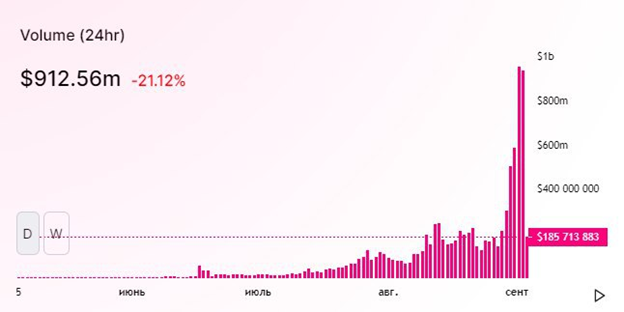

Data: Uniswap.

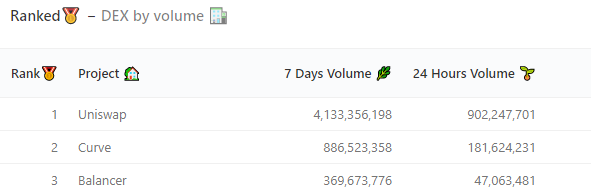

Data: Dune Analytics.

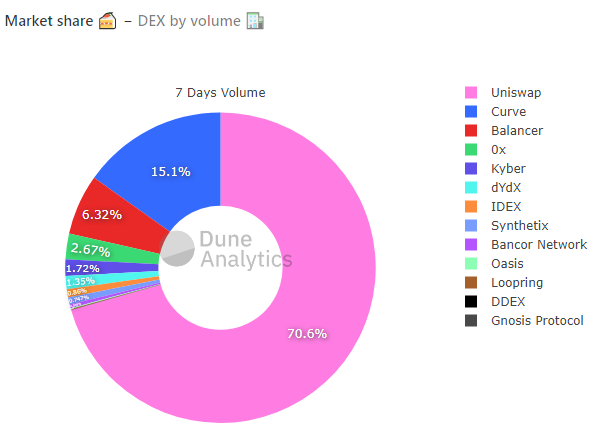

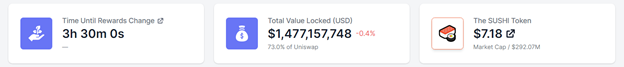

Over the past week the platform has drawn more than 70% of all DEX liquidity.

Data: Dune Analytics.

Three-quarters of the $1.77 billion locked on Uniswap are in the pool containing SushiSwap’s forked tokens.

Data: zippo.io.

Earlier, Forklog reported that the value of assets locked in SushiSwap exceeded $815 million three days after the DeFi project’s launch.

In August, trading volume on the DEX rose 143% — to $11 billion.

Subscribe to ForkLog news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!