Week in review: Bitcoin back at $40,000 as Robinhood begins trading on Nasdaq

The price of digital gold surpassed the $40,000 level, the Robinhood app conducted an IPO on Nasdaq, in Kazan the co-founder of Finiko Kirill Doronin was detained, and other events of the past week.

Bitcoin price returns to the $40,000 level

Against a backdrop of rumors about a possible integration of cryptocurrency payments on the Amazon marketplace, Bitcoin opened the week with a 12% gain, briefly hitting $40,600. On Tuesday, after the tech giant refuted the information, the price corrected to $36,380.

In the night of July 31, digital gold managed to settle above the $40,000 level. At the time of writing the asset was trading around $41,200.

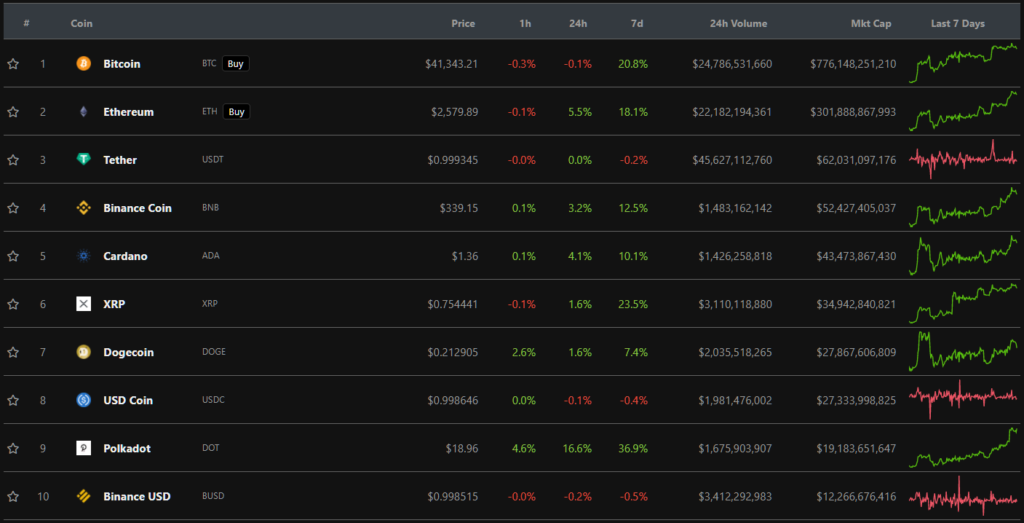

Over the past week Bitcoin rose more than 20%, according to CoinGecko. All top-10 by market capitalization assets were also in the green.

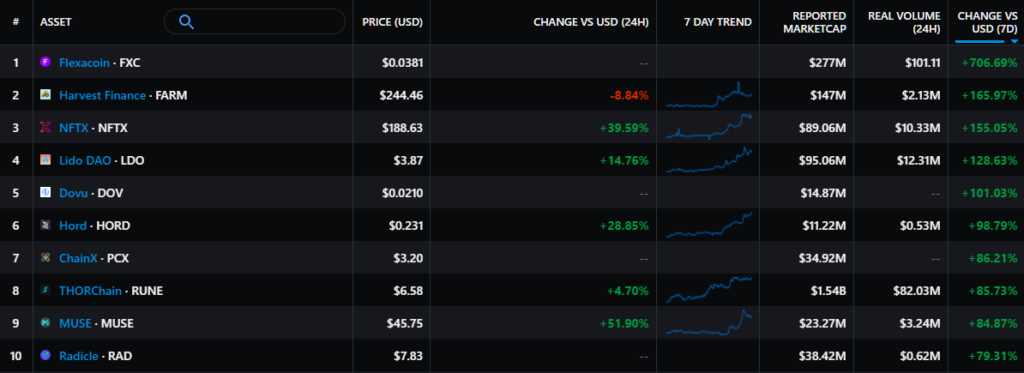

According to Messari, among digital assets last week, Flexacoin rose the most — its price surged by 706%. Its market capitalization stood at $277 million.

The biggest decline was Ampleforth — 47%. Its market capitalization fell to $150 million.

Total market capitalization rose to $1.7 trillion, and Bitcoin’s dominance index rose to 45.6%.

Ethereum marks its sixth birthday

On 30 July 2015 the alpha version of the Ethereum blockchain, called Frontier, was launched. According to Glassnode, over six years the total value transferred through the network reached $3.6 trillion.

In May 2021 the price of Ethereum hit a new all-time high at $4350, and the average number of active addresses in its network surpassed that of the Bitcoin ecosystem.

Monero developers disclosed a bug in the privacy-preserving algorithm

The Monero team discovered a bug in the decoy-selection algorithm, which could affect the privacy of users’ transactions.

The blockchain of the anonymous cryptocurrency uses ring signatures, including mixins in the form of inputs and outputs from other users’ transactions, made previously. They help to obfuscate traces and conceal the actual operation.

If a user spends the received funds after 10 blocks from receipt or ~20 minutes later, there is a high likelihood of identifying the true transaction. The vulnerability will be fixed in a future update.

Bitcoin mining difficulty increased for the first time in two months

On July 31, following another retarget, Bitcoin mining difficulty increased by 6.03%, reaching 14.5 T. This is the first uptick since May 13, when it peaked at 25.05 T.

After this, the metric declined: first by 16%, and then by another 5.3%. The subsequent drop was a record — 27.94%. Then the difficulty fell by 4.8%.

Robinhood shares begin trading on Nasdaq under the ticker HOOD

On July 29 the Robinhood app for trading stocks and crypto conducted an IPO on Nasdaq. The company set the offer price at $38 per share — at the lower end of the previously disclosed range, implying a market capitalization of about $32 billion.

Ten minutes after trading began, the stock fell by more than 10%, and the first session closed at $34.82. Market capitalization fell to $29 billion.

As a result, Robinhood’s IPO proved to be one of the worst in the United States among 51 companies that raised at least comparable capital to Robinhood.

More than 100 Finiko investors filed police reports in Tatarstan. Co-founder detained

At the law-enforcement agencies of Tatarstan there were more than 100 complaints from investors in the Finiko pyramid scheme. Applicants reported suspended payments, with the largest loss among them totaling 8 million rubles.

Towards the end of the week local media reported the detention of the company’s co-founder Kirill Doronin by law enforcement. Later the republic’s interior ministry confirmed this information.

Zelenskiy signed law allowing the National Bank of Ukraine to issue its own digital currency

President Volodymyr Zelenskiy signed the law “On Payment Services,” allowing the National Bank to issue its own digital currency. The Ukrainian central bank also gained the right to launch a regulatory sandbox to test services and tools based on “innovative technologies.”

Kazakhstan banks will be allowed to open accounts for crypto companies

According to local media, crypto-related service providers will be able to open accounts in Kazakh banks as part of a pilot project.

The measure concerns allowing credit institutions to open accounts for legal entities providing digital asset buying and selling services and registered under the Astana International Financial Centre (AIFC).

At the same time the AIFC proposed to set a monthly limit of $2,000 on crypto purchases for retail investors who have not verified their income.

Binance under regulator scrutiny in Malaysia and India

The Malaysia Securities Commission announced compulsory actions against Binance for illegal management of a digital asset exchange. The regulator ordered to disable the exchange’s website and mobile apps in the region, to stop promoting services to local investors, and to close access to its Telegram channel.

According to Bloomberg, India’s Money Laundering Control Bureau will investigate Binance Holdings’ role in a money-laundering case. Earlier, the exchange WazirX, owned by Binance, was suspected of currency-rule violations.

Against regulatory troubles, several crypto funds were reported to have ceased cooperating with the firm, according to the Financial Times. ARK36 and Tyr Capital were named as examples.

On July 26 Binance reduced leverage on its futures platform for new clients to 20x, and subsequently lowered the withdrawal limit from 2 BTC to 0.06 BTC for accounts that completed basic verification.

This week the platform unveiled an API for tax reporting and announced it would wind down crypto derivatives trading in Europe, starting with Germany, Italy and the Netherlands.

South Korea’s financial regulator will halt operations of 11 Bitcoin exchanges

The Financial Services Commission of South Korea accused several local crypto exchanges of illegal activity, according to The Korea Herald. The regulator will halt operations of 11 unnamed firms and report their violations to prosecutors and police.

These are small- and mid-sized exchanges. They failed to meet regulator requirements on customer identification using named bank accounts and used “fraudulent omnibus accounts”.

Coinbase: imminent SEC approval of Bitcoin ETFs is inevitable

In Coinbase, the firm was optimistic about the prospect of US approval of Bitcoin-based exchange-traded funds (ETFs) in the current year or in 2022. The company highlighted a number of favorable factors for registering such investment vehicles with the SEC:

- new SEC leadership under Gary Gensler, seen as more crypto-friendly;

- expansion of institutional participation in the industry;

- growth of the digital-gold futures market to levels regulators cited as benchmarks;

- successful debut of a Bitcoin ETF in Canada.

Goldman Sachs filed for launch ETF based on DeFi- and blockchain companies, and State Street will offer crypto services for private capital

The investment bank Goldman Sachs sent a filing to the SEC to launch an ETF whose basket will include stocks of public companies in the DeFi and blockchain space.

The second-oldest US bank, State Street intends to offer services to private funds for crypto trading. It said its $3.1 trillion asset-management entity aims to broaden services in crypto, CBDC, blockchain and tokenised equities.

U.S. Department of Justice initiated a probe into Tether. The company called the news clickbait

As reported by Bloomberg, the U.S. DOJ has initiated a probe into possible bank fraud by Tether executives in the early days of the firm. In particular, federal prosecutors are examining whether Tether hid crypto-related transactions from banks.

In response, Tether called the reports clickbait, based on unnamed sources and long-standing claims.

The United States will collect an extra $28 billion from taxing crypto transactions

The Internal Revenue Service will raise an additional $28 billion in taxes from crypto transactions. Such figures appear in the latest version of the bipartisan plan to fund infrastructure spending.

The latest draft proposes tightening tax-reporting rules for crypto brokers. It also includes a recommendation to require them to report all transfers of digital assets above $10,000.

The bill also expands the definition of “broker” in the U.S. tax code to cover virtually all industry participants, including non-custodial ones, and to require them to comply with KYC rules.

Attorney Jake Cherwin-sky criticised the document, noting that the new definition is so broad that it could be applied “to virtually any participant in the U.S. crypto industry.” He also noted that some participants (for example, miners) may not meet regulator requirements.

Industry experts from Coin Center and The Blockchain Association concurred.

Also on ForkLog:

- 41% of Russians strongly oppose receiving salaries in digital rubles.

- Huobi has exited its Beijing branch, and Bitmain announced the sale of Antpool

- In Russia a service to transfer keys to Bitcoin wallets by inheritance will be created.

- Kaseya received a decryptor key without paying hackers a ransom.

- Justin Sun spoke about participation in a research project under the Chinese Communist Party.

- The Hermitage and Binance NFT tokenise artworks from the museum’s collection

- Bitcoin hash rate began to recover amid miners leaving China

- An American assembled a Bitcoin miner from 10 USB devices with Bitmain chips

- PayPal completed development of its own crypto wallet

- FinCEN adviser called cryptocurrencies yet another means of payment

What else to read and watch

In an exclusive interview with ForkLog editor-in-chief Nikita Shteringar-d, the founder of FTX and Alameda Research Sam Bankman-Fried told about his worldview, corporate culture and business.

In an interview for ForkLog AI, Tango’s head of the data-science team Daniil Shvets discussed what the profession of a data scientist really entails, why algorithms are biased, how to combat deepfakes and why OpenAI sells its developments.

ForkLog explained the growth drivers of the ecosystem and the architecture of the Polygon protocol (formerly Matic Network), which became popular among users thanks to near-instant transactions and very low fees.

Many players in the crypto industry are showing particular interest in going public as the stock market recovers. The magazine investigated how much it costs to build a crypto IPO.

The blockchain technology remains one of the hottest trends among financial, government and commercial organisations worldwide. ForkLog has prepared an overview of the most interesting recent initiatives.

In traditional digests we have gathered the week’s main events in cybersecurity and artificial intelligence.

On 26 July in ForkLog’s live broadcast we discussed a lot: price and charts with trader Ilya Meshcheryakov, Ethereum ecosystem with Credentia CEO Stepan Gershun, and DeFi with Vladimir Ponimayushchim — a regular contributor.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!