Week in Review: Litecoin’s third halving occurs, MicroStrategy buys 467 BTC

Bitcoin’s price has traded in a range; Litecoin’s third halving occurred; MicroStrategy bought another 467 BTC; a hacker drained more than $60 million from Curve Finance pools; and other events from the week just ended.

Bitcoin holds the $29,000 level

Bitcoin’s price moved into a range. On Tuesday, August 1, Bitcoin’s price fell through the $29,000 level, then rose to $29,900.

At the time of writing, digital gold was trading at around $29,000.

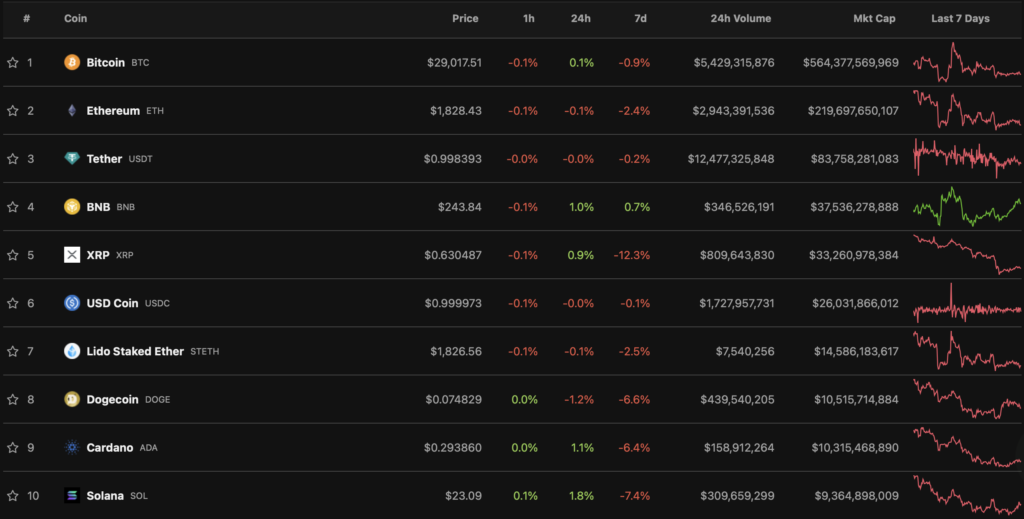

Most top-10 digital assets ended the week in the red. The exception was the BNB token, which gained 0.7%. The biggest losers were XRP (-12.3%) and Solana (-7.4%).

The combined market capitalization of the cryptocurrency market stands above $1.2 trillion. Bitcoin’s dominance index stands at 50.25%.

The Litecoin network’s third halving

On Wednesday, August 2, the Litecoin (LTC) took place a halving of the reward for the mined block from 12.5 LTC to 6.25 LTC.

Prices after the halving fell below the $90 level. As of writing, Litecoin is trading at around $83.

The halving occurred at block 2,520,000. The first halving occurred on August 25, 2015, the second on August 5, 2019.

Hacker withdrew more than $60 million from Curve. He has already begun returning funds

On July 30, an unknown launched an attack on Curve Finance’s stablecoin pools Curve Finance, using a vulnerability in the Vyper code. Initially, losses from the breach were estimated at $47 million. According to Defi Llama, the amount rose to $61.7 million.

On August 4, the hacker returned assets totaling more than $20 million. He explained his decision not out of fear of being caught, but a reluctance to ruin the project.

What to discuss with friends?

- A user moved 641 ETH purchased eight years ago.

- The author of a book about the OneCoin pyramid was threatened with violence.

- Grayscale explained why US presidential candidates focus on Bitcoin.

MicroStrategy buys 467 BTC for $14.4M

The analytics software provider MicroStrategy also purchased 467 BTC for $14.4 million. This was announced by the company’s founder Michael Saylor.

As of July 31, MicroStrategy holds 152,800 BTC worth about $4.53 billion at $29,672.

Binance’s user base surpasses 150 million

Binance CEO Changpeng Zhao announced surpassing the 150 million-user milestone.

In July 2022, the number of clients of the trading platform reached 120 million — over the year, it attracted 30 million users.

Also on ForkLog:

- In Belarus, authorities reported plans to use CBDC.

- FT: Meta is developing a competitor to ChatGPT.

- The Binance chief criticised the USDT stablecoin USDT.

SEC files lawsuit against HEX founder

The U.S. Securities and Exchange Commission (SEC) filed a lawsuit against HEX, PulseChain and PulseX founder Richard Heart for alleged sales of unregistered securities.

According to the SEC, the entrepreneur attracted more than $1 billion by selling tokens from three projects (HEX, PLS and PLSX), starting in 2019. The suit notes that he advertised them “as a path to enormous wealth for investors”.

July Bitcoin industry lost $303 million due to hackers

During July, cryptocurrency traders lost digital assets worth $303 million due to exploits and hacking attacks. CertiK reports.

In terms of losses, the most significant incident of the past month was the withdrawal of funds from the cross-chain protocol Multichain due to technical issues. The project lost about $125 million in various assets. After the arrest of CEO Zhao Changpeng, the platform ceased operations.

What else to read?

In ForkLog’s traditional digest, we collected the main events of the week in cybersecurity .

The cryptocurrency industry is attracting an increasing number of institutional players. This is evident in new investments in infrastructure and the growing attention that companies are paying to Bitcoin as an asset class. The most important events of the past weeks are in ForkLog’s review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!