Week in review: Russian authorities take an interest in p2p exchanges, and China discusses a mining ban

Week in review: Russian authorities take an interest in p2p exchanges, Jack Dorsey puts his first tweet up for sale as an NFT, China again discusses a mining ban, MicroStrategy increases its bitcoin exposure, and other events of the week.

Analysts talk of the end of Bitcoin’s correction

The first cryptocurrency began the week trading around $45,000, but by Wednesday, March 3, the price rose above $52,000.

Data: TradingView.

This reason to declare the end of Bitcoin’s correction was noted by analysts.

On that day CryptoQuant researchers recorded another large outflow of Bitcoin from Coinbase — the third in recent weeks.

Whales accumulating $BTC.

They are making a lot of bear traps lately, but the price seems to recover the institutional buying level, 48k.

Looking at recent Coinbase outflows, most of the outflows that went to custody wallets were at 48k price.

Chart 👉 https://t.co/20Dz85Y5mG https://t.co/28WZDD0v2h pic.twitter.com/KFSF4mcRra

— Ki Young Ju 주기영 (@ki_young_ju) March 3, 2021

CEO CryptoQuant Ki Young Ju says these were purchases of digital gold by large investors on the dip, conducted on the over-the-counter market.

Bitcoin was trading around $50,000 at the time of writing.

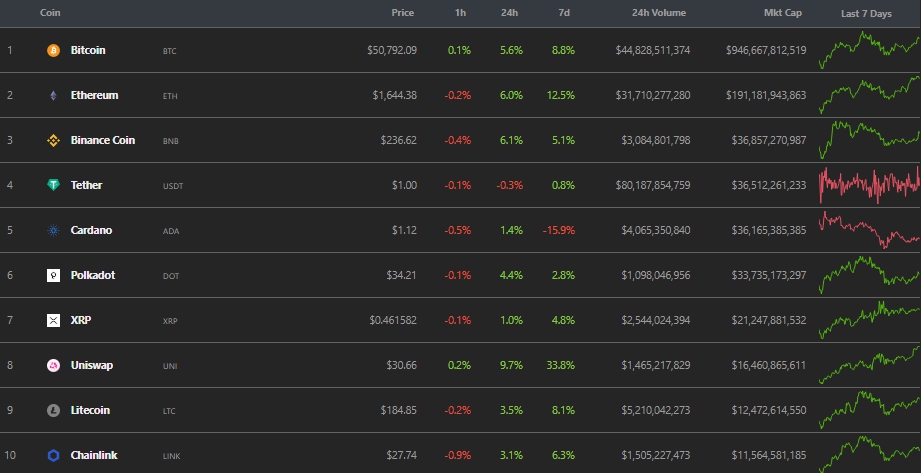

As last week, among leading cryptocurrencies the movement against the market was led only by Cardano. This time, however, the coin’s price over seven days fell by nearly 16%, and it ceded the No. 3 spot in market capitalization, after hitting an all-time high (per CoinGecko).

Data: CoinGecko.

Uniswap’s token broke into the top 10, rising by almost 34% over the week.

The total market capitalization stands at about $1.6 trillion, with Bitcoin’s dominance index sliding to 59.2%.

Media: Russian authorities take an interest in the operation of P2P exchanges

The Centre for National Projects (ЦНП) of the Analytical Center under the Russian government studied the activities of P2P exchanges. A report with the results will be sent to Deputy Prime Minister Dmitry Chernyshenko.

In the report, clients of such platforms are described as “all illegal online casinos, drug traffickers, gun dealers and other representatives of the criminal world who want, without naming names, to launder or legitimise money obtained through crime.”

The authors also note that in most cases P2P exchanges are not registered in Russia and their activity is not regulated by law. Therefore oversight by authorities and financial institutions is needed.

Media: Telegram Open Network investors demand $100 million from Pavel Durov

Investors from the Da Vinci Capital fund notified the founder of Telegram, Pavel Durov of their intention to sue the blockchain project Telegram Open Network (TON) companies, Forbes cited, referencing informed sources. They seek roughly $100 million in compensation, the publication notes.

People close to Telegram’s top management confirmed receipt of the letter, but noted that the demand in the letter is $20 million. Forbes does not know whether this is the only letter.

Jack Dorsey puts up his first tweet for sale. Justin Sun offers $2 million for it

The Twitter founder Jack Dorsey put up his first tweet for sale in the form of a non-fungible token (NFT).

The bid for the post with the text “Just setting up my Twitter” stood at $267,000. It was placed by user CurtLIU on Cent’s Valuables service.

p2p.org founder Konstantin Lomashuk offered $363,000.

Tron head Justin Sun raised the bid to $500,000.

Bridge Oracle founder Sina Estavi bid $1.5 million for Dorsey’s NFT.

Sun decided not to give up and raised the bid to $2 million.

MicroStrategy steps up its bitcoin investments

On Monday, March 1, the company bought 328 BTC at an average price of $45,710.

On Friday, March 5, CEO Michael Saylor announced the purchase of another 205 BTC for $10 million. The average purchase price was $48,888.

In total, MicroStrategy owns 91,064 BTC, having spent $2.19 billion.

To ForkLog, Kuna’s Head of Product Sergey Kalinin explained what hidden motives MicroStrategy and its shareholders may be pursuing in their Bitcoin-price-boosting play.

Financial micromatters: what’s behind MicroStrategy’s big bet on Bitcoin

Ethereum EIP-1559 to be included in the London hard fork despite miners’ opposition

The EIP-1559 proposal, which entails burning part of transaction fees, will become part of the London hard fork for July. The decision follows a conference of core developers, despite miners’ objections.

According to the published hard fork specification, in addition to EIP-1559 the update includes five other proposals.

The EIP-1559, introduced by Vitalik Buterin in 2018, EIP-1559 is designed to provide more “fair” fees to miners for including a transaction in a block. A portion of fees will be burned algorithmically based on network load.

This proposal has received strong support from both developers and users in light of record-high fees.

Mining pools are split between those willing to support EIP-1559 and those actively opposing it. The group of the latter includes Ethermine and SparkPool, which together with several other participants control 60% of the network’s hash rate.

John McAfee faces up to 100 years in prison on fraud charges

Entrepreneur John McAfee was formally charged on seven counts of fraud and money laundering. The case will be heard by the Southern District of New York.

Another defendant will be the executive adviser to the entrepreneur’s cryptocurrency team, Jimmy Lai Watson Jr., who was taken into custody the day before. McAfee was arrested in Spain in October 2020, and awaits extradition to the United States.

The maximum penalty for seven counts could reach 100 years in prison. They could also be fined.

Authorities in the Chinese region consider banning mining

The authorities of Inner Mongolia in northern China are studying the possibility of banning cryptocurrency mining.

The initiative aims to align with China’s program to cut carbon emissions. It could also affect miners in the Xinjiang region.

Unknown entity demanded 500 BTC from Tether

The issuer of USDT reported an extortion attempt of 500 BTC under threat of releasing documents that could “harm the Bitcoin ecosystem.”

Company representatives added that a fake exchange between one of their employees and Deltec, the bank that holds Tether’s assets, appeared online. The contents of the letters call into question the stablecoin’s full backing by reserves.

The company declined to pay the extortionist.

Ex-BitMEX head does not rule out voluntary surrender to US authorities

Arthur Hayes is negotiating with US authorities over a possible voluntary surrender on April 6, 2021. This was disclosed in the February court transcripts. Hayes is currently in Singapore.

These documents also revealed that US authorities began extradition proceedings for the head of business development Greg Dwyer from Bermuda.

Ripple CEO calls SEC suit regulatory caprice

Brad Garlinghouse and Ripple co-founder Chris Larsen filed filings in court in response to the SEC’s additional suit, which singled out their individual liability. Garlinghouse described the suit as regulatory caprice and plans to move for its dismissal. Larsen deemed the SEC’s evidence weak and asked the court to dismiss the case.

The Ripple CEO also noted that the SEC suit did not affect the company’s operations in the Asia-Pacific region, unlike Ripple’s partner MoneyGram. In a class action, MoneyGram’s customers accused the company of withholding information about XRP’s potential status as a security.

Ripple won a case in Delaware against British investment firm Tetragon Financial Group, which sought to redeem its preferred shares under the contract. Tetragon also sought a court order blocking Ripple’s use of cash and other liquid assets until payment.

The British firm brought the action after the U.S. regulator SEC charged the California fintech company with selling unregistered securities in the form of XRP.

However, the judge agreed that until the SEC case is resolved XRP’s status remains an open question, and dismissed the British firm’s claim.

Bitfinex launches its own payment system

Bitfinex Pay supports Bitcoin (including the Lightning Network), Ethereum, and the stablecoin USDT, enabling merchants to accept online payments in cryptocurrency.

The system imposes no additional fees beyond transaction processing. Assets can be automatically credited to the owner’s Bitfinex account.

Developers update Dogecoin software for the first time in a year and a half

Dogecoin received a “minor update with meaningful performance improvements.” Developers urged users to upgrade.

The main improvement in Dogecoin Core 1.14.3 was faster synchronization. According to the description, the speed-up was achieved by removing costly integrity checks that previously ran with every block transfer between nodes.

The previous client version had been in use since November 2019.

Dogecoin also became the most-discussed cryptocurrency on Twitter in February, ahead of Bitcoin and Ethereum.

Elon Musk revisited the topic. The founder of Tesla and SpaceX appealed to the authorities in Texas about creating a new city named Starbase. In response to Musk’s Twitter post about Starbase, users asked whether the city would be dog-friendly.

“Very much so. And the leader will be DOGE,” Musk replied.

ForkLog also wrote:

- In China, the combined net worth of 17 crypto billionaires was estimated at $77 billion, with the list led by Brian Armstrong of Coinbase.

- Rakuten began accepting cryptocurrency payments in Japan.

- Cardano developers launched the Mary upgrade.

- NVIDIA won a case over underreporting revenue from selling GPUs to miners.

- Google Finance added a tab for cryptocurrency prices.

- SEC chairman candidate Gary Gensler called Bitcoin a “catalyst for change.”

- Unknown individuals burned Banksy’s “Morons” and immortalised it in an NFT in a live stream.

- Litecoin creator compared NFT’s popularity to the 2017 ICO frenzy and altcoin craze in 2013.

What to read

February will be remembered for NFT hype and the rise of the DeFi ecosystem on Binance Smart Chain, which benefits from Ethereum’s scaling problems. Cardano and Binance Coin challenged for third place by market capitalization. Mining company stocks hit all-time highs, and Coinbase is at the starting line ahead of a massive direct listing.

All this and more in ForkLog’s new analytical report. All the essential cryptocurrency market highlights for the month in one piece.

The blockchain technology remains one of the hottest trends among finance, government and commerce worldwide. ForkLog offers a survey of the most interesting recent initiatives.

The unveiling of centuries-old letters, the revival of old photographs and other significant AI news from the past week in the traditional digest.

Facial recognition in Moscow’s metro, Tor’s battle against internet censorship and other cybersecurity developments over the week in ForkLog’s review.

Follow Forklog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!