Week in Review: Ethereum finalisation failure, and Bittrex files for bankruptcy

The Ethereum network experienced a finalisation failure, Bittrex filed for bankruptcy, Binance announced closures of operations in Canada, and other events of the week.

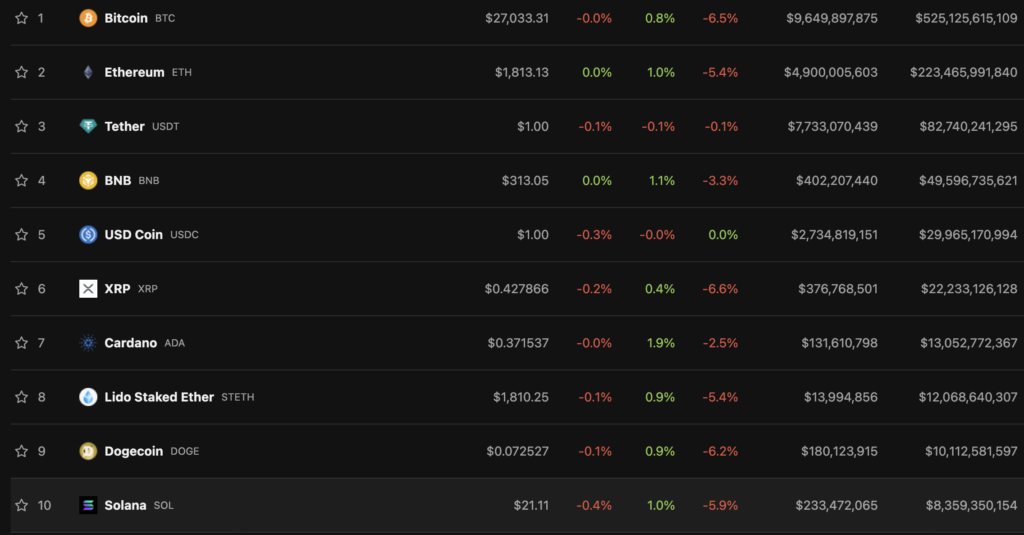

Bitcoin could not hold the $28,000 level

This week the US Bureau of Labor Statistics published inflation data. Year-on-year, in April its rise slowed from 5% to 4.9%, which was below the 5% forecast. On a month-on-month basis, price growth accelerated from 0.1% to 0.4%, in line with market expectations.

Against the backdrop of the May 10 report, Bitcoin price retested the $28,000 level, pushing daily gains to 1.3%.

At the time of writing, Bitcoin was trading a little above $27,000, and Ethereum was above the $1,810 level.

The top-10 cryptocurrencies by market cap closed the week in the red. XRP posted the worst performance, its price down 6.6%.

The total market capitalization of the cryptocurrency market stands at around $1.18 trillion. Bitcoin’s dominance index has fallen to 44.5%.

Binance to wind down Canadian operations amid tightening regulation

The cryptocurrency exchange Binance announced the winding down of its operations in Canada due to stricter requirements for trading platforms in the country.

Binance said it had postponed the decision in the hope of finding “prudent ways to protect” users, but could not. Local clients will receive emails with details on next steps.

On May 10, the company launched the Capital Connect service to facilitate connections between its VIP clients and investment fund managers. The exchange also said it would enable clients to trade Bitcoin-NFTs.

Earlier in the week, Binance said it would integrate the Lightning Network, a Bitcoin payment network, with the platform. The announcement came as withdrawals of the first cryptocurrency were paused due to a large volume of unconfirmed transactions.

Bittrex filed for bankruptcy protection

On May 8, the Bitcoin exchange Bittrex filed for bankruptcy protection in the state of Delaware, USA.

Two subsidiaries—Bittrex Malta Ltd. and Bittrex Malta Holdings Ltd.—also filed similar petitions. According to the documents, the bankruptcy will not affect the international platform Bittrex Global.

The company announced the bankruptcy less than a month after a lawsuit from the US Securities and Exchange Commission (SEC). The regulator accused Bittrex of operating an unregistered securities exchange.

This week the bankruptcy filing was also made by Everledger, the blockchain startup backed by tech giant Tencent. This followed a failed attempt to raise investments.

On March 31, Everledger staff received layoff notices. The external administrator was Vincents Chartered Accounts.

Ripple’s fight with the SEC costs $200 million

Ripple spent $200 million on legal costs in the case against the SEC, said CEO Brad Garlinghouse. He urged aspiring entrepreneurs to “not to start a business in the United States,” and asked the regulator to recognise that most people working in the industry are “honest professionals” who lack a structured set of rules.

Meanwhile, Marathon Digital reported another SEC subpoena. According to the document, the regulator is examining whether the company violated any provisions of federal securities laws.

Media: Jane Street and Jump Crypto will quit the US due to regulatory pressure

According to Bloomberg, two of the world’s largest market makers, Jane Street and Jump Trading will retreat from trading digital assets in the United States amid regulatory uncertainty. In the first case, this concerns shrinking crypto operations globally; in the second, in the US as activity expands in other jurisdictions.

Bloomberg noted that representatives of Jane Street and Jump Crypto were questioned by U.S. prosecutors as part of the Terra ecosystem collapse investigation. The latter market maker was a leading venture investor in Terraform Labs. Investigators did not bring charges.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried {{AOPEN__19}}asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causingtransactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to discuss with friends?

- Warren Buffett: Bitcoin has no chance of becoming a global reserve currency.

- Elon Musk pushed up Bitcoin sales with a post and announced his departure as CEO of Twitter.

- A traderpaid $120 000 in fees to buy the meme token FOUR.

- Binancewill launch a metaverse reality show Build The Block.

Worldcoin by Sam Altman released a zero-fee wallet

Worldcoin, Sam Altman’s crypto project, launched a “gasless” wallet for verified users. The new app, World App, is designed for iOS and Android.

The solution is built on the Polygon project and supports stablecoins USDC and DAI, as well as Ethereum, Worldcoin (WDC) and wrapped Bitcoin (WBTC).

Lido to start redeeming stETH after the release of the second version of the protocol

The Lido Finance announced the launch of the protocol’s v2 on May 15 after three days of voting on the proposal. Lido v2 will enable redemption of stETH for Ethereum.

Initially, around 270,000 ETH will be available in the platform’s treasury, enabling withdrawal requests without the lengthy exit of validators from the network.

Hong Kong authorities adopt a “hard” approach to cryptocurrency regulation

In Hong Kong, a hard approach to regulating the digital asset sector will be applied, said Eddie Yue, head of the local Monetary Authority, in an interview with Bloomberg.

From June 1, all centralized platforms doing business in the jurisdiction or dealing with local investors must be licensed by the Securities and Futures Commission. In addition, by 2024 authorities will introduce a mandatory licensing regime for stablecoins.

Bankman-Fried asks to drop some charges, and the IRS files claims totaling $44 billion against the FTX group

Lawyers for the founder of the collapsed exchange FTX, Sam Bankman-Fried asked the court to dismiss almost all charges, except the conspiracy to commit securities fraud, commodities fraud and money laundering. In the defense’s view, some counts are duplicative or relate to a single statute or arose after extradition.

Lawyers also argue that the company’s downfall was linked to the crypto-winter rather than to credit manipulation and the failure to support the native token FTT.

This week it emerged that the U.S. Internal Revenue Service (IRS) filed a series of lawsuits against FTX and its subsidiaries totalling $44 billion. The largest claims—$20.4 billion and $7.9 billion—pertain to Alameda Research LLC.

Tether posted $1.48 billion in net income in Q1

USDT issuer Tether Limited, in January–March recorded net income of $1.48 billion — a level twice that of the previous period.

As of March 31, 2023, the company’s assets stood at $81.8 billion, liabilities at $79.4 billion, equity at $2.44 billion. The latter figure was $960 million at the end of 2022.

Tether Limited disclosed it holds Bitcoin worth $1.5 billion and physical gold bars worth $3.39 billion. They represent 1.8% and 4.1% of total reserves respectively. The largest share of USDT collateral (84.7%) is kept in cash, cash equivalents and short-term deposits.

Meanwhile, the USDC issuer Circle revised the stablecoin’s collateral framework in favour of short-dated Treasuries to shield against potential US technical default.

There was a finalisation failure in the Ethereum network

On May 11, an unknown error occurred in the Ethereum blockchain causing transactions to fail to finalise for a period. The situation recurred on May 12.

The Prysm client developers announced an update that includes an optimisation to prevent high resource usage by nodes during periods of turbulence. The update is due to be released at the start of the week.

Also on ForkLog:

- The co-founder of Paxful shared plans to relaunch the P2P platform.

- Developer proposed to ban the BRC-20 tokens and Ordinals.

- Do Kwon did not admit guilt in forged documents.

- Arbitrum presented a plan to distribute tokens among ARB holders.

What to read next?

Traditional digests gather the week’s main events in cybersecurity and artificial intelligence.

The cryptocurrency industry is attracting an increasing number of institutional players. This is reflected in new investments in infrastructure and the growing attention that firms devote to Bitcoin as an asset class. The most important events of the recent weeks are in ForkLog’s overview.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!