Week in review: bitcoin falls below $80,000 and TheDAO relaunches

Bitcoin drops below $80,000; TheDAO relaunch; Trump names a Fed pick.

The crypto market suffered a deep correction, the Ethereum community moved to relaunch TheDAO, Trump floated a replacement for the chair of the Fed, and other events of the week.

A deep slide

The week began quietly, with bitcoin even heartening investors by rising towards $90,000. The second half brought several sharp sell-offs.

On Thursday, after the US session opened, bitcoin plunged from $88,000 to $83,000.

Shortly before the crypto sell-off, gold hit an all-time high at $5,600 per ounce before slipping to $5,100. The tendency to track the precious metal’s pullbacks persisted through the week.

Overnight on 30 January bitcoin continued to fall, lurching to $81,000. That triggered a wave of $1.7bn in liquidations.

The next day, after a rebound to $85,000, came another, steeper drop — below $80,000. Briefly, the coin tested $75,000 for the first time since April 2025.

Forced liquidations over 24 hours topped $2.5bn.

At the time of writing, digital gold trades around $78,000, down 12% on the week.

Market views on the next leg diverged. Trader Kit Alan suggested a double bottom forming around $74,000, which aligns with April’s support line.

MN Trading founder Michaël van de Poppe noted that the RSI on the weekly bitcoin/gold chart had dropped below 30.

«[…] это сигнал, который срабатывал во время минимумов медвежьего рынка в 2015, 2018 и 2022 годах. И он срабатывает снова», — добавил эксперт.

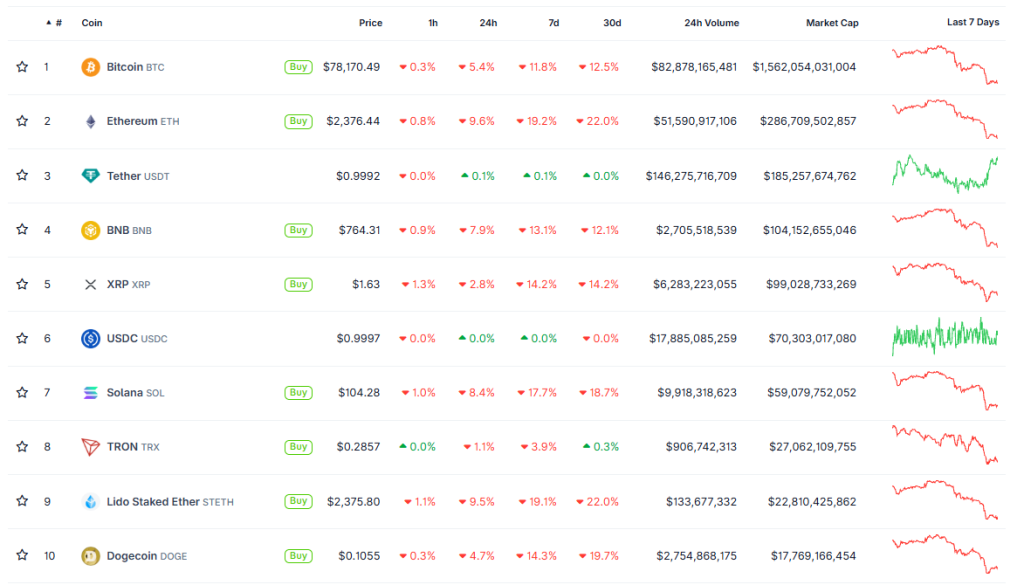

The rest of the crypto market bled alongside bitcoin; some coins fell much harder than the bellwether.

Ethereum sank to $2,300 (-19% in seven days), BNB to $750 (-13%), and Solana (-17%) to $100.

Total crypto market capitalisation fell to $2.7trn. BTC dominance is 57.5%, ETH 10.6%.

The Crypto Fear and Greed Index fell to 14 for the first time since mid-December 2025.

Raising the dead

On 29 December the Ethereum team announced a decision to relaunch TheDAO, hacked in 2016. The initiative took effect the same day.

Under the programme, the organisation becomes a fund to support blockchain security. It will be financed from part of the ~75,000 ETH left unclaimed since the attack.

TheDAO curators, including Vitalik Buterin, have already outlined plans to allocate $13.5m in grants for external developers. Distribution will occur through DAO mechanisms.

The remaining coins, worth about $200m, will go into staking.

«Цель фонда TheDAO — сделать Ethereum настолько безопасным, чтобы ваши сбережения было выгоднее хранить в DeFi-протоколе, чем в банке», — подытожили представители организации.

The attack on TheDAO was among the most high-profile hacks in crypto. The hacker withdrew ~3.6m ETH — at the time about 3.5% of supply. The incident later led to a contentious hard fork of Ethereum’s mainnet.

What to discuss with friends?

- Vitalik Buterin will spend $43m on Ethereum’s development.

- A major Chrome update: a Gemini side panel, Nano Banana and “Personal Intelligence”.

- The number of Solana validators has fallen to 2021 levels.

- The US has for the first time imposed sanctions on bitcoin exchanges over links to Iran.

Fed rate and a possible replacement for Powell

Another notable, though scarcely market-moving for crypto, event was the Fed’s rate decision. On 28 January the regulator kept the rate in a 3.5–3.75% range.

It surprised no one: analysts had almost fully priced in such an outcome. The Federal Reserve had hinted as much earlier, signalling a slowdown in easing.

«Имеющиеся показатели свидетельствуют о том, что экономическая активность растет устойчивыми темпами. Рост числа рабочих мест остается низким, а уровень безработицы демонстрирует некоторые признаки стабилизации. Инфляция остается несколько повышенной», — говорилось в пресс-релизе ФРС.

Chair Jerome Powell said the stance of monetary policy remains steady; inflation is still elevated and labour-market readings are less than stellar.

The latest pause likely prompted President Donald Trump to “go on the offensive”. On 30 January he named Kevin Warsh as his pick for the next head of the regulator. Powell’s term ends in May.

Trump said he has long known his nominee and is “not in doubt” he will go down in history as “one of the greatest Federal Reserve chairmen”.

Warsh — an American financier and bank executive — served on the Fed’s Board of Governors from 2006 to 2011. More on his record is in our article.

«Рынки в целом видят в возможном возвращении Уорша медвежий сигнал для биткоина. Его фокус на денежной дисциплине, высоких реальных ставках и сокращении ликвидности рисует образ криптовалюты не как защиты от обесценивания фиата, а как спекулятивного излишества, которое исчезает с окончанием эры дешевых денег», — считает основатель 10x Research Маркус Тилен.

US-only

This week Tether announced the full launch of USAT — a federally regulated stablecoin for the US market.

The asset was created in accordance with the Genius Act. Anchorage Digital Bank, N.A., the first in the country to receive the relevant licence, is responsible for issuance. Cantor Fitzgerald will hold the token’s reserves as designated custodian and primary dealer.

The “stable coin” is available on Bybit, Crypto.com, Kraken, OKX and via the Moonpay payments service.

«USAT предоставляет институтам дополнительный вариант: стейблкоин, сделанный в Америке. USDT более десяти лет доказывал, что цифровые доллары могут обеспечивать доверие, прозрачность и полезность в глобальном масштабе», — отметил генеральный директор Tether Паоло Ардоино.

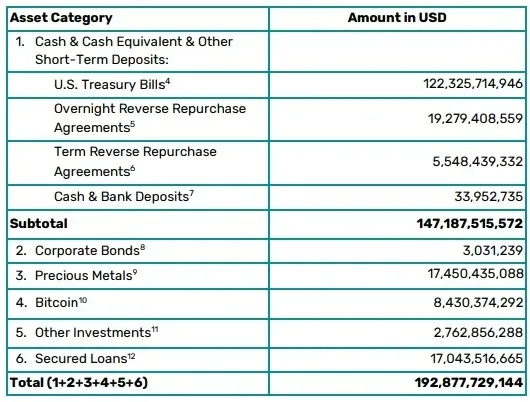

The company also reported its 2025 results. Tether International earned net profit above $10bn, and excess reserves reached $6.3bn.

Nearly 50bn USDT were issued over the reporting period, the second-largest issuance in the firm’s history.

Direct investments in US Treasuries exceeded $122bn.

By year-end the stablecoin issuer held precious metals worth ~$17.5bn and bitcoin worth $8.4bn. By end-January, the value of the company’s 140 tonnes of gold reached $23bn, and Tether used a former nuclear bunker in Switzerland to store it.

In parallel Tether said XAUT accounted for more than half of the entire market for physically backed gold stablecoins. The segment is valued at $5bn, of which more than $2bn is the USDT issuer’s asset.

Also on ForkLog:

- Benchmark: the quantum threat to bitcoin is overstated.

- Bit Digital will quit mining for AI and Ethereum.

- The SEC has equated tokenised assets with traditional securities.

- Experts mooted bitcoin’s failure as “digital gold”.

Frozen miners

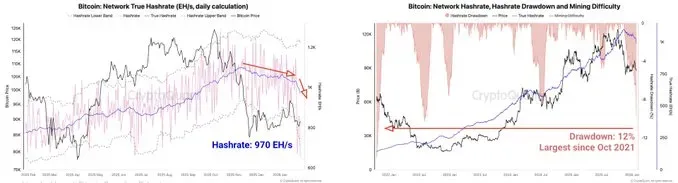

By end-January the network hashrate of bitcoin fell to 970 EH/s — the lowest since September 2025. Winter storms in the US disrupted miners.

On 24 January hashrate hit a low of 690 EH/s after shut down most of Foundry USA’s equipment.

The largest American mining pool reduced capacity by 60% because of storm “Fern”. Extreme weather hit the Southeast, Northeast and parts of the Midwest.

The storm stretched nearly 3,000km. Ice and snowfall left more than 1m residents without power. Miners had to curtail consumption to ease the load on city grids. Other pools were affected as well.

While the episode drew attention to the issue, Glassnode analysts noted that bitcoin’s hashrate has been declining for the past four months.

According to the firm, mining revenues fell sharply amid lower prices and operational outages. Daily revenue from mining dropped from $45m to a yearly low of $28m in short order, then only partially recovered to ~$34m.

«Ситуация указывает на крайне низкую доходность майниговых компаний в текущих условиях цен и сложности добычи даже после многочисленных корректировок показателя в сторону уменьшения», — добавили в Glassnode.

What else to read?

In the January digest we asked whether bitcoin has kept its haven status, analysed market moves and gathered the month’s most interesting longs.

We try to find out what the UN’s Hanoi cybercrime convention is for: tackling online wrongdoers or tightening the screws in the digital realm.

On the inevitable merger of two financial worlds, commodity tokenisation, oil-extraction royalties and futures on GPU compute.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!