Week in Review: Ethereum-ETF Launch and Bitcoin 2024 Conference

The week saw the launch of spot Ethereum-ETFs, Russia’s decision against banning cryptocurrency circulation, Trump’s promise to fire the SEC head and make the US the “crypto capital of the world,” among other events.

Bitcoin Fails to Hold Above $69,000

The leading cryptocurrency began the week at $68,000. On Monday, July 22, the digital gold’s price fell below $67,000, and the next day it dropped past $66,000.

On Thursday, July 25, Bitcoin fell to $64,000 but soon began to recover. On Saturday, July 27, the cryptocurrency surged above $69,000 before plummeting again.

At the time of writing, digital gold is trading at $67,700.

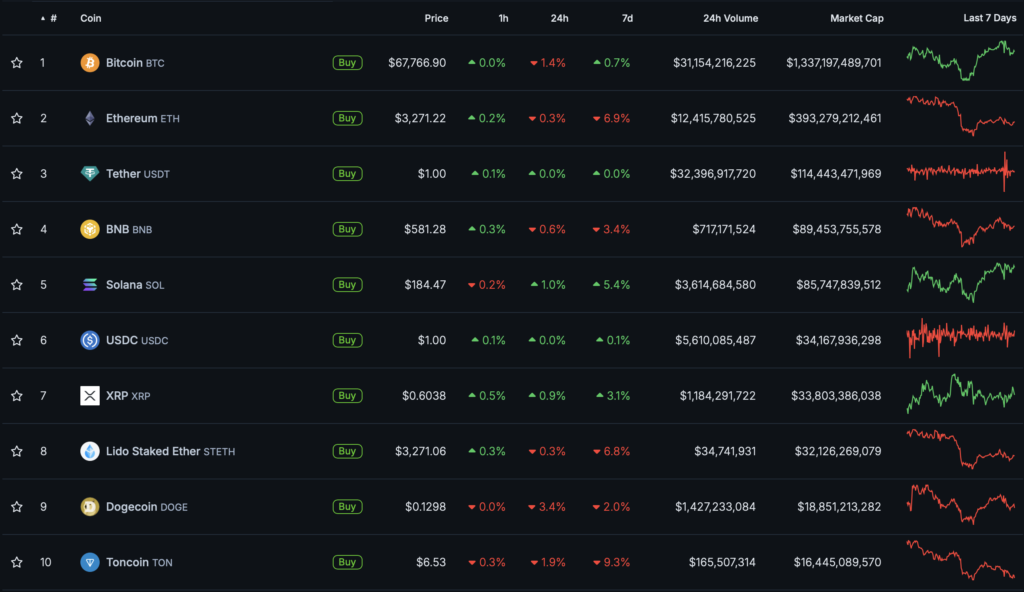

Most digital assets in the top 10 by market capitalization ended the week in the “red zone.” Toncoin lost the most (-9.3%), followed by Ethereum (-6.9%).

The total cryptocurrency market capitalization stands at $2.52 trillion. Bitcoin’s dominance index is 56.5%.

Spot Ethereum-ETF Trading Begins

On July 23, trading of spot Ethereum-ETFs commenced. On the first day post-listing, the products recorded a trading volume of approximately $1.08 billion—23% of the trading volume of Bitcoin-based ETFs for the same period.

The highest volumes were recorded by Grayscale Ethereum Trust (ETHE) and BlackRock iShares Ethereum Trust (ETHA) at $458 million and $248.7 million, respectively. Fidelity Ethereum Fund (FETH) and Bitwise Ethereum ETF (ETHW) rounded out the top four with $137.2 million and $94.3 million, while the product from 21Shares (CETH) did not surpass the $10 million mark.

Following the launch of spot Ethereum funds, Bitcoin-based instruments saw an outflow of $77.8 million for the first time in 12 days of trading.

The launch of these instruments had a minor impact on Ethereum’s price. At the time of writing, the asset is trading at $3270, having declined by 6.9% over the week, according to CoinGecko.

Russia Drops Ban on Cryptocurrency Circulation

On July 25, the Russian State Duma’s Financial Market Committee introduced amendments to the second reading of a mining bill, removing the ban on organizing cryptocurrency circulation. This was announced by Deputy Anton Gorelkin.

The provision had excluded the possibility of creating exchanges and exchangers outside the scope of experimental legal regimes (ELR). According to Gorelkin, the current version raised significant concerns among industry representatives.

Another contentious point—the ban on advertising digital currencies—remains, but it will be included in corresponding amendments to the Federal Law “On Advertising.”

The State Duma’s Energy Committee expressed concerns about “black” mining and the inefficacy of combating it through electricity consumption limits outlined in the bill. However, the proposal to completely ban individuals from mining cryptocurrencies did not pass.

Simultaneously, the meeting recommended passing the accompanying ELR bill in the second reading, which legalizes the use of cryptocurrencies for cross-border settlements.

Topics to Discuss with Friends

- The number of Telegram users nears 1 billion thanks to “tapalkas.”

- Gurinovich commented on ties with Hamster Kombat.

- Pavel Durov reported on developers of Catizen rescuing cats.

- A meme coin linked to Kamala Harris hit a new ATH.

Trump Vows to Fire SEC Head and Make US “Crypto Capital of the World”

During a speech at the annual Bitcoin 2024 conference in Nashville, US presidential candidate Donald Trump promised to fire SEC head Gary Gensler if elected and to create a strategic Bitcoin reserve.

The politician also stated he would not allow the sale of any of the 213,239 BTC confiscated by authorities, valued at $14.8 billion, which are held in US government wallets, according to Arkham.

“It will be the policy of my administration to retain 100% of all bitcoins that the US government currently holds or acquires in the future. […] This will serve as the core for a strategic national reserve,” Trump emphasized.

The Republican candidate promised to end the war on digital assets if elected. He claimed the US would become the cryptocurrency capital of the world.

Trump expressed respect for the Bitcoin community and compared the crypto industry to the steel industry 100 years ago. He also supported the mining and stablecoin sectors.

“If we don’t embrace cryptocurrency and Bitcoin technology, China and other countries will. They will dominate, and we cannot allow China to dominate,” the politician said.

Among other things, he reaffirmed his previous promises to commute the sentence of Silk Road founder Ross Ulbricht and release him, as well as to prevent the creation of a CBDC.

US Senator Cynthia Lummis announced a bill calling for the creation of a strategic Bitcoin reserve during her speech at the same conference. She will present it next week.

The document proposes the US Treasury purchase 1 million BTC over five years. According to Lummis, the country will hold Bitcoin for at least 20 years.

“Bitcoin is a great store of value. Over the past four years or so, it has grown by about 55% annually. During the same period, the US dollar has lost value, and we are seeing inflation rise,” the senator explained.

Lummis emphasized that the US could free itself from debt with Bitcoin.

Michael Saylor Predicts Bitcoin at $13 Million by 2045

The price of the leading cryptocurrency will reach $13 million by 2045, according to MicroStrategy founder Michael Saylor during his speech at the Bitcoin 2024 conference.

He stated that with Bitcoin’s current price around $65,000, its market capitalization is $1.3 trillion—just 0.1% of global wealth. With an annual return of about 29%, digital gold will reach $280 trillion and 7% by 2045.

Saylor provided an average outcome. His bullish forecast is Bitcoin at $49 million and 22% of global wealth, while the bearish scenario is $3 million and 2%, respectively.

The MicroStrategy founder urged the conference audience to become Bitcoin maximalists: buy the leading cryptocurrency, convert all assets into it, and move to a low-tax jurisdiction to invest saved funds in digital gold.

Edward Snowden Highlights Bitcoin Privacy Issues

During his speech at the Bitcoin 2024 conference, former NSA and CIA employee Edward Snowden urged American voters to remain critical and not trust politicians.

He noted that political figures and parties have their own interests, so it’s important to “cast a vote but not join a cult.”

Snowden expressed serious concerns about the privacy issues of the leading cryptocurrency. He reminded that Bitcoin transactions are not fully anonymous, despite common misconceptions, as they can be traced to specific individuals.

“They know what you read, what you buy, who you send [Bitcoin] to, who you support politically, where your donations went—all of this is available to them. They can infer your thoughts and beliefs,” Snowden stated.

In his view, many lawmakers are trying to win the affection of the Bitcoin community.

“They are not our clan. They are not your identity. They have their own interests and values they pursue. Try to get what you need from them, but don’t give yourself to them, even if you have to vote for them,” Snowden added.

Also on ForkLog:

- A solo miner mined a Bitcoin block and earned ~$212,000.

- An unknown entity moved “sleeping” 11-year-old 53 BTC.

- Mt.Gox moved bitcoins worth $2.85 billion.

- Ethereum worth ~$288 million moved for the first time in seven years.

Robert Kiyosaki Predicts Bitcoin Surge After Trump’s Victory

Author of the bestseller “Rich Dad, Poor Dad” and entrepreneur Robert Kiyosaki believes that gold, silver, and the leading cryptocurrency will rise following Donald Trump’s potential victory in the US presidential election.

“Trump wants a weaker dollar so that America starts exporting more than importing. With a weaker national currency, jobs will return, and assets will increase in value,” the businessman is convinced.

In his view, the re-elected former president intends to “drill, drill, and drill oil.” As a result, fuel prices will fall, and consequently, the dollar will decline.

Kiyosaki claims that the current US President Joe Biden has done “the exact opposite” during his term—he reduced production and supply of “liquid gold,” raising the price from $30 to $130 per barrel.

“High oil prices caused massive inflation, destroying the poor and middle class. Then Biden had to tap into America’s oil reserves because there wasn’t enough oil. Biden is an idiot,” the entrepreneur stated.

What Else to Read?

This week, ForkLog explored changes in Ethereum’s economy following the Dencun hard fork and how Monad is structured.

In the traditional digest, we gathered the week’s main events in cybersecurity.

The cryptocurrency industry is attracting an increasing number of institutional players. This is evidenced by new infrastructure investments and the growing attention companies are paying to Bitcoin as an asset class. The most important events of recent weeks are in ForkLog’s review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!