Week in Review: Bitcoin Hits Local High as Ethereum Network Experiences Unintended Fork

Bitcoin reached a local high above $50,000; the Ethereum network experienced an unintended fork; Poly Network developers regained control over $613 million stolen; and other events from the week.

Bitcoin Price Breaks Above $50,000

At the start of the week, the price of the first cryptocurrency reached a local high above $50,000. The price rise also revived the futures market, with open interest on Bitcoin-based contracts reaching $18 billion.

According to the latest recalculation, the mining difficulty rose by more than 13%, to 17.62 TH. At the same time, Glassnode analysts said that transactional activity on its network remained at a historically low level.

The asset failed to hold the milestone. At the time of writing, the first cryptocurrency was trading near $48,570.

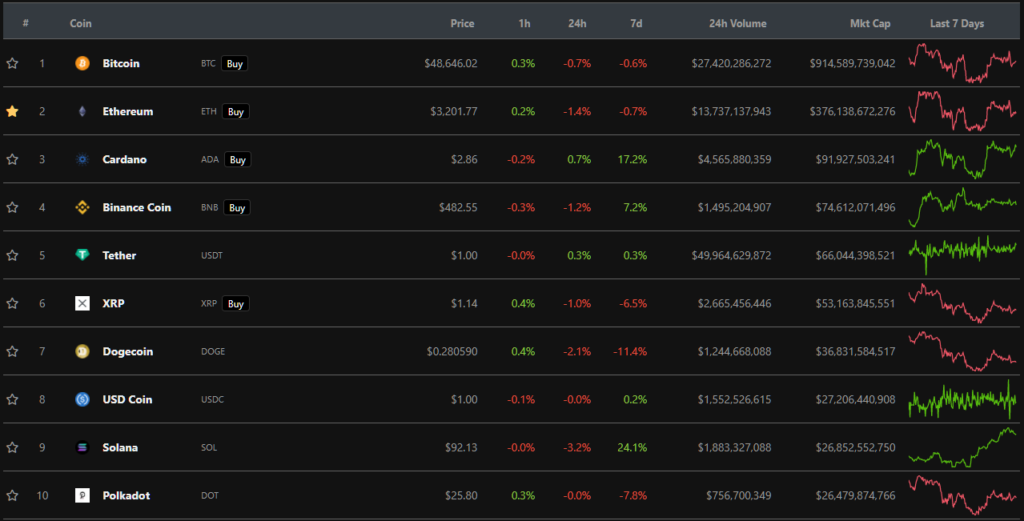

Over the week, the top-10 by market capitalisation showed wide dispersion. Cardano (ADA) and Solana (SOL) gained significantly—by 17% and 24%, respectively. Binance Coin (BNB) also rose by 7%.

Meanwhile, Dogecoin (DOGE) fell by 14%, Polkadot (DOT) lost almost 8%, and XRP declined by 6.5%.

The market capitalization of the crypto market stood at $2.17 trillion. Bitcoin’s dominance index fell to 42.2%.

An Unintended Fork Occurred in the Ethereum Network

On Friday, August 27, the Ethereum network experienced an unintended fork, with reorganisations affecting more than 450 blocks. It affected nodes running the Geth client.

The incident was caused by exploiting a critical vulnerability that developers warned about earlier. The flaw also affects other DEX-compatible chains such as Polygon, Binance Smart Chain and xDAI.

Most miners were on the latest software version, and the ‘correct’ chain ended up being the longest.

The Ethereum network’s hash rate reached an all-time high above 646 TH/s.

Poly Network hacker returns remaining $141 million

The organizer of the attack on China’s inter-network Poly Network provided the key to the multisig wallet and returned the remaining $141 million of stolen funds. In a transaction comment, the hacker explained the delay of the final payout by freezing about $33 million of stolen USDT. He added that the problem with Tether lies in excessive centralisation.

The hacker described the incident as “one of the craziest adventures of my life” and signed as “Chief Security Advisor.”

The protocol developers reported full restoration of the $611 million stolen assets and moved to the next phase — returning funds to users.

Liquid hacker sent about $20 million in Ethereum to Tornado Cash

The hacker who breached the Liquid exchange sent nearly $20 million in Ethereum to the Tornado Cash mixer. He also attempted to swap ERC-20 tokens worth $45 million into ETH to evade blocks by projects with such capability. To do this, the attacker used a DEX, including Uniswap and SushiSwap.

On August 26, Liquid raised $120 million in debt financing from the operator of the crypto-derivatives platform FTX. The funds are being used to roll out new products in Japan and Singapore.

Bilaxy Reports Hot Wallet Breach

The Seychelles-based cryptocurrency exchange Bilaxy reported a breach of hot wallets. The company did not disclose the amount of the loss, but security analyst Harry Denley of MyCrypto estimated that hackers could have withdrawn about $70 million from the platform.

Jack Dorsey to Develop Decentralized Bitcoin Exchange

Jack Dorsey said he is working on an open platform, TBD, to build a DEX based on his payments company Square.

The TBD head Mike Brock said that existing centralized platforms have several issues. He also noted that they are unevenly distributed around the world.

According to Brock, the project’s development will be fully public. The platform will have open-source code and protocol, and will support any wallets. He added that TBD will have no controlling organization.

Bisq, the non-custodial crypto platform, offered Dorsey to discuss collaboration. In 2019 it unveiled a new version of its DEX, which it described as “the most important milestone” in its development.

Facebook Integrates NFT in Digital Wallet

Facebook is considering the creation of NFT-related products and services, said the head of the payments division David Marcus. He said support for such assets is planned to be added to the Novi digital wallet.

Marcus did not specify which products the company will develop. He noted that users should be able to create, store, rent and sell tokens.

Reports Say Binance Plans to Raise Investment at $200 Billion Valuation

Journalist Colin Wu said that Binance is considering obtaining regulatory approval to start trading Bitcoin futures on the Chicago Mercantile Exchange. In the backdrop of Bitcoin’s rise to $50,000, the firm allegedly recorded a surge in client interest in the cryptocurrency.

Ripple Seeks Data on SEC Employees’ Crypto Transactions

Ripple filed a motion seeking disclosure of information about Securities and Exchange Commission employees’ dealings with Bitcoin, Ethereum and XRP tokens. The company argues that the regulator did not restrict workers from trading these assets, and therefore they are not securities.

Morgan Stanley and Miller Opportunity Trust Reveal Positions in Grayscale Bitcoin Trust

Morgan Stanley fundscould hold up to 25% of GBTC assets under management. For example, the Morgan Stanley Insight Fund purchased 928,051 GBTC shares.

Morgan Stanley Institutional Fund and Morgan Stanley Variable Insurance Fund also hold Bitcoin indirectly.

Miller Opportunity Trust, billionaire Bill Miller’s, owns 1.5 million GBTC shares, valued at $44.7 million as of June 30. The stake accounts for 1.55% of the fund’s total assets.

Also on ForkLog:

- Chip supplier for Bitmain will raise prices by 20%.

- 1inch Network opened a new investment round with a valuation of $2.25 billion.

- China-based hosting provider was ordered to return Genesis Mining equipment worth $200 million.

- In the U.S. Congress, a plan to regulate cryptocurrencies was sent back for consideration.

What to Read and Watch Next

In a few months, during China’s Winter Olympics, a digital yuan could be launched. ForkLog examines how the instrument will affect the leading players in mobile payments in China — Alipay and WeChat.

In traditional digests we collect the main events in decentralized finance and AI.

On August 23, a celebratory livestream dedicated to ForkLog’s birthday took place on our YouTube channel. We turned 7! To mark the occasion, the magazine unveiled an NFT collection on the marketplace OpenSea (auction runs until September 1) and held a giveaway of tokens among readers.

The livestream featured ForkLog editor-in-chief Nikita Shteringard, trader Vladimir Koen, ForkLog resident and trader Ton Veis, and blogger Cryptoiska.

Follow ForkLog’s Bitcoin news on our Telegram channel — cryptocurrency news, rates and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!