Week in Review: Ethereum Moves to PoS and Seoul Court Issues Arrest Warrant for Do Kwon

Ethereum developers have shifted the blockchain to the Proof-of-Stake consensus algorithm; Bitcoin failed to hold above $22,000 amid US headlines; ForkLog launched a Ukrainian-language edition of the magazine, and other events marked the close of the week.

Bitcoin price rose above $22,000, then retraced to below $20,000

On September 12, Bitcoin prices updated their September high, testing the $22,800 level.

On Wednesday, September 14, after the US CPI report was released, the price of the leading cryptocurrency began falling. In the following days the asset found local support at $19,500.

At the time of writing, digital gold was trading near $19,700.

Bitcoin mining difficulty this week reached an all-time high.

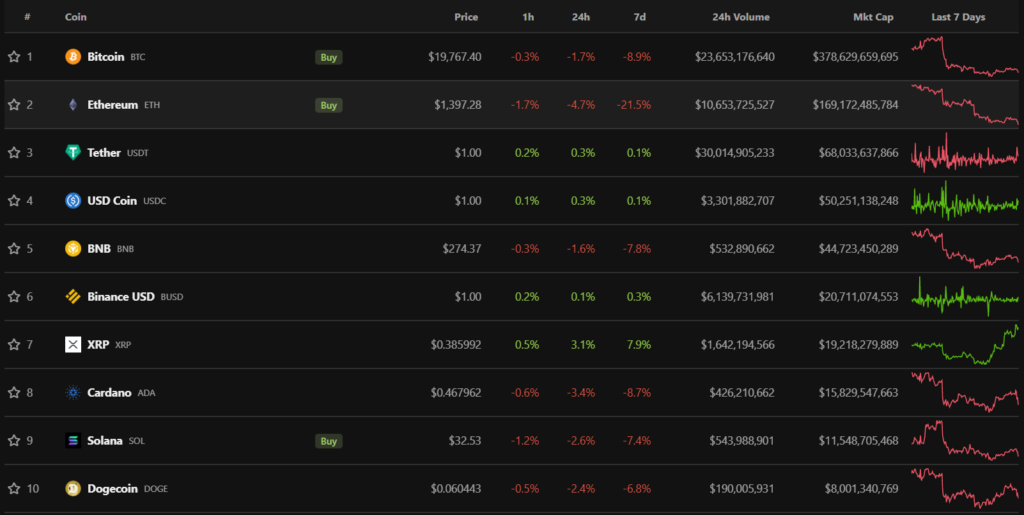

Nearly all top-10 assets by market cap closed the week in the red. The exception was XRP, whose quotes rose nearly 8% over the past seven days.

The total market capitalization of cryptocurrencies stood at $997.73 billion. Bitcoin’s dominance index rose to 37.9%.

The Merge activated in the Ethereum network. The blockchain moved to the PoS algorithm

On September 15 at 9:42 a.m. (Kyiv/Moscow time), developers activated the major The Merge upgrade on the Ethereum mainnet. The blockchain was successfully migrated to the Proof-of-Stake consensus algorithm. Validator participation surpassed 96%, with 66% of eligible validators, according to Nansen.

In the first block after the shift to PoS a user released an NFT, paying 36.8 ETH (~$58,700) in transaction fees. The last PoW block in the chain was #15 537 393. The mining pool F2Pool added a comment about it. Similarly, HashKey Capital documented the first PoS block.

Developers of the PoW fork of Ethereum announced the launch of mainnet within 24 hours after The Merge. A few hours after activation, the team published network identifiers. Support for the fork was announced by several platforms, including Binance, Bybit, FTX, Kraken and others.

Within a day after The Merge ETHW collapsed by 70%, and the network hashrate peaked at 100 TH/s, roughly 1/9 of Ethereum’s hash rate.

The main beneficiaries of miners’ migration were alternative PoW blockchains: Ethereum Classic (ETC), Ergo (ERG), Ravencoin (RVN) and others. ETC’s hashrate rose by 300%.

Analysts at Nansen noted that four platforms control more than 61% of Ethereum in staking.

Grayscale Investments stated that it would sell the ETHW obtained after the fork’s launch. The proceeds would be distributed among shareholders of the Ethereum Trust (ETHE) and the Digital Large Cap Fund (GDLC).

Grayscale expects to realise the cryptocurrency within 180 days of the initiative’s announcement. After the EthereumPoW fork, the ETHE trust held over 3 million ETHW, and the GDLC around 0.04 million ETHW.

Seoul court issues arrest warrant for Do Kwon

In Seoul, issued an arrest warrant for Terraform Labs chief Do Kwon and five others on charges including violations of the capital markets law. Prosecutors say the six defendants are in Singapore.

Later, the Seoul Southern District Prosecutors’ Office requested the revocation of the passports of five individuals, including Kwon.

On September 17 Reuters, citing Singapore police, reported that the Terraform Labs chief had left the city-state. A similar report was published by Lianhe Zaobao.

Do Kwon denied fleeing and said he was not evading government agencies, which he described as interested in communicating with him.

ForkLog launches Ukrainian-language edition of the magazine

The iconic ForkLog magazine has launched the Ukrainian edition of the publication. As ever, we will report daily on the most important and interesting news in the worlds of cryptocurrency, blockchain and Web3.

The Ukrainian community is growing rapidly, as is the popularity of digital currencies among citizens. Ukraine has for several years ranked among the world leaders in cryptocurrency adoption; President Volodymyr Zelensky signed the Virtual Assets Act, and Vitalik Buterin stated that the country has the potential to become a crypto hub.

We are committed to developing the Ukrainian crypto community and growing with it. In addition to Bitcoin industry news, ForkLog UA will cover topics of online privacy, artificial intelligence, metaverses, NFT markets and other sectors of the digital world.

Huobi will delist seven anonymous cryptocurrencies

On September 19 Huobi will delist seven privacy-focused coins.

The decision affects Dash (DASH), Decred (DCR), Firo (FIRO), Monero (XMR), Verge (XVG), Zcash (ZEC) and Horizen (ZEN). Trading of them will be halted on September 6, deposits disabled on September 12. Withdrawals remain available.

The Zcash developer Electric Coin Company criticised Huobi’s decision. The company said it remains open to dialogue with the exchange. They argued that ZEC is “fully compatible with global AML/CFT standards.”

What to discuss with friends?

- The resident of South Korea was sentenced to prison for harassment in the metaverse.

- Environmentalists decided to ‘nudge’ Bitcoin toward the PoS transition.

- On Twitter, a wave of The Merge scams appeared in Vitalik Buterin’s name.

- Ukrainian supermarkets VARUS began accepting cryptocurrencies.

U.S. outlines conditions for withdrawing assets from Tornado Cash addresses

The U.S. Department of the Treasury allowed users to withdraw digital assets from Tornado Cash addresses connected to the mixer. To do so, one must file an application for the corresponding OFAC license, providing detailed information about the transaction.

On Friday, September 16, the White House also presented a framework for regulating the crypto industry. Earlier President Joe Biden issued an executive order directing federal agencies to coordinate their oversight of the sector.

The framework faced criticism from members of the community. At the same time, Binance CEO Changpeng Zhao praised the administration’s efforts. In his words, a whole-of-government approach to crypto oversight would provide systematization and clarity of regulation.

Says Celsius CEO to revive the company

Celsius Network CEO Alex Mashinsky at a staff meeting voiced a plan to rescue the company from bankruptcy. The plan envisages Celsius focusing on crypto custody services and “charging fees for certain types of transactions.”

The new project is reportedly named Kelvin.

Opera Crypto Browser integrates MetaMask and other crypto wallets

Users of Opera can now choose the required wallet directly from the address bar using Wallet Selector. The feature automates switching between apps when exchanging tokens or transacting with dapps.

The company integrated domain names like ENS and a decentralized exchange PancakeSwap on the BNB Chain, and updated the mobile app.

Fidelity to offer Bitcoin trading to retail clients. Charles Schwab, Citadel and Fidelity to launch the EDX Markets crypto exchange

Earlier in the week, media reported that Fidelity would offer Bitcoin trading to retail clients of its brokerage division. Currently, a range of crypto ETFs and custodial and trading services for institutional clients are available.

At the same time, giants Charles Schwab, Citadel Securities and Fidelity Digital Assets, with backing from Paradigm, Sequoia Capital and Virtu Financial, are preparing to launch the EDX Markets exchange. The platform will serve both institutional and retail investors, according to the announcement.

Also on ForkLog:

- Dogecoin became the second-largest PoW cryptocurrency by market cap.

- The head of the SEC allowed Bitcoin and other PoS assets to be treated as securities after Ethereum’s migration.

- The market cap of Binance USD exceeded $20 billion.

- Changpeng Zhao assessed the EU crypto regulation bill.

What else to read?

Educational flashcards explain how to choose a bitcoin wallet and what the SOPR indicator is for. They explain the features of NEAR and Harmony, and recall the collapse of the Mt. Gox exchange.

In traditional digests, the main weekly events in cybersecurity and artificial intelligence are collected.

The crypto industry continues to attract more institutional players. This is reflected in new investments in infrastructure and the growing attention that companies give to Bitcoin as an asset class. The most important events of recent weeks are in the ForkLog overview.

Read ForkLog’s bitcoin news in our Telegram — news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!