Week in review: bitcoin’s fresh correction and record volumes in Russia’s crypto market

Bitcoin dips below $104k; Russia tops Europe by crypto volume; Bitcoin Core v30 stirs debate.

The price of digital gold dipped below $104,000; Russia’s crypto market led Europe by volume; a contentious Bitcoin Core update landed; and more from the week.

Bitcoin and the market — another pullback

At the start of the week the price of the first cryptocurrency continued to recover from the 11 October sell-off. It held above $115,000 before sliding.

The pullback sharply accelerated on Friday, 17 October, amid mass liquidations — mostly of long positions. The price of digital gold fell below $104,000.

As usual, the flagship’s drop dragged the market lower, with leading altcoins suffering steeper declines.

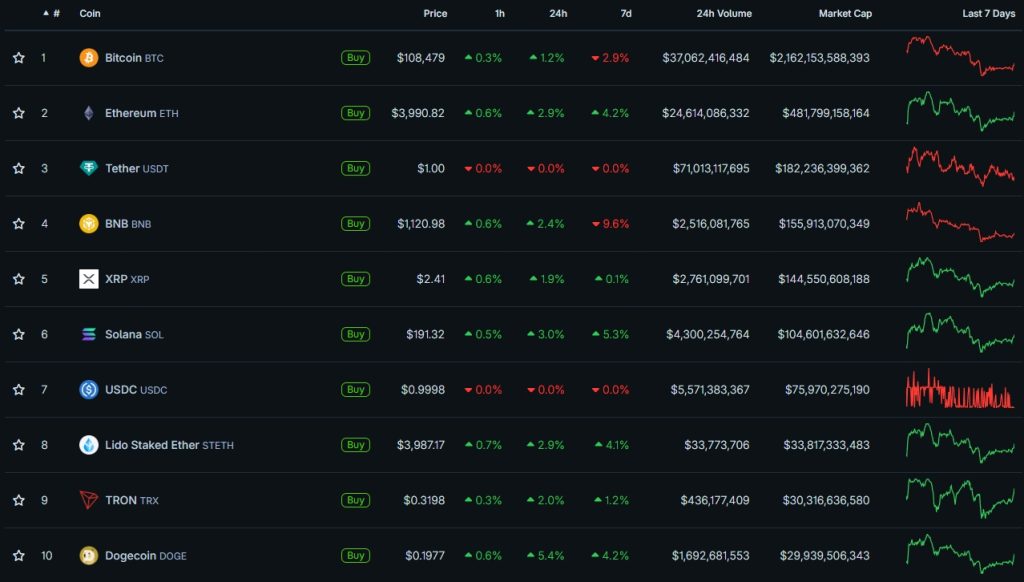

A rebound lifted bitcoin back to about ~$108,500. Over a volatile week, digital gold fell 2.9%.

Most other top-10 coins ended the period in the green. Solana rose 5.3%, Ethereum — 4.2%.

BNB was the outlier, down 9.6%. Negative headlines around Binance may have weighed on the token. The community accused the exchange of selling listings to crypto projects; media reported that France’s regulator had opened a probe into the platform.

Total market capitalisation slipped from $3.9trn to $3.8trn; bitcoin’s dominance eased to 57%.

The Crypto Fear and Greed Index failed to exit negative territory. A reading of 29 signals fear in the market.

Chainalysis: Russia’s crypto market hit a record $376bn

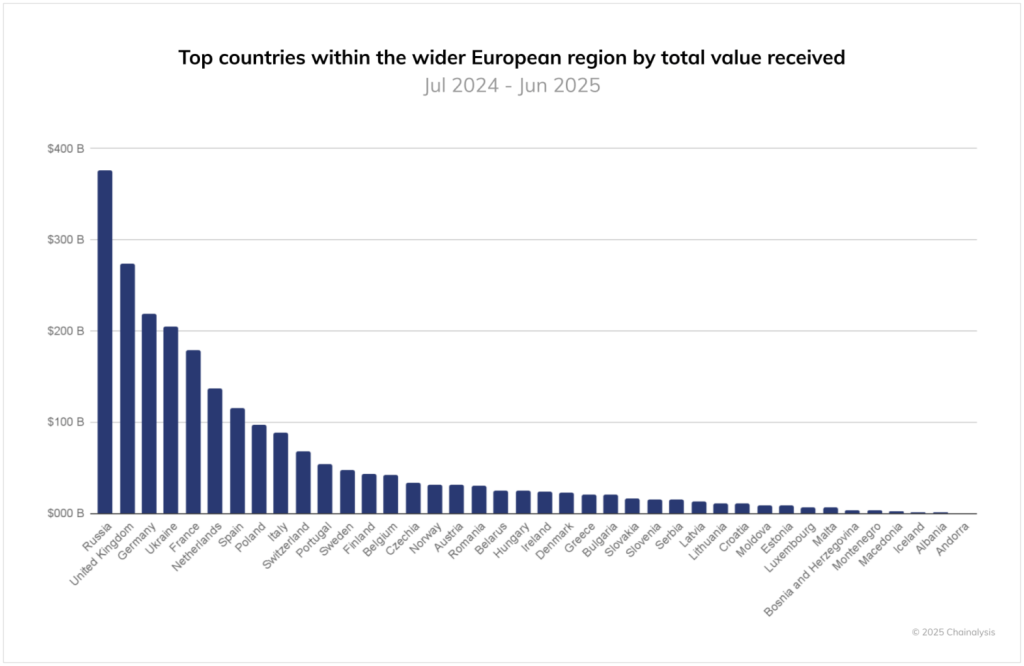

From July 2024 to June 2025, Russia’s crypto-market volume reached $376bn, putting the country first among European nations, the Chainalysis report says.

Britain, traditionally in top spot, slipped to second with $273.2bn. Germany ($219.4bn), Ukraine ($206.3bn) and France ($180.1bn) rounded out the top five.

Analysts also recorded a record rise in crypto-transaction volumes attributable to Russia, reaching $379.3bn.

A key driver was more large institutional transfers. Transactions over $10m jumped 86%, nearly twice the European average.

What to discuss with friends?

- Paxos mistakenly minted 300 trillion PYUSD.

- Study: politeness reduces the accuracy of AI responses.

- Hyperliquid’s co-founder suggested liquidation volumes on CEXs may be understated by 100x.

- Google developed an AI model for cancer treatment.

Developers released a contentious Bitcoin Core update

The Bitcoin Core team released client version v30, prompting a mixed reaction from the community.

All previous builds are deemed “final” and will no longer receive updates.

Version v30 includes bug fixes, changes to base fee rates, and improvements to performance and mining interaction.

The key change is a bump in the data-carrier limit in OP_RETURN outputs from 80 to 100,000 bytes. That will greatly increase the scope for non-financial transactions on the network. Users can still set a manual cap via the -datacarriersize option.

The proposal to lift the limit was submitted in April by bitcoin developer Peter Todd.

The initiative split the community. Opponents argue it encourages non-financial uses that bloat and congest the blockchain. Another concern is the potential spread of illegal content, for which node operators could face criminal liability.

Proponents counter that users will find other ways to post arbitrary data anyway, and miners have both the ability and the incentives to include such transactions in blocks.

Since the Bitcoin Core team announced in June that v30 would lift the limit, the client’s market share has fallen from 88% to 78%. The beneficiary has been the rival Bitcoin Knots, which offers stricter filters. More than 21% of nodes now run it.

Tether unveils open-source wallet development kit

Tether, issuer of the most popular stablecoin USDT, unveiled an open-source wallet development kit (WDK).

According to the company’s website, the toolkit is “built for people, machines and AI agents.” Multi-chain wallets can be integrated into any device — “from the smallest embedded systems to mobile, desktop and server platforms”.

Developers argue that non-custodial wallets are the foundation of a free and open financial system. They “create a resilient infrastructure, immune to interference or control by centralized entities”.

With WDK’s open source, anyone can build “their own independent, secure, permissionless solutions”.

Also on ForkLog:

- Gold’s market capitalisation reached $30trn for the first time.

- OpenSea is overhauling its business and will issue a token.

- Canaan unveiled a green mining solution. The firm’s shares jumped 40%.

- DEX aggregator Jupiter introduced the Ultra v3 protocol.

Ethereum developers successfully deployed Fusaka on the Sepolia testnet

On 14 October a test version of Ethereum’s major upgrade, Fusaka, was successfully deployed on Sepolia.

Activation took 20 minutes, according to reports.

The next step is testing the upgrade on Hoodi — scheduled for 28 October. On 3 December the hard fork will be deployed on the mainnet of the second-largest cryptocurrency.

Fusaka’s main goal is to improve Ethereum’s scalability and efficiency. The key change is introducing the PeerDAS protocol (EIP-7594). It is expected to double network throughput.

What else to read?

We recalled in a new piece in the “Silicon Tanks” series how hacker Richard Stallman sparked a revolution in software freedom by creating copyleft licences. The concept was recently endorsed by Ethereum co-founder Vitalik Buterin.

In our series on the Global South, we examined the digital paradox faced by Indonesia, the world’s fourth-most-populous country, whose chief asset is its young generation.

In the regular digest we rounded up the week’s main cybersecurity events.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!