Weekly Recap: ZKsync Airdrop Criticism and Fed Rate Decision

The Federal Reserve maintained its key interest rate, inflation in the US slowed, the ZKsync airdrop faced community criticism, Bernstein predicted bitcoin reaching $200,000 by the end of 2025, and other notable events of the past week.

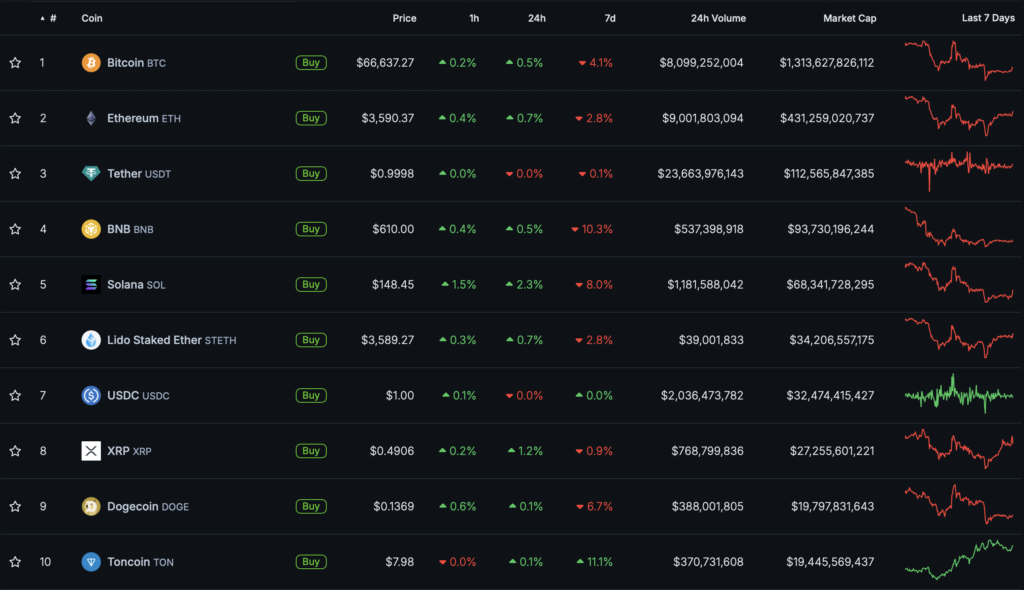

Bitcoin Price Falls Below $67,000

The leading cryptocurrency began the week below $70,000. On Tuesday, June 11, the price of digital gold plummeted to $66,000. The following day, bitcoin neared the $70,000 mark but fell again. By Friday, June 14, the asset’s price dropped to $65,000.

At the time of writing, bitcoin is trading at $66,700.

Most digital assets in the top 10 by market capitalization ended the week in the “red zone.” The exception was Toncoin (+11.1%).

The total cryptocurrency market capitalization stands at $2.56 trillion. Bitcoin’s dominance index is 55.2%.

Fed Maintains Key Rate as US Inflation Slows

On June 12, the US Federal Reserve maintained the key rate range at 5.25–5.5% per annum for the seventh consecutive time. The decision aligned with market expectations.

On the same day, the US Bureau of Labor Statistics released a consumer price report. The index value was below the forecast—3.3% versus 3.4%.

ZKsync Airdrop Limited to 13% of Wallets, Community Criticizes “Sybil” Accounts

The token distribution of the ZKsync L2 network (ZK) faced community criticism as only 13% of 6 million unique wallets were eligible, many of which were “Sybil” accounts.

“The airdrop of 17.5% [of ZK issuance] to 695,232 addresses is the largest coin distribution among users. The tokens have no vesting periods or lock-ups and are fully liquid on the first day. This amount exceeds the locked allocations for the Matter Labs team (16.1%) and its investors (17.2%),” the project’s blog states.

Users will be able to claim the coins from next week until January 3, 2025. Claims will be available from June 24.

However, some users complained about ineligibility for the airdrop. To qualify, they must meet certain criteria, including interacting with smart contracts and trading ERC-20 tokens in DeFi protocols.

According to Cinneamhain Ventures founder Adam Cochran, unlike regular users, airdrop hunters find it too easy to meet ZKsync drop criteria, as they could use scripts and bots to automate the process.

“Real users may only use a few decentralized applications or tokens on your network because it is new and has few projects,” he wrote.

Polygon’s Head of Security Mudit Gupta agreed with this sentiment, noting that the ZK distribution “became the easiest for Sybil farm owners.”

Topics to Discuss with Friends

- A trader made a 385-fold profit on the meme token DADDY.

- A student in Uzbekistan was arrested for selling Notcoin.

- A record series of inflows into spot bitcoin ETFs concluded.

- Apple will add ChatGPT to Siri, iOS, iPadOS, and macOS.

Vitalik Buterin on Cryptocurrency Applications in Everyday Life

Discussing the potential of digital assets in daily life, Ethereum co-founder Vitalik Buterin suggested the use of zero-knowledge proofs (ZKP) and other blockchain technologies.

He believes ZKP mechanisms can be applied for verifying “identity, credentials, or reputation.”

For cross-border payments, cryptocurrency P2P platforms, which have improved interfaces and reduced fees in this cycle, are suitable, according to the developer.

Buterin sees potential in decentralized social networks. Additionally, he highlighted prediction markets, which are already in active use.

The Ethereum co-founder proposed integrating ZKP into corporate applications to enhance data protection. He also suggested using the technology in voting to make it censorship-resistant.

Bernstein Predicts Bitcoin at $200,000 by End of 2025

Bernstein analysts raised the target price for the leading cryptocurrency to $200,000 by the end of 2025, up from $150,000. The forecast is driven by expectations of “unprecedented demand from spot bitcoin ETFs.”

“We believe ETFs have become a turning point for cryptocurrencies, triggering structural demand from traditional capital pools. In total, ETFs have attracted about $15 billion in new net inflows,” the analytical note states.

Experts believe bitcoin is in a new bull cycle. They described halving as a unique situation where the natural selling pressure from miners is halved or more, and new demand catalysts for cryptocurrency emerge, “leading to exponential price movements.”

Analysts pointed to previous cycles: in 2017, digital gold rose to a peak about five times the marginal cost of production, then fell to a low of 0.8 of that figure in 2018.

“During the 2024-2027 cycle, we expect bitcoin to rise to 1.5 times the metric, implying a cyclical peak of $200,000 (a 2.8-fold increase from today’s BTC price) by mid-2025,” the specialists wrote.

According to Bernstein’s base estimates, the price of the first cryptocurrency will reach $500,000 by the end of 2029 and $1 million by 2033.

Also on ForkLog:

- “Dormant” for over five years, 8000 BTC moved to Binance.

- A trader lost $13 million on the Ethena token’s decline.

- Andrew Tate’s meme token brought an insider $5.6 million.

- The Notcoin player base reached 40 million people. The token responded with growth.

Robert Kiyosaki Urges Bitcoin Purchases to Avoid FOMO

Author of the bestseller “Rich Dad, Poor Dad” and entrepreneur Robert Kiyosaki once again urged buying the leading cryptocurrency to avoid FOMO in the future.

“I get frustrated when I urge people to buy bitcoin. I receive so many unconvincing excuses. The most common: ‘Bitcoin is too expensive.’ And it is high, but not as high as it will be,” he wrote.

According to Kiyosaki, at such times he repeats his rich dad’s investment lesson: “Your profit is made when you buy, not when you sell.”

“We all wish we could buy bitcoin when it was $10. But those days are long gone. Don’t be a loser, buy a little, as much as you can afford, and keep buying,” the investor concluded.

What Else to Read?

This week, ForkLog explained how to recognize a rug pull.

In traditional digests, we gathered the main events in cybersecurity over the week, as well as the key metrics of mining companies for May.

The cryptocurrency industry is attracting an increasing number of institutional players. This is evidenced by new infrastructure investments and the growing attention companies are paying to bitcoin as an asset class. The most important events of recent weeks are in ForkLog’s review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!