Week in review: bitcoin slips below $110,000 as Aster tops Hyperliquid by volume

Bitcoin slipped below $110k; Aster topped Hyperliquid; Plasma launched mainnet.

Bitcoin failed to hold $110,000; the CZ-backed exchange Aster overtook Hyperliquid by trading volume; Plasma launched its mainnet, among other events of the week.

Bitcoin fell through $110,000

By the end of the workweek the digital gold slipped below $110,000. Over the weekend the asset traded around the lows set on the drop, perhaps establishing a new consolidation range.

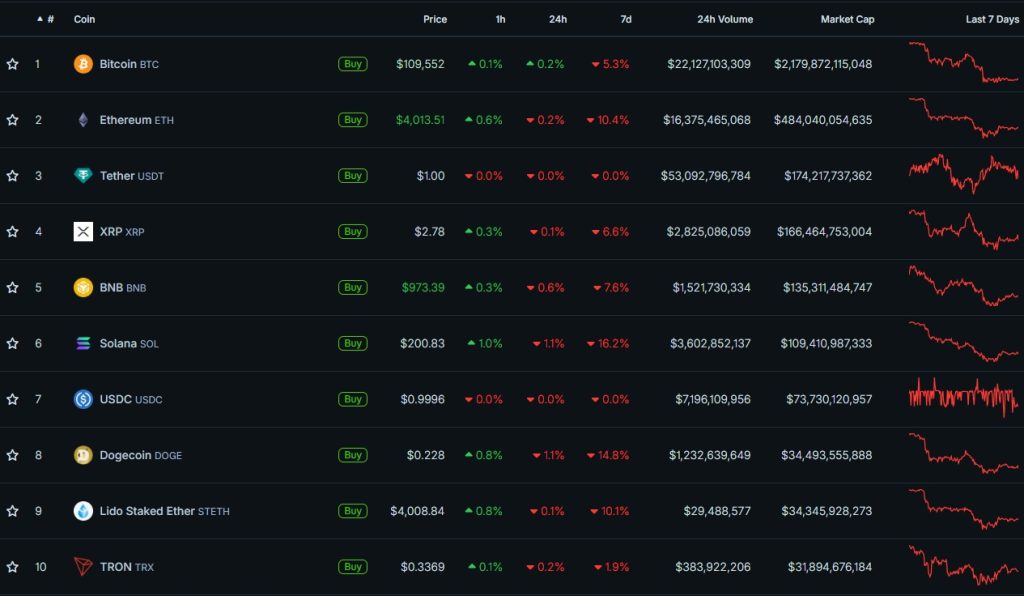

Over seven days bitcoin fell by more than 5%.

Most leading altcoins dropped harder. Ether declined 10% but held the $4,000 psychological level. Solana lost 16% yet stayed above $200.

Dogecoin (-14.8%) and Cardano (-12.6%) also slid sharply.

The crypto market’s capitalisation fell below $4trn—to roughly $3.8trn. Bitcoin’s dominance, amid the steeper altcoin pullback, firmed to 56.4%.

According to CoinMarketCap, the altseason index retreated from the 75 threshold to 66.

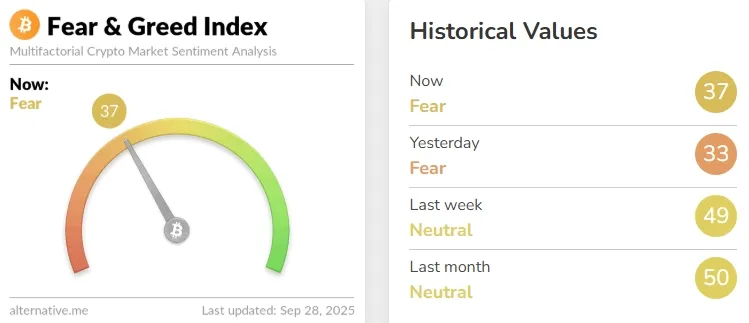

Crypto Fear and Greed Index fell from neutral readings to 37—into moderate fear territory.

CZ-backed Aster overtakes Hyperliquid by trading volume

On 24 September the decentralised exchange Aster overtook Hyperliquid by daily perpetuals trading volume. The platform reached $20.8bn versus $9.7bn for its rival.

By week’s end the gap had only widened—Aster and Hyperliquid posted volumes of $42.8bn and $4.6bn.

The BNB Chain-based DEX also outpaced its main competitor in fee revenue generation.

Aster emerged from the merger of APX Finance and Astherus in March. The platform drew the crypto community’s attention after launching its eponymous token on 17 September.

A key catalyst was a post by Binance founder Changpeng Zhao (CZ) congratulating the DEX on releasing its native coin.

The community had speculated that the entrepreneur himself initiated a decentralised venue in the BNB Chain ecosystem in response to Hyperliquid’s success.

CZ partly confirmed this, acknowledging that several former Binance employees are part of Aster’s team. YZi Labs, Binance’s venture arm, holds a minority stake in the platform.

That’s the correct quote! It’s not that hard.🤣 https://t.co/SNFLOyVIS0

— CZ 🔶 BNB (@cz_binance) September 27, 2025

CZ himself, by his account, serves as an adviser to Aster. He added that the DEX does compete with Binance but ultimately benefits the BNB Chain ecosystem.

In one tweet Zhao noted that “now everyone wants to be a Perp DEX”.

“More players will increase the market size faster. A rising tide lifts all boats,” he wrote.

What to discuss with friends?

- The hacker who breached UXLINK became a victim of an attack himself.

- An expert pointed out that bitcoin’s rally cycle is nearing exhaustion.

- The number of crypto millionaires rose by 40% over the year.

- QCP warned of the risk of bitcoin falling to $107,000 and ether to $3,300.

Vitalik Buterin sets out the key to scaling Ethereum

Ethereum co-founder Vitalik Buterin said, that the PeerDAS technology will be a key component for scaling the network. It will be part of the forthcoming Fusaka upgrade.

PeerDAS will let nodes verify block data availability without downloading it in full. Nodes will receive small fragments and, using erasure coding, reconstruct the rest. Buterin called the approach unique.

For some operations in the first version of PeerDAS, full data will still be needed. However, only one honest node will be required, making the system resilient to attacks.

Plasma launches mainnet and XPL token

The L1 blockchain Plasma focused on stablecoins launched its mainnet and native token XPL.

The project offers fee-free USDT transfers thanks to its own PlasmaBFT consensus.

Developers position Plasma as a solution for global money transfers. The blockchain is EVM-compatible. At launch it supports over 100 DeFi integrations, including Aave, Ethena, Fluid and Euler.

At the time of writing the platform’s TVL reached about $4.9bn (DeFi Llama). That put Plasma sixth by the metric, ahead of Base.

The project also announced the launch of its own neobank, Plasma One. According to the statement, the vehicle will offer yields above 10% per annum, delivered by DeFi protocols in the Plasma ecosystem.

Also on ForkLog:

- Nvidia is investing $100bn in OpenAI.

- Authorities in China and South Korea introduced new restrictions for the crypto market.

- Trustee Plus commented on the NBU’s claims about P2P operations.

- Circle will add reversible transactions to USDC.

Uniswap unveils Compact v1 to tackle cross-chain fragmentation

Uniswap Labs developers unveiled The Compact v1, a tool based on ERC-6909 smart contracts designed to eliminate cross-chain fragmentation.

The solution forms “a developer-focused common framework for building customizable and composable systems.”

“The Compact enables secure cross-chain settlement through a system of reusable resource locks and programmable commitments,” the blog says.

At the core of the mechanism are sponsor deposits: they place tokens into a contract, creating Resource Locks represented in ERC-6909 format. These locks remain under sponsors’ control but can back multiple Compacts—verifiable commitments with specified conditions under which other participants can access the assets.

What else to read?

Discussed with “Party of the Dead” MP Maksim Evstropov how necroeconomics differs from the economics of the living, how the Proof-of-Death algorithm works, and why capitalism has a distinctly religious character.

We broke down how Plasma, a platform purpose-built for stablecoins, works.

In the regular digest we collected the week’s main cybersecurity events.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!