What are leveraged tokens and how can you profit from them?

What are leveraged tokens?

Leveraged tokens are instruments with fixed leverage, automatic reinvestment and a low risk of liquidation. In a steady trend with rapid price moves in the underlying, leveraged tokens can outperform positions in futures contracts.

The price of a leveraged token is calculated as:

asset price + (asset price change × multiplier)

This means that if the underlying moves 1%, the token’s price changes by 1 × X%. For example, the ETHBEAR token has a multiplier of −3. If ETH falls by $10, ETHBEAR rises by $30.

An issuer can peg a token to any crypto asset. For now, AMUN has issued tokens only for BTC and ETH, while the crypto-derivatives exchange FTX has issued them for 43 coins.

How do leveraged tokens work?

Exchanges issue leveraged tokens, which traders buy on the spot market or directly from the exchanges.

Exchanges use the proceeds to open positions in perpetual futures. If those positions are profitable, leveraged-token prices rise.

As trading progresses, token prices move while collateral stays the same. To keep leverage fixed, exchanges rebalance daily. Two scenarios are possible: the position is in profit or at a loss.

How exchanges keep leverage fixed.

Issuers charge a 0.1% issuance fee and a 0.03% daily rebalancing fee.

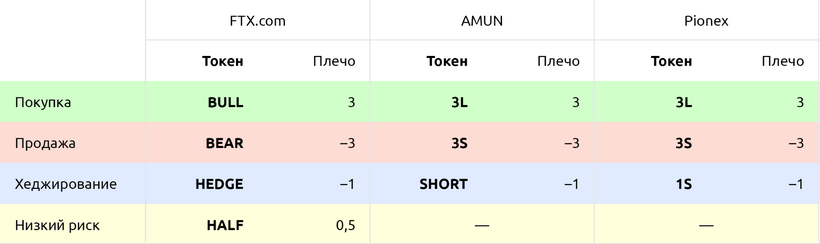

What types of leveraged tokens exist?

Four types are distinguished by pricing formula:

- BULL: X × price change, used to profit from rises;

- BEAR: −X × price change, used to profit from declines;

- HEDGE: −X × price change, with X = −1, used to hedge positions;

- HALF: 1/X × price change, used for lower-risk investing.

The multiplier X sets how the token price responds. Thanks to it, BULL tokens rise faster than the underlying, while HEDGE tokens fall when the underlying rises.

The issuer sets X at launch. For BULL and BEAR it is typically 2 or 3, for HALF it is 2, and for HEDGE it is always 1.

Who issues leveraged tokens?

The crypto-derivatives exchange FTX launched the first leveraged tokens in August 2019. The instrument quickly caught on with traders: daily turnover in ETH-linked tokens reached $1m. By year-end other exchanges had listed FTX’s tokens.

Currently, leveraged tokens are issued by FTX, the fintech firm AMUN and the exchange Pionex.

Here are some of the most popular leveraged tokens:

Low-risk tokens are available only on FTX.

FTX offers the deepest liquidity in leveraged tokens. In August 2020, for instance, BTC- and ETH-linked token turnover on FTX was $234m, compared with $122m on Pionex and $180m for AMUN tokens on gate.io.

How do leveraged tokens differ from futures?

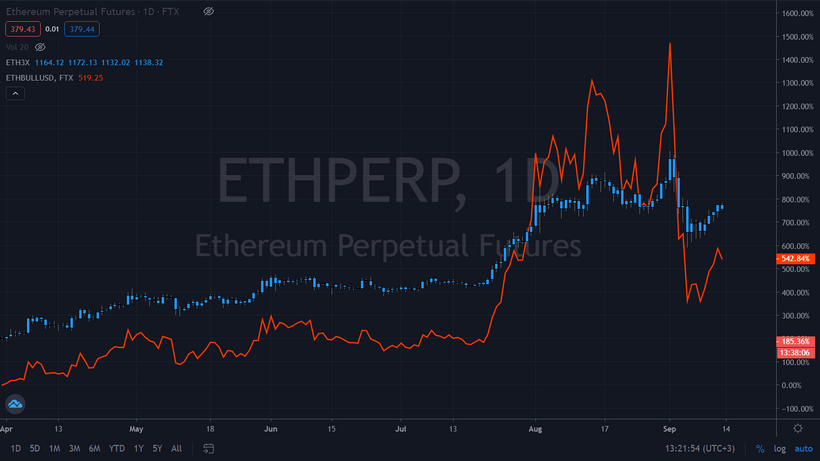

In trending markets, leveraged tokens show stronger price dynamics than futures

When markets trend, a token’s price moves more than a comparable future. That means token holders can earn more than futures holders. To compare, we multiplied ETHUSD prices from April to September 2020 by 3 to mimic a 3x leveraged future.

We then compared ETHUSD with the ETHBULL token. The chart shows the difference in dynamics.

In a trend, ETHBULL (red) returned 400%, while ETHUSD at 3x (blue) returned 270%.

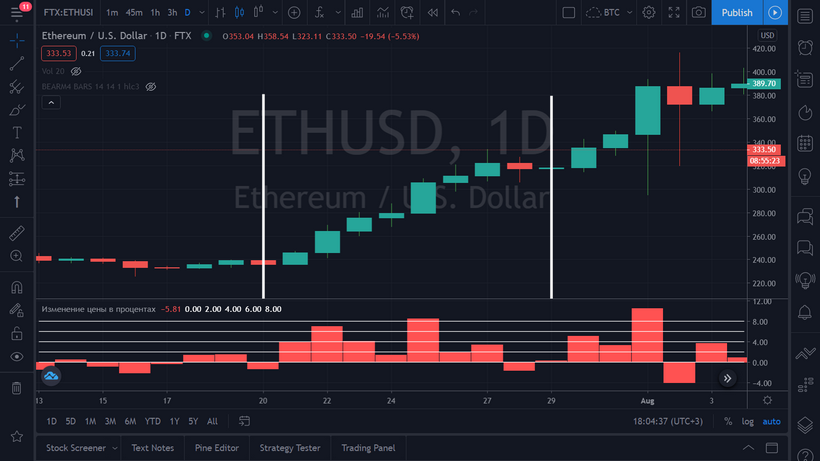

In a steady trend, tokens can outperform a regular leveraged position

Consider this example. On 21 July a trader opened a $1,000 long in the ETHUSD contract with 3x leverage. At the same time, they invested $1,000 in ETHBULL on FTX.

The trader held both for a week. Over that period ETHUSD rose 25%.

Daily ETHUSD futures chart on TradingView. Below: daily percentage change.

On 28 July the trader closed both. The future returned 75.7%; the token returned 101%.

The token position earned 58% more than the futures position.

Rebalancing reduces the risk of token liquidation

Another example. A trader opened a $1,000 long in ETHUSD with 3x leverage, then bought ETHBULL for the same amount.

They held both for a week while ETH fell 5% per day.

When ETHUSD dropped 33% from entry, the futures position was liquidated. The token position showed a 68% loss but was not liquidated.

With a 35% drop in the underlying, the futures position was liquidated; the token position lost 68%.

On rebalancing, exchanges move the liquidation price away from the underlying’s price at the moment of reopening the position. A 3x token would be liquidated only if the underlying moved 33% in a single day.

For example, ETH is $300. A trader buys 3x ETHBULL tokens. The liquidation point is $200. On day one, ETHUSD closes at $267—one third of the way to liquidation. At rebalancing the exchange reopens the position at $267 and shifts liquidation to $178.

If the underlying moves 10% per day, issuers trigger forced rebalancing:

- FTX rebalances BULL tokens when the underlying moves 11.5% and BEAR tokens when it moves 6.7%;

- Pionex rebalances when actual leverage deviates from 3x by 33–66%, depending on token type and direction.

On average, exchanges crystallise losses and push out the liquidation point after an 11% move.

How to trade leveraged tokens

On a spot exchange. Buy and sell leveraged tokens like any other cryptocurrency.

Via deposit. A user posts collateral on an exchange and requests token issuance. The exchange mints new tokens and delivers them to the user.

Convert in-wallet. In FTX’s wallet, any asset can be swapped for leveraged tokens.

When to trade leveraged tokens

In long-running trends. Exchanges reinvest profits daily through rebalancing. In such conditions, tokens can outperform futures.

For conservative trading. Mandatory rebalancing means exchanges avoid liquidating token positions during bouts of volatility in the underlying. With futures you risk losing the entire position; with tokens, only part of it.

When not to trade leveraged tokens

In choppy trends. If the price swings both ways within a day, leveraged tokens tend to earn less than a futures position.

For intraday trading. You will not benefit from the rebalancing that reinvests profits, and results will mirror those of leveraged futures trading.

How much can you earn with a choppy trend?

Suppose a trader put $1,000 into a long BTCUSD future and $1,000 into BULLUSD, holding both for a week while bitcoin rose 10% in fits and starts. The trader earned $300 on the future and $302 on the token.

In a choppy trend, the token earned $2 more than the futures position.

With erratic prices, a futures trader realises the loss once—on exit. With tokens, losses are realised daily. This shrinks the position and reduces final profit.

Further reading on leveraged tokens

To dig deeper, see:

- a market review of leveraged tokens;

- FTX’s leveraged-token FAQ;

- a historical comparison of token and futures performance;

- a review of risks when trading with leverage.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!