Weekly Recap: Bitcoin’s Recovery and Hamster Kombat Airdrop Criteria

Bitcoin rebounded after falling below $50,000, criteria for the Hamster Kombat airdrop were revealed, Michael Saylor announced holdings of digital gold exceeding $1 billion, and other events of the past week.

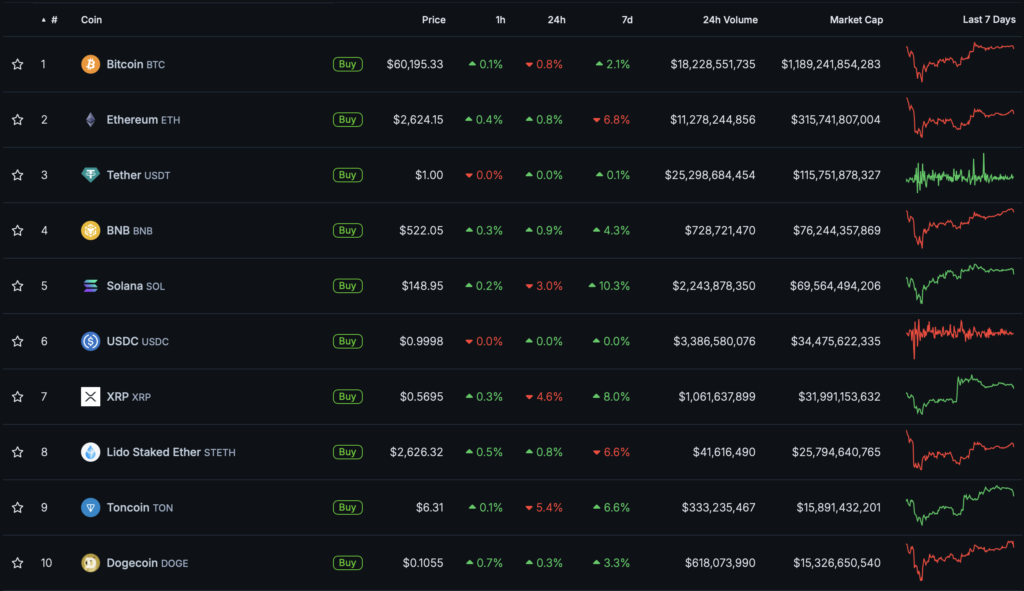

Bitcoin Price Recovers to $60,000

The leading cryptocurrency began the week with a drop below the $50,000 mark, only to recover. On Friday, August 9, digital gold returned to $62,000 before correcting to $60,000.

At the time of writing, Bitcoin is trading at $60,100.

Most digital assets in the top 10 by market capitalization ended the week in the “green zone.” Ethereum was an exception (-6.8%).

The total market capitalization of the cryptocurrency market is $2.2 trillion. Bitcoin’s dominance index is 57.5%.

Bitcoin Holders Increase Holdings by 404,448 BTC in 30 Days

The balance of long-term investors’ wallets in the leading cryptocurrency increased by 404,448 BTC ($23 billion) over the past 30 days, according to CryptoQuant CEO Ki Young Ju.

“I’m almost sure something is happening behind the scenes. This is clear accumulation,” the expert emphasized.

The expert predicted that in the third quarter, some organizations, large companies, and governments of several countries will announce investments in digital gold.

“Retail investors will regret not buying Bitcoin. Because they were worried about coin sales by German authorities, Mt.Gox compensations, and the current macroeconomic nonsense,” the expert stated.

Based on these observations, the CEO of CryptoQuant concluded that the bull market is likely to continue.

“If the price doesn’t recover within two weeks, I’ll reconsider my opinion. I follow ‘smart money,’ so if I’m wrong, then the new whales are either mistaken or underestimating the macroeconomic situation,” he explained.

The specialist also noted signs of the end of miner capitulation and the return of the hash rate to levels close to ATH.

Hamster Kombat Airdrop Criteria Revealed

Hamster Kombat developers updated the AirDrop section, revealing the criteria for the project’s airdrop distribution:

- passive income — hourly profit indicator;

- task completion;

- attracting active players to the app;

- achievements;

- subscription to the Telegram channel;

- keys.

User activity is converted into points, which will be considered during the distribution of future app tokens.

Developers clarified that these are not all the criteria.

Topics to Discuss with Friends

- Vitalik Buterin earned $103,000 from dumping the meme coin NEIRO.

- Meme coins on Solana rose by 25–35% amid optimism around SOL-ETF.

- Do Kwon’s extradition from Montenegro was postponed again.

- Elon Musk filed a renewed lawsuit against OpenAI.

Michael Saylor Announces Bitcoin Holdings Exceeding $1 Billion

MicroStrategy founder Michael Saylor revealed that he personally owns the leading cryptocurrency worth over $1 billion.

“About four years ago, I tweeted about owning 17,732 BTC. [Since then] I haven’t sold a single Bitcoin, only continued to buy,” he stated.

In October 2020, Saylor indeed reported holding 17,732 BTC, acquired at an average price of $9,882. In December 2021, he confirmed holding the same amount of the leading cryptocurrency.

In August 2024, when asked by a Bloomberg journalist about the current amount of Bitcoin he holds, Saylor replied briefly: “At least as much.” Thus, the MicroStrategy founder declined to disclose a more precise amount.

“It’s an excellent investment asset for an individual, family, institution, company, or country. I see no better option for investments,” Saylor stated.

He also called digital gold “the ultimate property of the United States” in light of recent political events. Saylor noted Senator Cynthia Lummis’s proposal to create a national Bitcoin reserve. Additionally, presidential candidate Donald Trump saw the leading cryptocurrency as a solution to the US national debt problem.

“I think the discussion has changed, and every politician in the world has begun to realize that Bitcoin is the most desirable property in cyberspace, it’s the future,” the MicroStrategy founder stated.

Binance Lists TON

On August 8, the cryptocurrency exchange Binance listed TON. Trading of the token began at 13:00 (Kyiv/MSK) in pairs TON/BTC, TON/USDT, TON/FDUSD.

At the time of writing, TON is trading at $6.4.

According to CoinGecko, the asset appreciated by 6.4% over the past week.

Also on ForkLog:

- Ripple began testing the RLUSD stablecoin.

- A “sleeping” address for 11 years moved Bitcoins worth $11.5 million.

- The head of TON’s gaming division discussed the future of Notcoin and Hamster Kombat.

- Bitcoin whales increased activity to a four-month high.

Nassim Taleb Criticizes Bitcoin as Poor Market Crash Hedge

The sharp market downturn demonstrated how poorly the leading cryptocurrency serves as a hedge against systemic collapse, according to writer and scholar Nassim Taleb.

“Bitcoin has once again proven that it does not protect against the melting of your assets,” noted the author of “The Black Swan.”

In Taleb’s view, the leading cryptocurrency has performed worse than other financial instruments because it is a “speculative asset that behaves like expensive Manhattan real estate” and exists primarily to “track the stock market.”

In terms of value preservation, the writer called gold a superior means:

“If you bury a gold chain in the ground for 10,000 years, it will still be gold.”

What Else to Read?

This week, ForkLog explained what Validium is and how it helps scale Ethereum, as well as when to expect a Fed pivot and how a rate cut will affect cryptocurrencies.

In the traditional digest, we compiled the main events of the week in the field of cybersecurity.

The cryptocurrency industry is attracting an increasing number of institutional players. This is evidenced by new infrastructure investments and the growing attention companies are paying to Bitcoin as an asset class. The most important events of recent weeks are in ForkLog’s review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!