Week in Review: Bitcoin tops $27,000 as US regulators rescue SVB and Signature Bank depositors

Bitcoin prices crossed the $27,000 mark, US regulators rescued the depositors of Silicon Valley Bank (SVB) and Signature Bank, the Arbitrum team announced an ARB token airdrop, and other events from the past week.

Bitcoin climbs above $27,000 amid troubles in the US banking sector

In the night to Monday, March 13, the price of the first cryptocurrency rose sharply from $20,200 to levels above $22,500.

After the US market opened there was a significant sell-off in the banking sector. Bitcoin reacted by rising above $24,000.

On Tuesday, March 14, the digital gold continued its recovery, breaching the $26,000 threshold. On Friday, March 17, Bitcoin surpassed the $27,000 mark.

At the time of writing the asset was trading at $27,200, up 33.4% for the week.

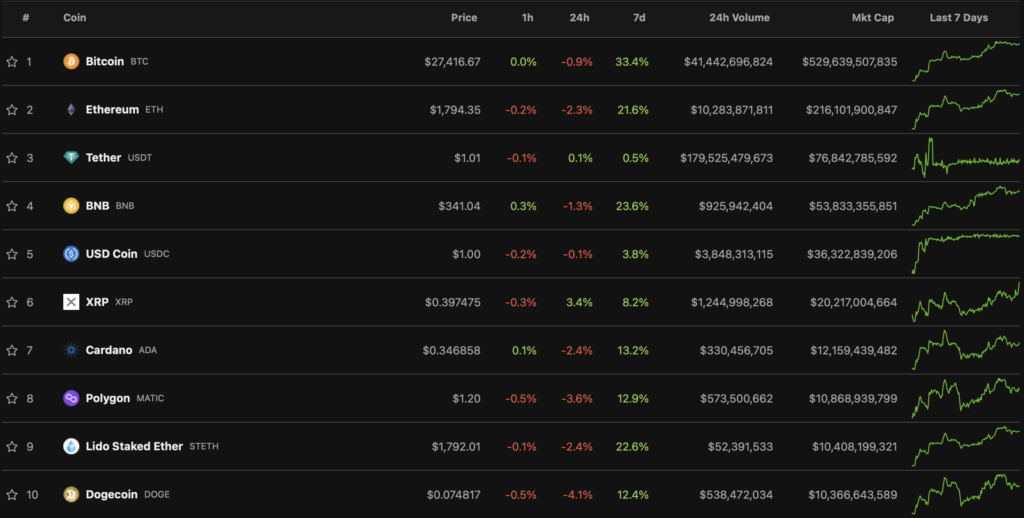

Following Bitcoin, all top-10 cryptocurrencies by market cap moved into the green zone. According to CoinGecko, the biggest weekly gainers were BNB (+23.6%) and Ethereum (+21.6%).

The aggregate market capitalisation of cryptocurrencies surpassed $1.2 trillion.

US rescue of SVB and Signature Bank depositors. Stablecoins retrace depegging

On March 10 the California Department of Financial Protection and Innovation closed SVB and appointed the FDIC as receiver. Regulators argued the move was necessary to bolster confidence in the banking system amid a sharp decline in the capitalisation of regional lenders.

On March 12 the US Treasury, Fed and FDIC announced a rescue of SVB and Signature Bank. Depositors received access to their funds from March 13.

Measures also affected Signature Bank. The latter, along with Silvergate, has been a pillar for participants in the crypto industry, prompting concerns in the community about a cascading effect among banks friendly to digital assets and liquidity difficulties.

The founder of Tron, Justin Sun stated his willingness to back the initiative to create a bank for the industry. US-based OKCoin temporarily stopped taking dollar deposits.

Circle gained access to SVB deposits totaling $3.3 billion

The issuer of USDC, Circle, gained access to deposits of $3.3 billion at SVB, its CEO Jeremy Allaire said. He noted the irony of a traditional bank harming the crypto economy, not the other way around as regulators had suggested. Allaire also said the company moved its existing reserves to a “safe custody” arrangement with Bank of New York Mellon.

The measures brought USDC back to its peg of $1. According to Arkham, since March 10 Circle redeemed about 6.2 billion tokens and issued about 1.66 billion USDC. Therefore the supply of the stablecoin declined by 4.5 billion USDC. In this context USDT by market capitalisation has roughly overtaken USDC.

Arbitrum team announced ARB token airdrop

The Arbitrum team planned on March 23 an airdrop with a subsequent transition to a decentralised governance model. The first stage includes a distribution of 12.75% of the total supply.

Ethereum developers activated Shapella hard fork on the Goerli testnet and set date for mainnet update

The Ethereum team conducted the Shanghai-Capella (Shapella) hard fork on the Goerli testnet. According to developers, it will be the last test before activation on the mainnet. Its main aim is to enable withdrawals of ETH from staking.

The long-awaited mainnet upgrade is scheduled for April 12 (epoch 620,9536). The liquid staking platform Lido Finance plans to open redemption of stETH for the “original” cryptocurrency in mid-May 2023.

Euler Finance hacked for $196 million

On March 13 the DeFi protocol Euler Finance was hacked. The damage amounted to more than $196 million. The hacker exploited a vulnerability in the flash-loan mechanism on the platform, despite numerous audits. The Euler team blocked the vulnerable module.

The team proposed a bounty for the return of assets, and later set a $1 million reward for information about the attacker. By the end of the week it emerged that one of the wallets connected to another hack — Ronin Finance for $625 million. It is linked to the North Korean Lazarus group.

Notably, of the 1,800 ETH sent to the Tornado Cash mixer, 100 ETH landed at the address of one of the victims, who signed a transaction to the hacker’s address asking to return “all his savings” — 78 ETH.

What to discuss with friends?

- PeopleDAO was robbed of $120,000 in Ethereum via a Google Sheet.

- An NFT community will host a trip to Japan to meet the Dogecoin mascot.

- OpenAI unveiled the multimodal GPT-4 model. The algorithm identified a vulnerability in an Ethereum-based smart contract.

- Playboy reported a $4.9 million loss from its Ethereum NFT collection.

US and German authorities seized servers of the chipmixer cryptocurrency mixer

German and US authorities, with the support of Belgium, Poland and Switzerland, shut down the ChipMixer infrastructure, Europol said. In the course of the investigation law enforcement seized 1,909.4 BTC valued at €44.2 million ($46.3 million), and seized four servers and 7 TB of data.

Sam Bankman-Fried seeks to use D&O insurance to pay his lawyers’

bills

The former FTX chief Sam Bankman-Fried (SBF) wished to use directors and officers (D&O) insurance to pay the lawyers’ bills. Granting this request would give him an advantage in payouts relative to other users.

Meanwhile, FTX released a new court filing stating that the so-called inner circle of the ex-CEO received $3.2 billion in payments and loans. Most of this sum came from Alameda Research, the sister company to the bankrupt exchange. Its former head Caroline Ellison received only $6 million, while SBF received $2.2 billion.

This week several YouTube bloggers faced a $1 billion class action for “active promotion” of the collapsed exchange.

Binance will suspend hryvnia purchases via Settlepay and Advcash, and pound purchases via Paysafe

From March 21 Binance will limit transactions with hryvnia through Settlepay and Advcash fiat gateways. The move is part of a crackdown on the gambling industry that has touched crypto exchanges, the company said. It added that users can use the P2P service.

Binance also restricted deposits and withdrawals in pounds sterling for new users from March 13. The company’s payments partner Paysafe cited the UK’s complex regulatory framework for cryptocurrencies.

Report: Moscow City exchangers help cashing out USDT in the UK

Several crypto platforms operating in the Moscow City office complex offer anonymous cross-border transfers, including to the United Kingdom, according to Transparency International Russia.

According to experts, Moscow City houses 21 crypto companies. Fourteen of them are over-the-counter brokers exchanging rubles for USDT. Eight platforms exchange the stablecoin for pounds with cash-out in London.

Bitcoin mining difficulty hits new all-time high

As a result of another recalculation, Bitcoin mining difficulty rose by 1.16%. The metric set a new all-time high at 43.55 T. The network’s average hash rate stands at 315 EH/s.

Also read

- The Uniswap team deployed the third version of the protocol on the BNB Chain.

- Halborn warned of a serious vulnerability in Dogecoin and 280 other projects.

- Unstoppable Domains launched a domain-name service on the Polygon network.

- Meta will discontinue NFT projects and cut 10,000 jobs.

MetaMask fixes privacy issue linked to account merging

MetaMask developers, in the latest update, removed automatic merging of all accounts when a non-custodial wallet interacts with dapps. Now, when connecting to decentralized applications, accounts will be separated — they will be supported on separate browser tabs.

The update provided options to limit the data sent to external services, and to switch the RPC provider from Infura by default. Infura is owned by ConsenSys, which also owns MetaMask.

Also read

The ForkLog AI editorial team looked into why AI tokens are needed and the risks of investing in hype projects.

In traditional digests they gathered the main weekly events in cyber security and artificial intelligence.

The cryptocurrency industry is attracting more institutional players. This is reflected in new investments in infrastructure and the growing attention companies pay to Bitcoin as an asset class. The most important events of recent weeks are in the ForkLog overview.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!