Week in Review: Ethereum Tests $2,000 as Tornado Cash Is Sanctioned

Bitcoin rose above $25,000 but failed to hold the level; Ethereum tested $2,000, and the Tornado Cash mixer was added to the sanctions list by OFAC and other developments from the week.

Bitcoin rose above $25,000 but closed the week below the threshold

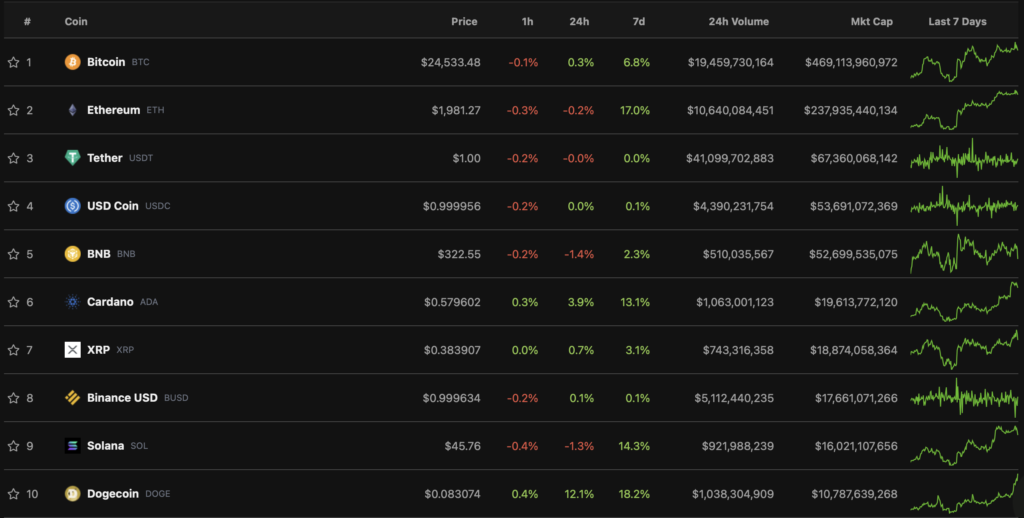

The first cryptocurrency finished the week below $25,000, although on 14 August intraday it превысила an important level. Over the past seven days the asset rose by 6.8%.

At the time of writing Bitcoin was trading around $24,500. The market capitalisation of digital gold stands at $469 bn, according to CoinGecko.

All top-10 by market capitalisation closed the week in the green. The best performers were Dogecoin (DOGE) and Ethereum (ETH) — their prices rose 18.2% and 17% respectively.

Galaxy Digital head Mike Novogratz forecasted that bitcoin would stay in a $20,000–$30,000 range due to the lack of meaningful inflows from institutional investors.

According to gold advocate Peter Schiff, the first cryptocurrency is more likely to continue falling to $10,000 and below than to reach new highs.

Ethereum final testnet moved to PoS and date for mainnet upgrade announced

On 13 August the price of Ethereum surpassed $2000 amid the transition of the Goerli testnet to the Proof-of-Stake consensus algorithm. According to a new announcement, The Merge is expected to take place around 15–16 September. The final date depends on the hashrate of the second-largest cryptocurrency.

The specifics regarding timing revived active discussions about miners’ fate. JPMorgan suggested they would need to seek alternative sources of income, and one of the main beneficiaries of the upgrade would be Ethereum Classic (ETC). In CoinShares called the possible PoW fork of Ethereum unviable due to the difficulty of migrating projects.

In the ETC community there were indeed doubts about the feasibility of the PoW version of Ethereum (ETHW). In an open letter, the ETC Cooperative noted the labouriousness and cost of developing the fork, as well as its subsequent recognition by major players in the sector.

In response, ETHW supporters stated their intention to roll back the burn mechanism introduced with EIP-1559. Later they called the fork inevitable — the project assembled a team of developers and even carried out the first important updates, as noted by the ETC Cooperative.

Tornado Cash under US sanctions

On 8 August OFAC placed on the sanctions list the Tornado Cash website, along with 39 Ethereum- and 6 USDC- addresses linked to it. The agency says the platform helped criminals launder $7 billion since 2019. In total, the blocked wallets hold $437 million in stablecoins, ETH and WBTC.

The story evolved quickly. Initially, stablecoin issuer Circle blocked the wallet addresses and the assets on them. Subsequently, infrastructure firms Infura and Alchemy restricted RPC calls to the service. All blocks were implemented at the frontend level, and the mixer could still be used directly via the smart contract.

Blockers to Tornado also included the derivatives exchange dYdX and the platform Oasis.

As a form of protest, an unknown Tornado Cash user began sending small sums of ETH to wallets of prominent U.S. figures. Among them were Coinbase CEO Brian Armstrong, host Jimmy Fallon, YouTuber Logan Paul, and Rand y Zuckerberg. Discussions also revealed that Vitalik Buterin used the service to donate to Ukraine.

On 12 August in the Netherlands arrested an unnamed Tornado Cash developer. The Block reports the person is Aleksei Pertsev.

MakerDAO, which backs the decentralised stablecoin DAI, asked about potentially backing the collateral with ETH due to concerns about fund-blocking.

Hodlnaut and Hotbit halted withdrawals

On 8 August the Hodlnaut crypto lending platform halted withdrawals, swaps and deposits of tokens due to a liquidity crisis.

The company explained the situation as a result of current market conditions. The project team, in conjunction with Singapore-based Damodara Ong LLC, is working on a recovery plan.

From 10 August the Hotbit exchange also suspended trading, deposits and withdrawals for all clients. The timetable for resumption remains unclear.

A former Hotbit executive was involved in an unnamed project in 2021, which is under investigation. As part of the proceedings, several top managers were called to testify, and part of the company’s assets were frozen.

CoinFLEX and Nuri file for restructuring

The CoinFLEX platform filed for restructuring in the Seychelles court.

Informed clients of the process by email. CoinFLEX aims to raise $84 million to repay debt, and to win creditor and court approval for a Recovery Value USD (rvUSD) token, shares and blocked FLEX tokens.

A similar filing was submitted by the German crypto bank Nuri. Its services were used by more than 500,000 clients.

What to read with friends?

- The owner of Belarus’ “largest crypto exchange” was announced to be under international arrest.

- In China’s social networks, 12,000 accounts were blocked for promoting cryptocurrencies.

- In South Africa, a Bitcoin transfer via SMS service was introduced.

Coinbase posts net loss twice forecasts

Coinbase’s net loss in Q2 2022 was $1.1 billion, or $4.98 per share, more than double analysts’ expectations ($2.47). Net revenue in April–June fell from last year’s $2.03 billion to $803 million. This was linked to declines in digital asset prices and trading volumes on the platform from $462 billion to $217 billion.

This week the exchange confirmed it had received inquiries from the US Securities and Exchange Commission about operations, client programmes, and existing and future products.

Curve Finance users lost $573,000 in a frontend attack

On 9 August unknown attackers compromised Curve Finance’s frontend. As a result, users lost assets valued at $573,000. An analysis showed server and provider infrastructure were not compromised; investigators are still pursuing the root cause.

On 12 August Binance CEO Changpeng Zhao said the attacker redirected funds to the platform, after which the team froze and recovered $450,000.

Alexander Vinnik appears in U.S. court for the first time

Alexander Vinnik, extradited from Greece, appeared in a U.S. court in San Francisco for the first time. According to the inmate profile on Santa Rita prison’s website, he is not eligible for release on bail.

According to the indictment, Vinnik and his associates owned and ran the BTC-e crypto exchange, which facilitated cybercrime and money laundering, allowing users to trade bitcoins with a high degree of anonymity. During its operation, trading volume totalled $4 billion. The Russian national faces around 50 years in prison.

WazirX co-founder refuted statements by Binance’s CEO

WazirX co-founder Nischal Shetty disputed a set of statements by Binance CEO Changpeng Zhao regarding the exchange’s relationship.

«Technology, product, domain, brand and everything else was sold by Binance to our Singaporean company Zettai», — said Shetty, denying Zhao’s statements about an unfinished deal.

What to read next?

They discussed the crypto-industry’s would-be “saviours” in bear markets, acting in their own interests and funding only those companies most beneficial to them.

We looked at the prospects of the new standard EIP-4626, designed to open the next page in DeFi 2.0 development.

Educational cards covered the “bull trap,” the Elrond blockchain, on-chain analytics, the L2 solution Optimism and an improvement proposal for Bitcoin code (BIP).

In traditional digests we gathered the week’s main events in cybersecurity and artificial intelligence.

The decentralized finance sector continues to attract heightened investor attention. ForkLog has summarised the most important events and news in a weekly digest.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!