Uniswap releases governance token UNI as Bitmain feud continues and other developments

As the week draws to a close, we look back at Uniswap’s release of the governance token UNI, Bitcoin’s attempts to hold above $11,000, Ukraine’s updated cryptocurrency bill, a new twist in the Bitmain co-founders’ feud and other notable events.

Bitcoin fails to hold above $11,000

Over the course of the week, the price of the leading cryptocurrency twice attempted to hold above the $11,000 level.

Source: TradingView.

From Monday the leading cryptocurrency began to rise, trading around $10,300, and by Wednesday, September 16, it rose to $11,100. It could not sustain the psychological level.

The second attempt of “digital gold” occurred on Saturday. Prices reached $11,200, but by Sunday Bitcoin had retraced below $11,000 again.

As of writing BTC trades around $10,800.

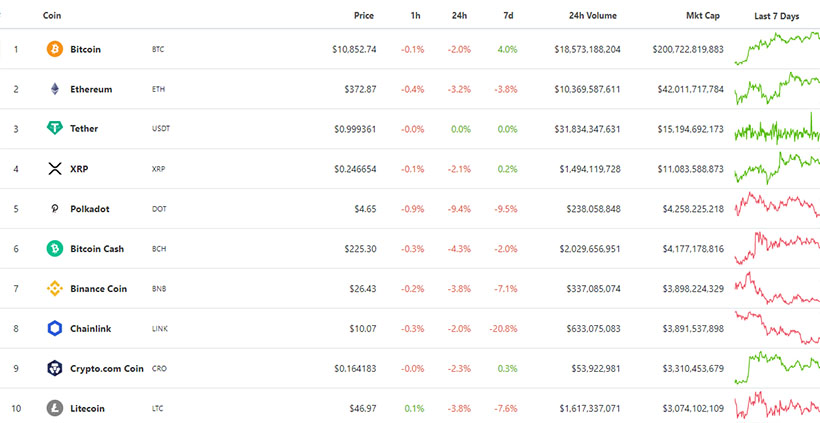

Over seven days, Bitcoin remains one of the few leading cryptocurrencies in the green zone, adding 4%. The biggest losers were Chainlink and Polkadot — 20.8% and 9.5% respectively (data from CoinGecko).

Source: CoinGecko.

As a result of yet another recalculation of the Bitcoin mining difficulty, one of the fundamental network metrics grew by 11.35% and reached a new all-time high — 19.31 T. This occurred amid a record hash rate for the leading cryptocurrency.

Total market capitalization of the cryptocurrency market stands at just over $352 billion, BTC dominance index at 57%.

Uniswap releases governance token UNI

The leading decentralised exchange (DEX) Uniswap released the governance token UNI.

The total supply of UNI will be 1 billion. 60% allocated to the community — to be distributed over four years.

The team, current and future employees, will receive 21.51% under the vesting program. Another 17.80% has been allocated to investors, and 0.069% to project advisors.

After four years an inflation mechanism will kick in — its annual rate will be 2%.

Binance added UNI to listing an hour after the release, and Changpeng “CZ” Zhao warned of extreme volatility.

New coin, a couple hours old. $UNI

Relatively well known project, grandfather of DeFi (NOT endorsement)

Expect high volatility.

HIGH RISK. https://t.co/oY9I7UJswX— CZ Binance (@cz_binance) September 17, 2020

That same day Coinbase Pro, the largest American exchange, announced adding support for the Uniswap token. Later the listing of UNI was conducted by Bitfinex.

The price of the coin on Friday, September 16, rose to a high of $7.82. As of writing UNI trades around $5, according to CoinGecko. Since the start of tracking, prices have risen by about 68%.

Over 138 000 UNI holders became the DeFi project SushiSwap — a fork of Uniswap, which had previously crashed its liquidity by 70%.

The SushiSwap administrator thanked the original protocol for the funds, noting that at current token prices they will be enough to cover developers’ salaries for several months.

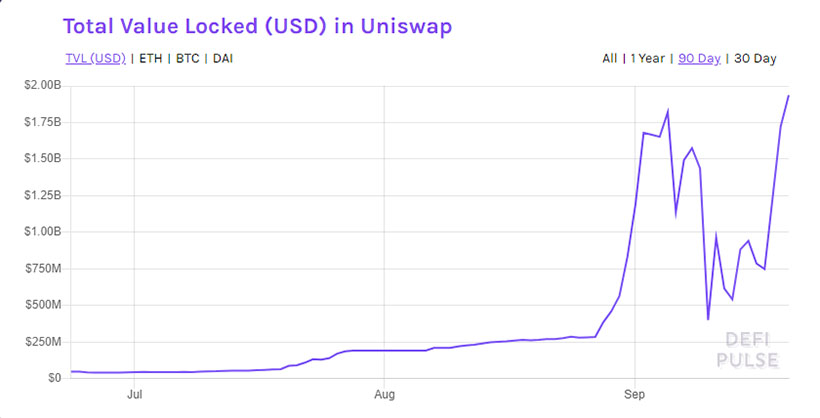

On September 20, the amount of assets locked in Uniswap reached an all-time high of $1.94 billion (DeFi Pulse data). The protocol again topped this metric among DeFi projects.

Source: DeFi Pulse.

The successful launch of Uniswap’s governance token creates a risk that companies lacking a proper business model will start issuing similar tokens that prove to be “valueless,” warned The Block analyst Larry Cermak.

What I worry the Uniswap success will start is that companies without a proper business model will now all be releasing “valueless” governance tokens. This will just dilute the market, exhaust investors even more and eventually the market could look just like in 2017

— Larry Cermak (@lawmaster) September 19, 2020

“This will dilute the market, exhaust investors even more, and ultimately lead to a situation like 2017,” he added.

Some users agreed, noting that the DeFi sector resembles the ICO boom of 2017. Others believe investors today are more experienced and remember the ICO bust.

The hype around the Uniswap governance token spurred interest in memes with similar names. One of them — Unicorn Token — rose more than 60,000 times, after which crashed back to its initial levels. The episode recalled a pump-and-dump that occurred in early September for SushiSwap meme-clones — HOTDOG, PIZZA and KIMCHI.

The price of SushiSwap’s governance token, from its all-time high of $11.17 reached on September 1, had collapsed within days to $1.2 (CoinGecko). As of writing, SUSHI trades at around $1.63.

According to well-known trader Tone Vays, all DeFi projects are nothing more than Ponzi schemes.

In Ukraine, updated draft law On Virtual Assets registered

The Verkhovna Rada of Ukraine has introduced a refined draft law “On Virtual Assets,” regulating cryptocurrency activity within the country.

In the updated bill virtual assets are now treated as intangible property.

“Definitions and classifications of virtual assets have been refined, and some definitions of service providers have been changed,” said Deputy Minister of Digital Transformation Alexander Bornyakov.

He expressed hope that the bill would be approved by the end of the current year.

According to a press release from the Ministry of Digital Transformation, the bill was refined with regulators’ and market participants’ wishes.

The previous version of the document was introduced in June.

Kraken becomes the first cryptocurrency exchange in the US to obtain bank status

The Bitcoin exchange Kraken became the first in the US to receive the status of a Special Purpose Depository Institution (SPDI), empowering it with functions of a traditional financial institution.

The corresponding application by the California-based company was approved by the Wyoming Banking Board.

This structure was designed specifically for crypto firms and will allow Kraken to dispense with external providers, performing banking functions in-house, including accepting deposits, custodial services and fiduciary management of digital assets.

With greater regulatory clarity, Kraken gains direct access to the federal payments infrastructure and aims to build a full bridge between traditional finance and cryptocurrencies.

Chainalysis: Eastern Europe leads in darknet market activity

Easter Europe leads darknet-market activity among regions worldwide, according to an analysis by Chainalysis.

According to the analysts, Eastern Europe ranks second after Latin America in the volume of cryptocurrency transactions sent to illicit organisations — 1.4% of total volume over 12 months.

The majority of darknet-market cryptocurrency transactions in Eastern Europe go through Hydra, one of the largest by volume in the region.

Chainalysis emphasised that in no other region does a darknet marketplace rank among the top ten most popular services by this metric.

In Russia, GPU sales for mining rise

Russian retailers and distributors reported rising sales of graphics cards that can be used for mining cryptocurrencies.

A representative of Marvel Distribution, Andrey Kirichevsky, clarified that the uptick in demand for GPUs has been observed since early August.

The Citilink network said GPU sales that can be used for mining rose 49% in monetary terms.

In Nvidia, a twofold increase in sales was recorded compared with the same period last year. The company linked this to the emergence of new games and applications requiring updated devices.

Market participants confirmed that, overall, demand for computer components rose in the summer.

Jihan Wu regains control of Bitmain

Bitmain co-founder Jihan Wu has become the company’s legal representative and chief executive officer.

The status as legal representative gives Wu the right to act on behalf of the company, sign and enter into agreements. Bitmain’s management plans to restore normal operations of the company and its subsidiaries.

The other co-founder, Micri Zhang, remains in the role of general manager. But the dispute between the partners has not been resolved.

Fisco sues Binance for aiding bitcoin laundering

The Japanese crypto exchange Fisco accused Binance of failing to act in laundering assets stolen in 2018 from Zaif. The suit was filed in the Northern District of California.

Fisco claims attackers laundered 1,451 BTC through Binance. They allegedly aided by weak KYC/AML measures that do not meet industry standards.

“Shortly after the hack, Zaif’s representatives asked Binance to freeze the accounts related to the stolen bitcoins. But the exchange did nothing,” the suit states.

Fisco seeks the court to award more than $9 million and “fair compensation for the time and money spent locating the property.”

The Japanese exchange Zaif was hacked in September 2018. Soon after the incident Zaif was acquired by investment company Fisco. It promised to reimburse users of the platform.

MicroStrategy raises bitcoin investment to $425 million

The Nasdaq-listed analytics software provider MicroStrategy, previously investing $250 million in bitcoin, added another 16,796 BTC for $175 million.

Total investments in the leading cryptocurrency, including fees and costs, reached $425 million.

After the purchase in August, 21,454 BTC, MicroStrategy became the first publicly listed company to invest part of its capital in cryptocurrency.

Through its stake in MicroStrategy, the indirect holder of 577 BTC became the Norwegian sovereign wealth fund—the largest in the world with assets over $1 trillion. Major holders of MicroStrategy shares also include Vanguard ($6.2 trillion under management) and BlackRock ($7.43 trillion under management).

An official proposal for Ethereum’s transition to the Proof-of-Stake algorithm published

The senior Ethereum Foundation developer Danny Ryan published the official EIP-2982 proposal, envisaging the launch of Ethereum 2.0 and the transition of the second-largest cryptocurrency from the Proof-of-Work consensus algorithm to Proof-of-Stake.

If approved by other leading developers, Serenity, the zero phase of Ethereum 2.0, would be launched. It would activate the Beacon Chain, where Proof-of-Stake would be used.

What else to read and watch?

This week ForkLog published material on the controversial DeFi project SushiSwap, around which a number of notable sector events occurred.

The runaway “Chef,” DeFi fever and the whales’ gambit: how SushiSwap attracted $1B in two weeks

ForkLog examined the diversity of projects and the main directions of development in the rapidly expanding DeFi sector.

DEX, DAOs and tokenized bitcoins: how not to get lost in the DeFi wilderness

Also published is the traditional “Institutional Watch” on significant investment events in the crypto industry over the past weeks.

In Tone Vays’s latest Weather Forecast, the well-known trader discussed the ongoing DeFi hype, the prospects of the investigation into Bitfinex and Tether, and many other things, and of course gave a bitcoin price forecast.

Follow ForkLog’s news on Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!