Week in review: DeepSeek shock, Fed hold and US tariffs

China’s DeepSeek startled markets, the Fed kept its key rate unchanged, US tariffs triggered a bitcoin correction, mining difficulty eased, and other highlights from the week.

Rates and ‘trade wars’

It was a choppy, highly volatile week in crypto. Monday opened with a pullback: bitcoin plunged from $105,000 to $99,700, dragging other digital assets with it.

Analysts linked the decline to profit-taking amid President Donald Trump’s regulatory initiative to create a cryptocurrency task force.

The first half of the week saw the asset recoup losses, briefly topping $105,000 on 30 January after the Fed meeting.

The regulator kept the target range for the policy rate at 4.25–4.5% per annum, in line with expectations. Chair Jerome Powell noted the possibility of US banks engaging with cryptocurrencies provided risks are properly managed.

However, the Fed considers inflation still far from the 2% target.

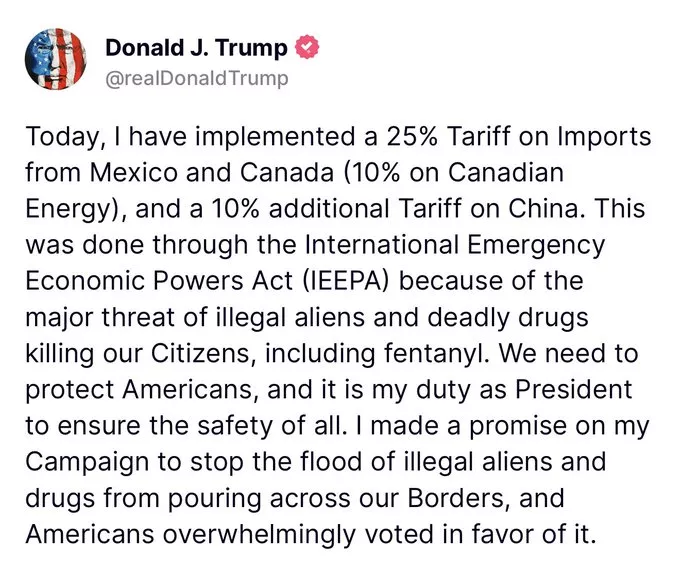

The post-meeting bounce proved short-lived: on Friday bitcoin began another swift slide. The market was further unsettled by Trump’s decision to impose tariffs on goods from Canada, Mexico and China.

Equities had yet to react to the “trade wars”, but on Sunday digital gold slipped below $100,000. Daily liquidations in crypto exceeded $500m.

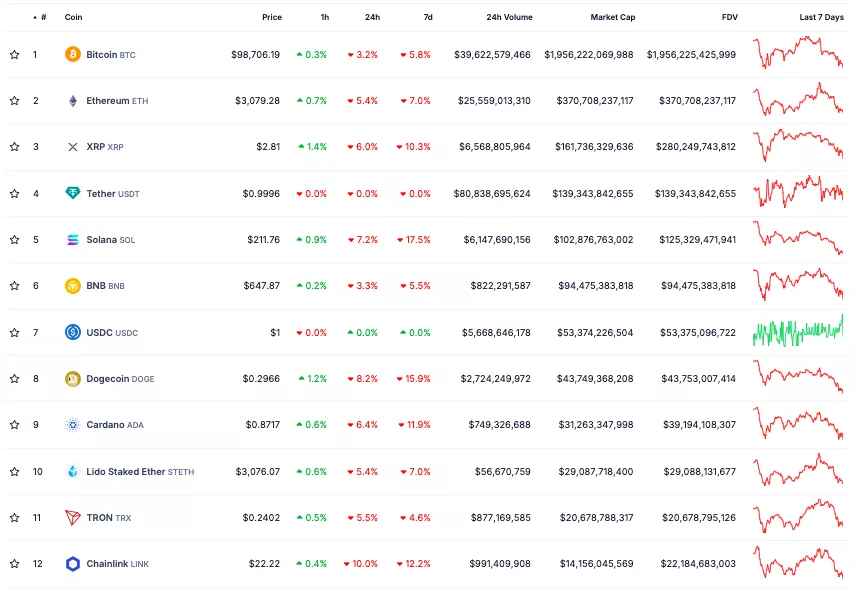

Other top-ten assets by market capitalisation were also in the red. Ethereum fell below $3,100, losing 7% on the week.

Solana shed 17.5%, Dogecoin 15.9% and XRP 10.3%.

Total crypto market capitalisation stands at $3.53trn (-5.6%).

Bitcoin’s dominance is 56.5%; Ethereum’s is 10.7%.

Chinese AI rattles markets

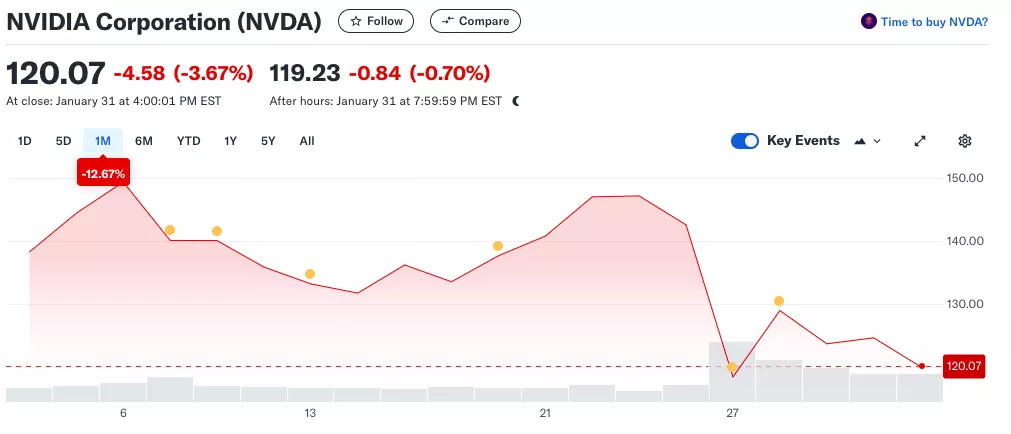

On 20 January the Chinese AI start-up DeepSeek released an open-source reasoning model, DeepSeek-R1. Over the past weekend the model drew strong attention, prompting sell-offs in equities and crypto at the start of the week.

The chatbot quickly climbed the US App Store’s free-app rankings, overtaking even ChatGPT.

The main reason for the frenzy is cost. Only $5.6m was spent on developing DeepSeek, compared with hundreds of millions for American rivals. The product also needs far fewer graphics processors and can run on gaming GPU.

In several tests the Chinese model outperformed the latest Llama 3.1, GPT-4o and Claude Sonnet 3.5. Independent specialists assessed accuracy, problem-solving, mathematics and programming.

DeepSeek also surprised observers by apparently bypassing US export restrictions. Even Telegram founder Pavel Durov drew attention to the app.

The chatbot’s success triggered a sell-off in the tech sector, including Nvidia. The chipmaker’s shares fell 15% over the trading week.

Crypto also corrected, particularly AI-linked tokens — down 21% over seven days.

Despite the blow, DeepSeek spurred companies to accelerate. On 28 January Alibaba unveiled a “DeepSeek killer”, and OpenAI added the o3-mini model to ChatGPT.

The hype around DeepSeek did not come without scandal. First, the company was suspected of stealing data from OpenAI; later, researchers found a leak of user data from the app.

The model is also criticised for traditional Chinese censorship.

Mining difficulty freezes

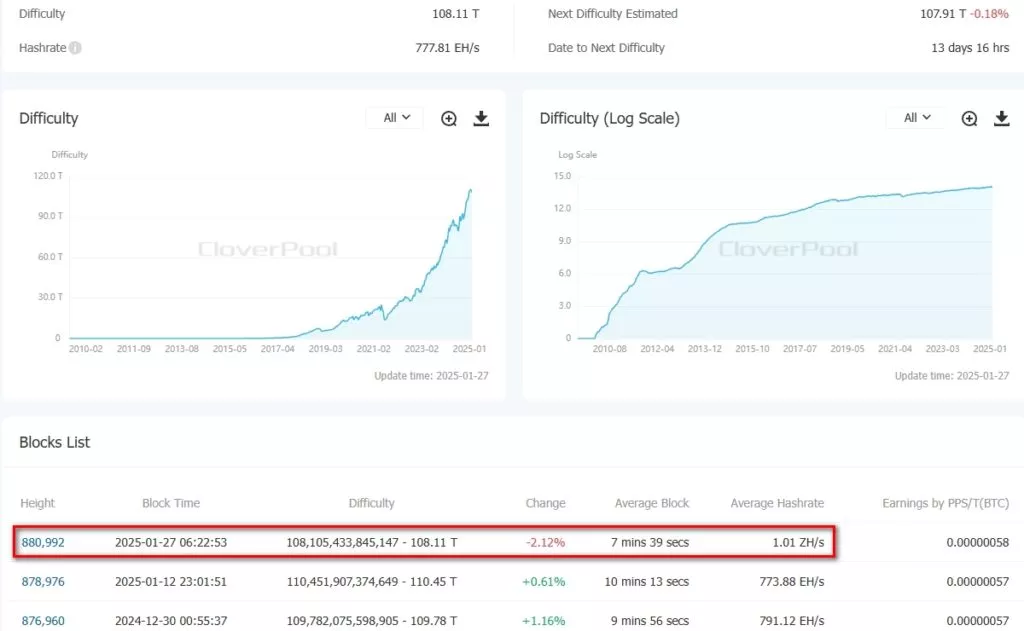

On 27 January, after the latest adjustment, bitcoin’s mining difficulty fell by 2.12%.

The metric eased to 108.11 T from the earlier peak of 110.45 T. This was the first decline since September 2024.

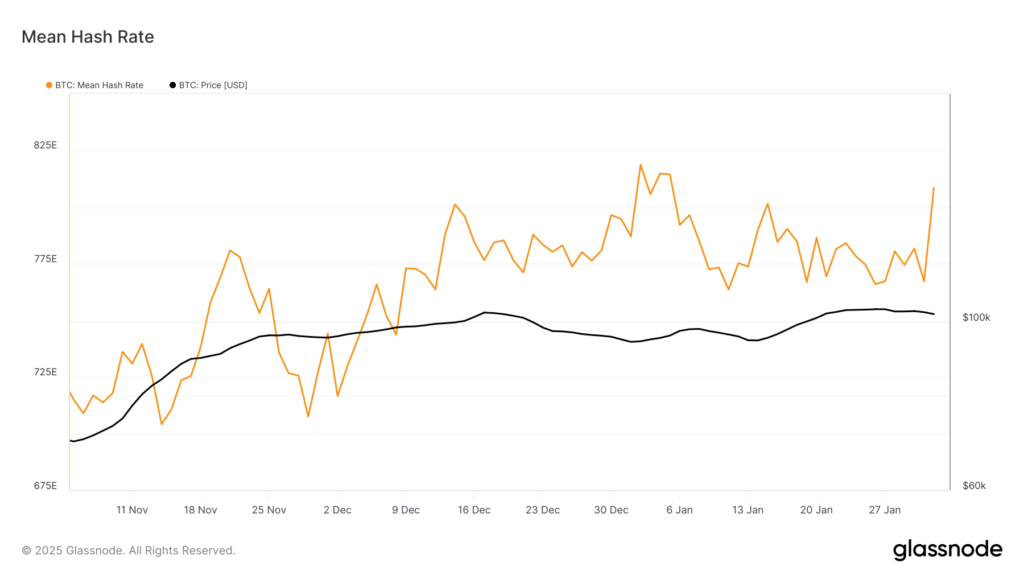

According to Glassnode, on 2 January the hash rate (seven-day moving average) reached a high of 818.7 EH/s. At the time of writing it stands at 808 EH/s.

The difficulty adjustment is attributed to bitcoin’s price drop and cold weather in the US. According to Luxor, lower temperatures in the south of the United States pushed up electricity prices, squeezing the profitability of digital-gold mining.

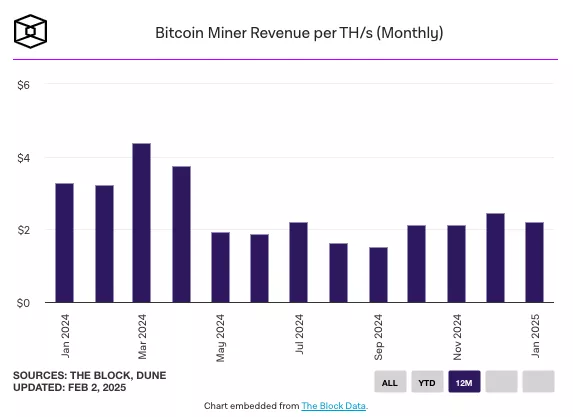

Amid the weather-related disruption, miners’ revenue fell from $2.46 per TH/s in December to $2.19 per TH/s in January.

Luxor regards the drop in difficulty and miner revenues as temporary, expecting metrics to resume rising once conditions improve in the United States.

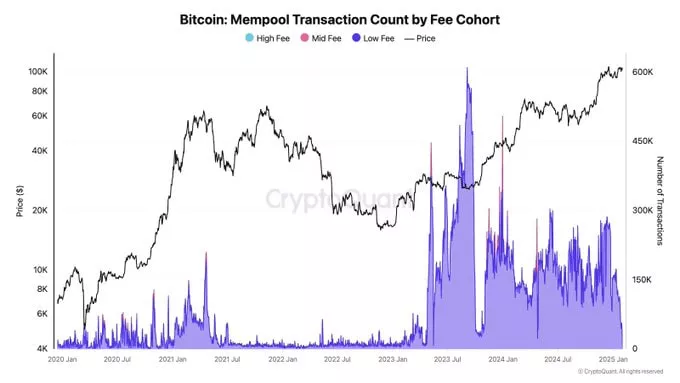

Meanwhile, CryptoQuant’s head of research Julio Moreno noted that bitcoin’s mempool is almost empty and fees are around 1 sat/vB. Transaction activity on the network has fallen to March 2024 levels.

What to discuss with friends?

- Uniswap Labs launched Uniswap v4.

- Ethereum developers patched a vulnerability in the most popular client.

- Changpeng Zhao spoke about Ethereum’s prospects and the reasons for Solana’s surge.

- Standard Chartered urged buying bitcoin on dips.

A bitcoin reserve in the Czech Republic

This week Aleš Michl, head of the Czech National Bank (CNB), proposed to the board the option of diversifying the state reserve by investing in the first cryptocurrency.

The initiative envisages allocating up to 5% of the €140bn reserves to digital gold, acknowledging the asset’s growing global appeal.

“If I compare my point of view with other bankers, I am a jungle explorer or a pioneer. I used to manage an investment fund, so I am a typical investment banker. I would say I like the profitability [of bitcoin],” noted the head of CNB.

At the same time, Michl did not rule out that investments in cryptocurrency could turn out to be useless, recalling the cases of Enron and Wirecard.

According to the regulator’s calculations, had the CNB held 5% of foreign reserves in bitcoin over the past decade, its annual return would have been 3.5 percentage points higher, with volatility doubling.

Later, the Central Bank of the Czech Republic approved a proposal to analyse possibilities for investing in additional asset classes, including bitcoin. Based on the findings, the CNB will decide on next steps.

Exchange troubles

Over the past week several centralised crypto exchanges (CEX) ran into difficulties. On Tuesday reports emerged of the start of an investigation by French law enforcement into Binance.

The platform is accused of money laundering, tax fraud, illegal drug trafficking and other unlawful activity. Later, the Office for Combating Economic and Financial Crime at the Paris Prosecutor’s Office clarified that it is examining possible offences from 2019 to 2024.

“Binance fully denies the accusations and will vigorously fight any charges brought against it,” said a Binance representative.

It also emerged that the SEC won a partial victory in its case against Kraken. California judge William Orrick dismissed one of the defence’s arguments concerning the major-questions doctrine.

At the same time, the judge found merit in Kraken’s arguments about not receiving “fair notice” from the regulator of a violation of the law. The exchange has been litigating with the regulator since 2023 over allegations of offering unregistered securities in the form of digital tokens on its platform.

Meanwhile, KuCoin admitted operating an unlicensed money-transmission business in the US and agreed to pay nearly $300m in fines and restitution.

The week’s last high-profile setback among CEX was the closure of Ukrainian crypto exchange Kuna. Its founder, Mikhail Chobanyan, decided to wind down the company’s operations in all countries.

Users were given two months to withdraw funds.

Before that, Ukraine’s State Service of Special Communications blocked the exchange’s domain under a decision by Kyiv’s Shevchenkivskyi District Court at the request of the Bureau of Economic Security. According to Chobanyan, the essence of the claim is allegations of tax non-payment.

“What taxes, on what — I do not yet know, but we will definitely find out. I am curious by what formula and from which specific activity they calculated the shortfall,” said the founder of the exchange.

Also on ForkLog:

- Glassnode compared the current and previous bitcoin bull runs.

- Rising interest in DeFi led to a 37% jump in active Ethereum addresses.

- Meta will maintain high AI spending.

- Cointelegraph forecasts: bitcoin at $150,000, altcoins at $3trn and DEX volumes above $4trn.

What else to read?

In a new piece we examined how the decentralised-science ecosystem will develop in 2025.

Our regular digest gathered the week’s main events in cybersecurity.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!